Eurodollar University

Jeff Snider

Jeff Snider will guide you through the realm of monetary science. Multiple episodes uploaded each week, discussing big news and key current events, the state of markets and what they are telling you, as well as historical summaries and deep background material so that you can understand what’s really going on in this eurodollar’s world.

Episodes

Mentioned books

Aug 17, 2020 • 1h 1min

What are they thinking?

The final setting of Margaret Atwood's The Handmaid's Tale occurs well into the future, at a symposium of historians examining the Handmaid era. Your podcaster expects a similar, future gathering of sober scholars evaluating the Time of CoVid. They'll likely conclude it was an economic and political bankruptcy - a mathematical and moral fiasco. Still, it wasn't all bad, and this podcaster imagines that sitting at the back of the room a lowly assistant will indecorously interrupt proceedings with, "At least the Funny Flu allowed Cannonball Run that stood for ages!"Before security could be called to escort this violator of stodgy proceedings out the banquet room - the iconoclast would blithely explain, that the Cannonball is an unofficial, entirely illegal 2,800 mile (4,500 kilometer, but who knows with inflation these days) car race from New York City's Red Ball Garage to the Portofino Hotel in Los Angeles. That the pre-'Rona record was 27 hours, 25 minutes. That with Captain Trips clearing the roads of grandmas, convoys, smokey, panda and the fuzz the new record was set at an eyelid-peeling 25 hours, 55 minutes. And that two general documentaries were already released on the subject, including Cannonball Run II - which is in your podcaster's sincere, very unprofessional opinion the best documentary ensemble cast ever, including stars: Burt Reynolds, Dom DeLuise, Dean Martin, Sammy Davis Jr., Shirley MacLaine, Frank Sinatra, Marilu Henner, Aristotelis Savalas, Catherine Bach, Susan Anton and Jackie Chan, among others.And it is the idea of the "ensemble cast" that makes this 22nd episode of Making Sense a special one. We try to answer three questions: which paradigm do central banks inhabit, was Aristotle an idiot, are low rates stimulative? In trying to answer them we turn to Jeff Snider. But also, Aristotle himself, and Ben Bernanke, Benoit Mandelbrot, the Bride, Christopher Nolan, the Cohen Brothers, Cormac McCarthy, Eugene Fama, Henri Poincaré, Hugh Hendry, Janet Yellen, Jay Powell, Jeb Hensarling, Joe Rogan, the Joker, Keith McCullough, Louis Bachelier, Milton Friedman, Paul Samuelson, Plato, Robert Brown, Ronald Coase, Socrates, Steve Keen, Thomas S. Kuhn, Two-Face and William F. Buckley Jr.----------WHERE----------AlhambraTube: https://bit.ly/2Xp3royApple: https://apple.co/3czMcWNiHeart: https://ihr.fm/31jq7cICastro: https://bit.ly/30DMYzaTuneIn: http://tun.in/pjT2ZGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYCastbox: https://bit.ly/3fJR5xQBreaker: https://bit.ly/2CpHAFOPodbean: https://bit.ly/3enSAkrStitcher: https://bit.ly/2C1M1GBOvercast: https://bit.ly/2YyDsLaSoundCloud: https://bit.ly/3l0yFfKPocketCast: https://pca.st/encarkdtPodcastAddict: https://bit.ly/2V39Xjr----------WHAT----------Was Aristotle An Idiot? Welcome Back August 9, The Answer To That Question The Key To The Next Golden Age: https://bit.ly/30UMILSThomas S. Kuhn's The Structure of Scientific Revolutions: https://bit.ly/3gZiFZ0Eugene Fama’s Efficient View of Stimulus Porn: https://bit.ly/2Y0kk9tFama 2: No Inflation For Old Central Banks: https://bit.ly/3gYVuhAEugene Fama Interview (Inflation is Totally Out of the Control of Central Banks): https://bit.ly/2Y1Y7aYLow Rates Aren't a Central Bank Providing Accommodation: https://bit.ly/3iF0cBs----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, making economics erogenous again. Artwork by David Parkins, the thinking man's Auguste Rodin. Podcast intro and outro "Mt. Fuji" by Ooyy and Smartface at Epidemic Sound.

