Eurodollar University

Jeff Snider

Jeff Snider will guide you through the realm of monetary science. Multiple episodes uploaded each week, discussing big news and key current events, the state of markets and what they are telling you, as well as historical summaries and deep background material so that you can understand what’s really going on in this eurodollar’s world.

Episodes

Mentioned books

Jun 5, 2020 • 43min

Mailbag

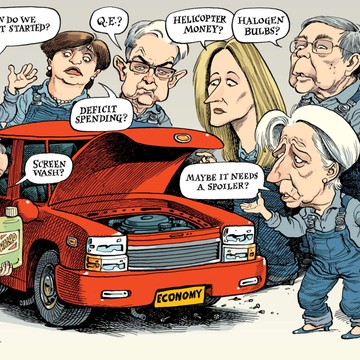

Legendary figures took on the mantle of "Mail Carrier!" including: founding father Benjamin Franklin, Wells Fargo cowboys of the Pony Express, and nice guy Mr. McFeely from Mr. Rogers' Neighborhood. In more recent decades the profession saw its reputation sullied. Represented at one end of the spectrum by the austere, virginal, trivia-oracle Clifford C. Clavin, Jr. and at the other end the covetous and lurid Newman.But in this episode of Making Sense, Jeff Snider endeavors to bring back the profession's good name, just like Kevin Costner did in The Postman, a 1997 escapist fable about a post-Apocalyptic America that begins to find its soul thanks to a mailman. The film takes on a more documentary-like tone these days. Snider as itinerant nomad, wandering the dystopian monetary order delivering long lost answers to bewildered people asking why -- in a world where a smokey haze obscures the horizon -- oil is more valuable underground and stock prices are lighter than air. "Why? Why?! Why!"Sure, Rotten Tomatoes gave The Postman an 8 percent rating with one reviewer thinking, 'Relative to this, Waterworld is Citizen Kane.' Well, this podcaster disagrees and gives the movie 100 percent for British actress Olivia Williams alone.Is the US Treasury deluge good? Are banks opting out of the game? What's the deal with foreign central banks and their dollar reserves? Can the banking system function without central bank reserves? Why buy lower-yielding sovereign debt from Europe or Japan instead of the US Treasury? How to animate reserves? Should we add asset managers to the Primary Dealer pool? Is inflation low due to Chinese goods? Why is the Federal Reserve buying mortgage backed securities? Is it a violation of the Federal Reserve Act to buy risky assets? Why is the S&P500 exploding higher? Why was there inflation in the 1970s?WHATAlhambra InvestmentsRealClear MarketsMetals & Markets BlogWHOJeff Snider, Head of Global Research at Alhambra Investments with Emil Kalinowski, not mailman material. Artwork by David Parkins, il primo ballerino of the colored pencil.

May 29, 2020 • 37min

The Worst V Since "V"

In the mid-80s parents allowed their children to watch an innocent-looking television program titled V thinking it was some kind of Sesame Street offshoot. Imagine little Johnny and Suzy Q's horror when, instead of Reading Rainbow, they were watching a sci-fi melodrama about disguised reptilians. The Visitors, presenting themselves as competent, benevolent beings here to teach the backwards ape a few things, were hiding behind masks -- including their beautiful smokeshow of a leader Diana -- and had actually come to harvest Earth's water and snack on humans. A sophisticated allegory about economists? Perhaps...The mini-series had been the reigning champion of "Worst V of All Time" until the 2007-09 financial crisis, which sent the global economy off its post-World War Two trend. Unlike all downturns since 1945, this one was different in that a plurality of economies representing a majority of global gross domestic product never regained their pre-crisis trend growth. The V-shaped recovery that three generations had come to take for granted turned out to be a grossly misshapen, lizard-like L that was visible beneath the mask of positive numbers in all manner of broad economic accounts, including: global foreign direct investment, world merchandise trade, the 35-country Organisation for Economic Co-operation and Development industrial production index, etc.In this eleventh episode of Making Sense, Jeff Snider, Chief Investment Officer of Alhambra Investments (and Resistance Leader) explains why 2020 may surpass the intergalactic reptiles AND dethrone 2007-09. We review the US Congressional Budget Office's very un-V forecast through 2021, estimate in trillions the depth of the contraction in the US, put into context Washington D.C.'s inadequate-sized stimulus and review the Euro Area's broad survey of economic confidence.No iguanas were hurt in this episode.WHATGetting A Sense of the Economy’s Current Hole and How the Government’s Measures To Fill It (Don’t) Add UpThe *Optimists* Have Some Terrible News For the ‘V’What Would The Hole Be Without The ‘L’?What Flood?WHOJeff Snider, Head of Global Research at Alhambra Investments with Emil Kalinowski, still working on his ABCs. Artwork by David Parkins, mammal.

