Eurodollar University

Jeff Snider

Jeff Snider will guide you through the realm of monetary science. Multiple episodes uploaded each week, discussing big news and key current events, the state of markets and what they are telling you, as well as historical summaries and deep background material so that you can understand what’s really going on in this eurodollar’s world.

Episodes

Mentioned books

Jan 30, 2025 • 33min

HUGE Global Central Bank Decision Today (Here's What You Need to Know)

The discussion kicks off with an analysis of the Federal Reserve's recent decision to hold interest rates steady and its impact on global markets. Highlights include the bond market's early reactions to anticipated changes. Attention turns to Sweden's rate cuts, signaling economic strains. The team also examines Europe's puzzling economic growth figures alongside rising unemployment, prompting questions about effective central bank strategies. Rate cuts loom as a crucial response to stalling recovery across the continent.

Jan 29, 2025 • 18min

BREAKING: Shipping Data Reveals The Global Economy Is Cracking

Shipping rates have plummeted, signaling a troubling state for the global economy. The Baltic Dry Index reflects dwindling demand for raw materials, raising alarms about economic stability. Consumers are increasingly anxious about jobs and incomes, despite a momentary sense of recovery. Analysts dissect the disconnect between seasonal trends and ongoing economic weakness, suggesting a challenging path toward sustained growth. The insights paint a grim picture of the financial landscape as 2025 approaches.

Jan 28, 2025 • 21min

China’s Economy is COLLAPSING, and Even the Government is Panicking

Chinese banks are in crisis, struggling to stabilize amidst alarming economic conditions. The government’s attempts at distraction with AI innovations fail to address the deeper issues, including troubling deflation. A property slump in Hong Kong adds to the fragility of the financial landscape. As lending slows and government measures prove ineffective, concerns grow over social stability and potential global impacts. This landscape paints a grim picture, highlighting the disconnect between official optimism and the harsh realities on the ground.

Jan 27, 2025 • 18min

South Korea is PLUNGING and it’s Spreading to the Rest of the World

South Korea is the latest to fall into "forgot how to grow" and Texas Instruments showed the world why. Both were slammed this week for getting to the same place from different perspectives. Critical cyclical indications that shocked the consensus. Eurodollar University's conversation w/Steve Van MetreBloomberg Texas Instruments Suffers Worst Rout Since 2020 on Weak Forecasthttps://www.bloomberg.com/news/articles/2025-01-23/texas-instruments-outlook-signals-chip-slump-is-persistinghttps://www.eurodollar.universityTwitter: https://twitter.com/JeffSnider_EDU

Jan 26, 2025 • 22min

OH SH*T... The Global banking System Is Breaking Down

Global banks are tightening their belts, prioritizing U.S. Treasuries over lending. This trend highlights shared reluctance among both U.S. and European banks to support economic growth during turbulent times. Meanwhile, dollar scarcity is causing foreign governments to raid their reserves, raising alarms about the stability of the global banking system. The podcast delves into how these banking behaviors reflect deeper risks and challenges in the world economy, questioning the prospects for recovery.

Jan 24, 2025 • 20min

Trump DEMANDS Rates Cut NOW—Will this Crash the Economy?

A powerful speech at Davos has sparked a debate about the demand for lower oil prices and interest rates. The podcast delves into OPEC’s miscalculations regarding supply cuts and the overall economic fallout. High oil prices are tested against consumer realities and the global economy's health. It highlights a crucial disconnect: simply lowering prices won't guarantee recovery without more profound systemic changes. Can political demands really steer economic recovery, or is the strategy futile?

Jan 23, 2025 • 18min

The Real Economic Effects of Trump’s Policies: A Deep Dive

The podcast dives into the impending tariffs on Canada and Mexico and their potential economic fallout. It highlights a drop in the Baltic Dry Index, signaling reduced global shipping demand. The discussion reveals the freight industry's struggles, including J.B. Hunt’s unexpected announcements and bleak recovery forecasts. Listeners learn how trade wars are compounding economic challenges, leading to skepticism about industrial growth projections and the real impacts of Trump's policies on neighboring economies.

Jan 23, 2025 • 20min

The UK Labor Market Is Sending A MASSIVE Warning to the World

UK job markets took a dramatic downturn during the holidays, signaling potential economic woes ahead. Rising unemployment isn't just a local issue; many Western countries are facing similar challenges. The podcast dives into the impacts of inflation on consumer confidence and job stability. Historical practices of the Fed are scrutinized for their role in current economic instability. Disturbingly, countries like Sweden, Canada, and New Zealand are witnessing unemployment trends that could herald a looming recession.

Jan 21, 2025 • 21min

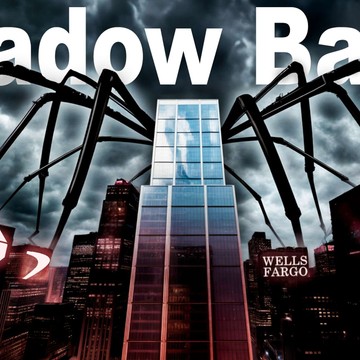

What Are Shadow Banks and How Do They Silently Control the World?

Explore the intriguing world of shadow banks and their growing influence in the financial system after the 2008 crisis. Discover how these institutions operate in the shadows, avoiding conventional regulations. The discussion highlights both the efficiency they bring and the serious risks posed by their lack of oversight. Delve into their role in past financial crises and understand the vulnerabilities created by our reliance on these unregulated players. Get ready for a revealing look at who truly controls global finance!

Jan 20, 2025 • 17min

HOLY SH*T: Shocking New Data Shows Holiday Shopping COLLAPSE

Steve Van Metre, an expert in retail sales and consumer behavior, breaks down the bleak state of holiday shopping for 2024. He discusses how consumers are eager to spend but face financial constraints, leading to disappointing sales results. The conversation delves into troubling trends, such as reduced restaurant visits and shifts in entertainment spending as households reassess budgets. Van Metre also highlights alarming signs in the labor market, with layoffs and stagnant wages foreshadowing a potential economic downturn.