Aug 9, 2020 • 1h 1min

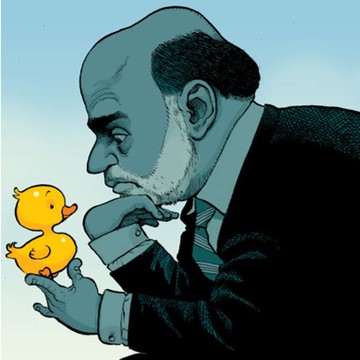

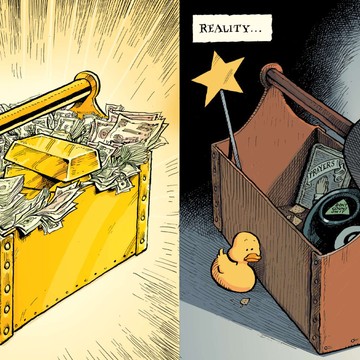

What's in the Monetary Toolkit?

Life is full of problems. And when particularly irritated by them, we turn to professionals for help. Sure, men - especially the married kind - will insist they can take care of it. Plumbing? No problem. The Johnson-rod is loose in the car? I got it. Open wound with compound bone fracture? Rub some dirt on it. Still, eventually even men will get to a point when they'll ask for directions, because what can be done - they built the city all wrong. And so, when the technical expert is called we damn well expect they've got a toolbox of specialized, effective gadgets.For example, those tooth-yanking sadists are expected to make small talk about The Marathon Man while utilizing a tray of mouth mirrors, sickle probes, scalers and saliva ejectors. Go to the stables and you'll see brushes, sweat scrapers, hoof picks, deworming pastes, fly bonnets and liniments that will give your mare that glossy finish. One expects the same of our monetary technocrats. Their toolkit - you'd EXPECT - to hold a printing press, bond certificates, gold, as well as maps and barometers identifying the specification, production, distribution and utilization of modern money.In this 21st episode of Making Sense, Jeff Snider tells us what IS in the monetary toolkit after spending a professional lifetime reading meeting minutes, transcripts and speeches. What's in there? Yeah, Magic-8 Ball. A rubber duck. Prayer book, of course. Half-eaten egg-salad sandwich. And importantly, the phone numbers of financial journalists. Join us as we discuss the monetary toolkit through the lens of: China's unchanging foreign exchange reserves, credit conditions in the United States and PMI scores from around the world. Also, we end the show by holding a candle-light vigil for the 13th anniversary August 9, 2007. The day that the global monetary order malfunctioned. A day that the then-CEO of the British bank Northern Rock said, "the world changed." A day that The Guardian newspaper analogized to August 4, 1914 - the start of The Great War. A day that has yet to end.----------WHERE----------AlhambraTube: https://bit.ly/2Xp3royApple: https://apple.co/3czMcWNiHeart: https://ihr.fm/31jq7cICastro: https://bit.ly/30DMYzaTuneIn: http://tun.in/pjT2ZGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYCastbox: https://bit.ly/3fJR5xQBreaker: https://bit.ly/2CpHAFOPodbean: https://bit.ly/3enSAkrStitcher: https://bit.ly/2C1M1GBOvercast: https://bit.ly/2YyDsLaSoundCloud: https://bit.ly/3l0yFfKPocketCast: https://pca.st/encarkdtPodcastAddict: https://bit.ly/2V39Xjr----------WHAT----------What’s In The Same Number? China’s Part In The (euro)Dollar Story: https://bit.ly/3ahCjNDReading the Tea Leaves About China (Making Sense Episode 14): https://youtu.be/UTTjUGp-K-oBuckets and Tookits, Empty Each: https://bit.ly/33BNUFRPurchasing Managers Indigestion: https://bit.ly/3imBky6Author Christopher Clark lecture on "Sleepwalkers: How Europe Went to War in 1914": https://youtu.be/6snYQFcyiyg ----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, standing there looking pretty. Artwork by David Parkins, operating with palette knives, color charts, painting palettes, tube wringers and paint rollers. Podcast intro is "Cornelia" by The Eastern Plain, remixed by Luwaks, at Epidemic Sound.

Aug 3, 2020 • 52min

Strike 9! Will the Fed Ever be Called Out?