May 22, 2020 • 39min

Stock Magiq

We are informed by the financial press the agitated creation of reserves are, to capital market participants, a mix of whiskey and Felix Felicis; liquid courage and luck. The first manifestation of the wealth effect, which will encourage households to consume and corporations to invest. The financial market animal spirit. The economist's Patronus Charm. But what did the Federal Reserve do - and more importantly not do - in 1929, 1987 and throughout 2008-20 to support US stock markets? When was there a direct link between bank-created money and the stock market? And when was there nothing more tangible than "expectations policy" - the modern equivalent of the warlock's frantic charms, hexes, jinxing and spell-casting? Also, Federal Reserve Chairman Jerome Powell was interviewed on the American news program 60 Minutes this week. He said, the Fed saw the market meltdown coming, that the central bank increased money supply - he says they can print 'real' money too, you know - that there's no limit to what they can do to support the economy (and also that the said economy may not 'get back to zero' until the end of 2021). We review the interview by pointing out what the smoke is obscuring, where the mirrors have been placed, and discuss how "theatricality and deception are powerful agents to the uninitiated." WHATStocks Haven’t Been MoneyedThe Reason For So Many Lies: He Finally Realizes He’s In Way Over His HeadWHOJeff Snider, Chief Investment Officer of Alhambra Investments with Emil Kalinowski, a physical (precious metals) man; artwork by David Parkins, sculptor of the color wheel.

May 15, 2020 • 33min

Japanification

It is often said that there is, "nothing new under the sun", and with a few exceptions (e.g. negative nominal interest rates, negatively priced oil, TikTok) that is true, even with a monetary gewgaw like quantitative easing. Japan, so as to revive its economy, has been implementing different flavors of QE for just under two decades now (that's all one really needs to know about its effectiveness). In this episode we explore what lead up to the first QE program with a tour guide: Milton Friedman.What was Friedman's analysis of 1970-90 from the perspective of money supply and economic activity? How did the Bank of Japan seemingly lose its way during the 1990s when it had 'got it all right' during the 70s and 80s? Why did Friedman believe that QE would be the solution? Why did the Japanese bond market disagree from the get-go? Why is a sovereign bond market important anyway? Why do low rates - not high - signal monetary tightness and vice versa? On the other side of the Pacific, in late 2001, with the Good Ship Q.E. having already been launched, researcher Mark Spiegel from the Federal Reserve Bank of San Francisco raised a critical question: what if private banks don't want to put this newly 'printed money' to work? In Japan that question has remained unanswered for two decades. In the United States and Europe? Over a decade. Is it a matter of difficulty or ideology that impedes the answer? We believe it is the latter.WHATThere Was Never A Need To Translate ‘Weimar’ Into Japanese by Jeff SniderReviving Japan by Milton FriedmanQuantitative Easing by the Bank of Japan by Mark SpiegelA Tally of 23 Japanese QEs by Jeff SniderWHOJeff Snider, Chief Investment Officer of Alhambra Investments and Emil Kalinowski, not bad at fantasy football. Artwork by David Parkins, curator of the illustrated aesthetic.