Baseball. The nation's pastime. For well over a century the sport has nestled itself in the romantic nook of America's soul. Its greatness captured in sentimental movies like The Natural and Field of Dreams. But light is balanced with darkness and for all its majesty the sport bears scandals and self-inflicted wounds: the 1919 Black Sox, a racial barrier. And of course, there's that gray space between light and dark where tragi-comedy lies. The 1888 poem Casey at Bat. Yogi Berra's relationship with paradox and irony. The Red Sox and the 20th century.Like any phenomenon, the game has a full life that cannot be reduced to just one idea, one moment, one game. To do so would be the height of chutzpah and ego. So - let your podcaster oblige. The greatest game ever played was on February 2, 1946. Known as the Baseball Bugs game it took place in New York City's famed Polo Grounds where the Tea Totallers hosted the Gas-House Gorillas. The aged Totallers - one could even go so far as calling them elderly - were no match for the unshaven, cigar chawing players with shoulders as broad as the outfield placards. By the fourth inning the visitors were up: 96 to 0. So total was the farce that the home team turned to fans in the outfield for help. One such wasn't even a man. Or woman. It was a rabbit. Bugs Bunny.He struck out the first Gorilla with fastballs. Then - well - he changed baseball history with a single, off-speed pitch that struck out the side as three Gorillas swung three times each before the ball reached the plate. Players ever since have attempted to recreate the throw. And though pitches such as the Fossum Flip, Super Changeup, balloon ball, parachute, gravity curve and the Monty Brewster have come close, nothing has been seen like that magical day in 1946. Nothing until America's central bank came up to bat on August 9, 2007.For 13 years the Fed has been hacking away at the same pitch of monetary disorder. And unlike the Gas House Gorillas, apparently there is no limit to the number of swings it can take at this slow-moving soap bubble. In this, the Frank Robinson episode of Making Sense, Jeff Snider recounts just the three most recent strikes: Gold, Dollar, and Inflation Expectations. As part of the discussion we'll talk about Goldman Sachs' claim that "real concerns are emerging" about the dollar's reserve currency status and note that negative yielding US bonds are only a hare's hair away. Also, the Euro, the yen and other important things like Magnum PI's mustache and whether Jeff likes baseball.----------WHERE----------AlhambraTube: https://bit.ly/2Xp3royApple: https://apple.co/3czMcWNiHeart: https://ihr.fm/31jq7cICastro: https://bit.ly/30DMYzaTuneIn: http://tun.in/pjT2ZGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYCastbox: https://bit.ly/3fJR5xQBreaker: https://bit.ly/2CpHAFOPodbean: https://bit.ly/3enSAkrStitcher: https://bit.ly/2C1M1GBOvercast: https://bit.ly/2YyDsLaSoundCloud: https://bit.ly/3l0yFfKPocketCast: https://pca.st/encarkdtPodcastAddict: https://bit.ly/2V39Xjr----------WHAT----------Would The Real Dollar Please Stand Up: https://bit.ly/3hWwyHGUS Dollar Index (DXY) Futures: https://bit.ly/3giQK6aStrike 1: Gold; Strike 2: Dollar; Strike 3: Inflation Expectations: https://bit.ly/39IlJG6The Fastball Behind Strike 3: https://bit.ly/2XjV11BOMG The Dollar!!!: https://bit.ly/2XfRamqKevin Warsh Quote (Jerome Powell Is a Barely Adequate Writer of Fiction): https://bit.ly/2BNmHV3----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, hidden in right field. Artwork by David Parkins, the Ernest Thayer of the colored pencil. Podcast intro and outro is "Suddenly You" by Golden Age Radio, at Epidemic Sound.

Jul 27, 2020 • 54min

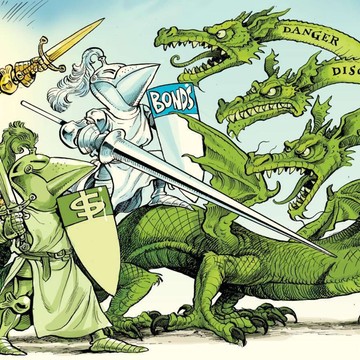

Gold, Dollar and Treasury battle Deflation, Disorder and Danger

Now, admittedly SOME commodity prices have gone up. Half of the agricultural and livestock prices are up year-to-date. Copper is up! But these are the results of supply line disruptions and demand surges. The temporary, transitory reactions to the CoVo. NOT the persistent, broad-based multi-year inflation carried in by a monetary surge that central bankers suggest. Almost every energy-based commodity is DOWN. Most all industrial metals are DOWN. We address the issue in three segments, in this, the 19th episode of Making Sense. First, gold's sauntering up to $2,000. Silver is looking lustily at $30. Inflation, right? Central bank printing, true? Politicians handing out stipends and stimulus, yes? NO! Gold has been rising regularly - in concert with sovereign bonds - since October 2018 signaling deflation, disorder... and danger.Then in part two, America's dollar is said to be the global reserve currency. But might there be hostile nations scheming furiously to undermine the US dollar? They are, after all, selling US Treasuries on net, since 2014. Is there a dollar Pearl Harbor ahead? No. Precisely the opposite. It's the real reserve currency - the EURODOLLAR - that holds nations hostage, including the USA.And finally, Federal Reserve officials are promoting the notion the central bank will allow inflation to run. Run pure. And hot! A Bloomberg opinion column called it "a whole new ballgame [baby!]" (I added the "baby!" part). We've heard this story before. Not only from the Fed but as children. From Aesop. We knew it then as, "The Boy Who Cried Wolf".That's not Inflation's war cry. Not in this monetary disorder and economic depression. It's a publicity campaign. A caterwauling.----------WHERE----------AlhambraTube: https://bit.ly/2Xp3royApple: https://apple.co/3czMcWNiHeart: https://ihr.fm/31jq7cICastro: https://bit.ly/30DMYzaTuneIn: http://tun.in/pjT2ZGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYCastbox: https://bit.ly/3fJR5xQBreaker: https://bit.ly/2CpHAFOPodbean: https://bit.ly/3enSAkrStitcher: https://bit.ly/2C1M1GBOvercast: https://bit.ly/2YyDsLaSoundCloud: https://bit.ly/3l0yFfKPocketCast: https://pca.st/encarkdtPodcastAddict: https://bit.ly/2V39Xjr----------WHAT----------Exposing The Golden LieSign of the Times: Gold Has Its Most Vocal Proponents Helping Sell Jay Powell’s FictionHuge, Massive Difference: De-dollarizing vs. Being De-dollaredMore To Being De-dollaredNot This AgainThe Fed Is Setting the Stage for a Major Policy Change----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, wandering hedge knight. Artwork by David Parkins, descendant of Arthur Eld ancient King of All-World. Podcast intro and outro is "Aoraki" by Ooyy, at Epidemic Sound.

Jul 20, 2020 • 50min

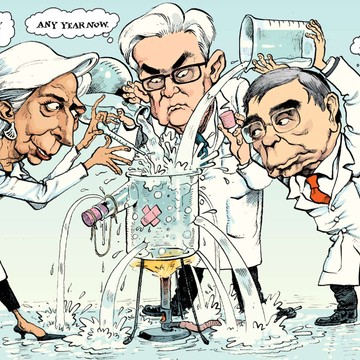

The Fractured Flask

2008. Albuquerque, New Mexico. The first business meeting of what would become the best-known chemist team since Nobel-prize winners Molina, Crutzen and Rowland was not auspicious. Pinkman wanted to cook as an artist, with chili powder. White, called Pinkman's chili-p recipe -- garbage. In-turn, Pinkman dismissed White's science; all he needed was a big jar. He was actually referring to a volumetric flask, which as - the appalled chemistry teacher Mr. White responded - is for general mixing and titration you wouldn't apply heat to it. That's what a round bottom 5000 millilitre boiling flask was for. Pinkman's flasks almost certainly fractured often and leaked out.It is the metaphor of the fractured flask, the punctured pail - the leaking bucket - that Jeff Snider uses, in this the 18th episode of Making Sense, to explain why the inflationary concoction created by monetary technocrats isn't boiling over. First, we discuss why the Federal Reserve's monetization of debt isn't inflationary. Second, we review the latest inflation readings from the United States. Finally, Snider explains why the accelerating size of the US Treasury's checking account isn't inflationary either. It is all about the metaphor - technocrats and politicians pour inflationary water in yes, but not only is the bucket not a full one, ready to spill over, but it's perforated.Well, to head off a letter writing campaign, this podcaster acknowledges that a fair number of you dear listeners feel your podcasting team missed the opportunity to employ the metaphor of the leaky cauldron. To cast central bankers as a coven of warlocks preparing a witches brew of inflation. However, your podcaster prefers the analogy of the fractured flask. The technocrats style themselves as scientists, not magicians. They surround themselves with very rare 800 millilitre Kjeldahl-style recovery flasks and dynamic stochastic general equilibrium models, Griffin beakers and Erlenmeyer flasks. The tragi-comedy is that despite the scientific accouterments, they go about it in a Pinkman-like manner. Heating volumetrics, adding adulterants like yield curve control, bank reserves and chili-p.----------WHERE----------AlhambraTube: https://bit.ly/2Xp3royApple: https://apple.co/3czMcWNiHeart: https://ihr.fm/31jq7cICastro: https://bit.ly/30DMYzaTuneIn: http://tun.in/pjT2ZGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYCastbox: https://bit.ly/3fJR5xQBreaker: https://bit.ly/2CpHAFOPodbean: https://bit.ly/3enSAkrStitcher: https://bit.ly/2C1M1GBOvercast: https://bit.ly/2YyDsLaSoundCloud: https://bit.ly/3l0yFfKPocketCast: https://pca.st/encarkdtPodcastAddict: https://bit.ly/2V39Xjr----------WHAT----------So Long As The Bucket Is Full of Holes, Treasury Demand Comes FirstTransitory, The Other WayWait A Minute, The Dollar And The Fed’s Bank Reserves Are Directly Not Inversely RelatedA General Sense of Treasury’s General Account----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, Pinkman. Artwork by David Parkins. Podcast intro and outro is "Full House Dusk" by River Foxcroft, at Epidemic Sound.