May 12, 2020 • 45min

Mailbag

Will unlimited dollar swaps by the Federal Reserve solve the dollar shortage? How does collateral shortage in the repo market affect, for example, equities? Why does the gold price plunges when there are collateral fails in the repo market? Does re-pledging and/or re-hypothecation take place in the repo market? If there's liquidity crisis, why do corporations get such cheap loans still? Interest rate swaps go negative; what does it mean? Why aren't bank reserves useful to the monetary system? Why does a financial entity sell cash to buy a Treasury to put it up as collateral to get cash; wut? What is an individual to do in this chaos? Does stress in the interbank markets reach the real economy and if so, how? What is your definition of inflation and does asset inflation factor in?Sadly, we did not get to each inquiry. Also, some did not really pose questions but took the opportunity to send death threats and ransom notes; we love the passion! (But yes, we didn't get to those either.) However, please continue asking questions on Twitter and YouTube, and if we - or someone from the community - don't answer there, we hope to do so on a future show. WHATAlhambra InvestmentsRealClear Markets Metals & Markets BlogWHO@JeffSnider_AIP, Head of Global Research at Alhambra Investments with @EmilKalinowski, professional gentleman of leisure. Artwork by David Parkins, paintbrush performance artist.

May 8, 2020 • 40min

No Modern Weimar Republic Here

Quantitative easing, like foie gras, is controversial. The gavage-based production of duck and goose livers is considered cruel to the animal, gorged helplessly as it is in a pen. Central banks likewise perform a force-feeding, a monetary gavage of reserves forced onto the private bank balance sheet. What makes it a peculiar practice is that the monetary farmer expects this gorged banking goose to then dance around carefree - honking out credit at every passing leaf or tussled blade of grass. Since 2001 this 'monetary husbandry' has failed. In Japan, the United States, Britain and Europe. (Worse still, the result isn't a rich, buttery and delicate specialty that could be enjoyed with some mustard seeds and green beans in duck jus.) In this episode we review three articles that delve even farther back in history, to the Great Depression, to show that similar sounding solutions didn't work then either. The fear of unchecked inflation - "Weimar", for short - now that fiscal authorities and central banks are both encouraging the leaden economy to flap its wings is therefore misplaced. At least, not until wholesale reform of process and procedures within the modern central bank. Not until credibility and competence is prioritized over its credentials.WHERE@JeffSnider_AIP@EmilKalinowskiWHATWeimar Ben Didn’t Happen, So Now Weimar Jay?Weimar Thirties Didn’t Happen Because It’s What You Don’t See Everyone Knows The Gov’t Wants A ‘Controlled’ WeimarChicago Fed's Monetary Policy in a Lower Interest Rate EnvironmentWHOJeff Snider, Head of Global Research at Alhambra Investments with Emil Kalinowski, one of several people - along with Archibald Leach, Bernard Schwartz and Lucille LeSueur - who've never been in your kitchen. Artwork by the Brunelleschi of our day, David Parkins.

May 1, 2020 • 39min

Fragile, Complex Systems

In 1929 a plague struck Florida resulting in an overwhelming government response. The consequences were not only agricultural but financial as banks, heavily exposed to the Sunshine State's horticulture sector, approached insolvency. Bank stability, Federal Reserve responses and a suitcase stuffed with six million dollars are all part of the thrilling story. But so is the notion of bureaucratic delay, wild swings from hope to despair (and back), contemporary titans of industry offering reassuring words, and the impotence of human effort against the monstrous chaos of a complex system reverting back towards simplicity.In today's day, the US Treasury bond market was warning for the better part of two years that the monetary, financial and economic - to say nothing of the political and social - facets of our system were fragile. Weak. Already enervated by six years of political upheaval and a dozen years of monetary disorder. The virus was the banana peel upon the wall that Humpty Dumpty was dancing on.The United States and European Union GDP estimates for the first quarter corroborate the bond market's opinion. Though the virus, and the government response to it, only took hold in the final month of the quarter (with exceptions of course, Italy for example) the result was catastrophic nonetheless. In other words, the US and EU economies were already stumbling about the street, late at night after a 12-year bender when Corona stepped out from the shadowy alleyway with a billy club and an appetite for mayhem.1929 Florida Plague as ParableBond Markets Dismiss FedQ1 US GDPQ1 EU GDPJeff Snider, Head of Global Research at Alhambra Investments and Officer of the Offshore with Emil Kalinowski, Getting His Pump On. Artwork by the Caravaggio of caricature, David Parkins.

Apr 24, 2020 • 46min

Modern Myths

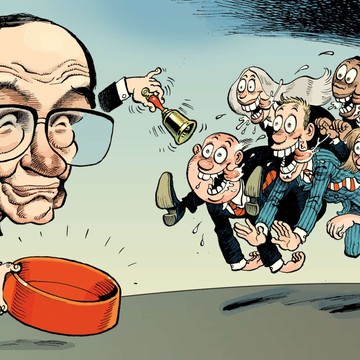

The Earl of the Eurodollar Jeff Snider (@JeffSnider_AIP), Chief Investment Officer at Alhambra Investments and Emil Kalinowski (@EmilKalinowski) discuss the four topics.First, what happened this past week when the price of oil to be delivered in May was priced at a negative $50(ish) dollars per barrel? And much more importantly than the bizarre price, what does the back-half of the oil futures curve say about the medium-term condition of the global economy? Nothing good unfortunately.Second, why do well respected names in the financial industry continue to believe that US Treasury yields will rise? They are called Bond Kings and one of them recently had to take off his crown (temporarily). But was it the Fed's changing policy that caused the change of heart? Or was it the bond market all along who was signaling the bond kings wore crowns but nothing else?Third, the important German ZEW survey shows very sharp pick-up in optimism. No surprise, ZEW survey respondents traditionally respond very positively to central bank 'liquidity' programs, even if the real economy does not follow through. It is the legendary Greenspan Put gone international.Fourth, the multi-decade Japanese experience regarding 'overwhelming' purchases of stocks and bonds is instructive for investors counting other advanced economy central banks buying financial instruments. It seems bullish, on the surface at least. But recently the Bank of Japan opened the taps and increased their equity purchases to record amounts. The result? A 31 percent decline. You're welcome.Alhambra Investment articles discussed:Let Japan Show You Again Just How Laughable The Idea That Central Banks Can Support MarketsThe Greenspan BellThe Fallen Kings & The Bond Throne of CollateralWhat Was Monday’s Negative Oil, And Why It Was Overshadowed On Tuesday

Apr 17, 2020 • 35min

Oil Bears, Equity Bulls

Jeff Snider, Chief Investment Officer of Alhambra Investments and Baron of the Balance Sheet @JeffSnider_AIP and Emil Kalinowski, Not Hard on the Eyes @EmilKalinowski.The World Trade Organization offered two outlooks for 2020-21, one that is not terrible and the other distinctly so. Jeff and Emil discuss how getting back to previous levels would be an impressive achievement in itself and how it suggests that central bank actions are limited in their impact on the broader economy.The US labor force shrank a horrifying 1.6 million people in March which is almost as much as the entire 2007-09 contraction. Jeff explains what the difference is between unemployment and exiting the labor force entirely.The oil market has experienced a conniption fit over the last month but in the last couple of weeks only the front half of the futures curve is still having a full body dry heave. The back half, the half that represents market expectations of future economic activity levels, has settled down. Where it has gotten cozy offers no inspiration about the economic outlook.

Apr 3, 2020 • 32min

Confronting the Dollar Bull

We draw on five articles posted at Alhambra Investments to draw out the difference between a central bank - central to money supply - and a bank authority - central to a smooth functioning banking system. Jeff notes that we are not facing a local banking crisis that requires a banking authority but an international 'money' supply problem (there's not enough of it). Not only is the Fed not central to that money supply but nobody is. Interestingly Jeff is not concerned about another banking crisis per se as the banks have been barricading themselves behind "fortress balance sheets" for a dozen years now. Also, Jeff explains why he's not - for now - concerned about a sovereign debt default cycle nor a corporate credit default cycle. Instead he fears a 2008-style (or worse) liquidity crisis. This entirely plausible - and perhaps straight up probable - crisis would then starve perfectly healthy businesses of the required funding to keep operating.Articles covered include: "What Is The Fed’s New FIMA? The Potential For A SHADOW Shadow Run Is Very Real", "Banks Or (euro)Dollars? That Is The (only) Question", "(No) Dollars And (No) Sense: Eighty Argentinas", "Dollar, Not Bank" and "The Empty Bank".