Jul 11, 2020 • 49min

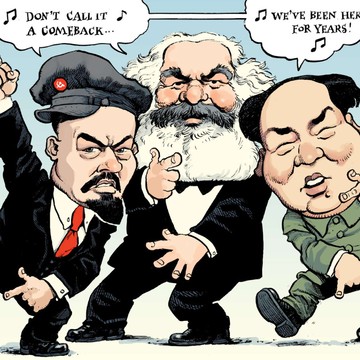

Communism - Don't Call it a Comeback

Plato, Kant, Nietzsche, Buddha, Confucius, Rousseau, Aristotle, Bastiat, Molinari, Cicero, Hegel, Hobbes, Kant... LL Cool J. The contemporary philosopher sits on the social and political branch of the Western tradition. He began releasing treatises in 1985 after collaborating with Def Jam. Radio was his first. Two years later, Bigger and Deffer. But 1989's Walking with a Panther was 'too pop-y', said the Philosophical Review. 'So much empty fluff,' pondered the British Society for Phenomenology. Dialectica wouldn't even look at it. His fourth commentary however, returned him to the top. Both the album and its most famous song were titled Mama Said Knock You Out. The single famously begins with, "Don't call it a comeback, I been here for years".Singing that tune these days are Communism, Marxism and Socialism. In this, the 17th episode of Making Sense, Jeff Snider explains how to understand their philosophy and why their recent popularity is not a comeback despite the doctrine's body of work. Marxism was never gone, it was waiting for the club of mostly wealthy nations to reach the end of their capitalist potential. Well, a thirteen year depression on par with the 19th century's Long and the 20th century's Great depressions is making a good case. So then, how to counter the argument? But that's for the back-half of the show. First, a Catch-22 like paradox in bond markets. Safe sovereign and risky corporate bonds both display falling yields. Why? We look back to the last worldwide depression for answers. Then, yield curve control. This podcaster has a feeling it'll be the must-have toy for central bankers by Christmas. We look back at the US experience with the policy during the 1940s. Then Marx, Lenin and Mao take the stage, grab the mic and start spitt'n.----------WHAT----------Don’t Low Rates On Junk Bonds Mean Fed-fueled Credit Bubble? No. Precisely The OppositeYield Cap History Is Rock Solid, Just Not At All In The Way They Are Telling YouYield Caps = ToddlersFrom QE to Eternity: The Backdoor Yield CapsSocialism Would Have Been Easy to Discredit, Had There Been GrowthBrent Johnson & Jeff Snider "Breaking Down Eurodollars" Webinar by BlockWorks GroupReddit Late Stage Capitalism Thread 549,000 Strong----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emilulous. Artwork by David 'Straight Outta London' Parkins. Podcast intro and outro is "Callin Shots" by Damma Beatz at Epidemic Sound.

Jul 4, 2020 • 38min

What is... Eurodollar Mailbag?

After half-a-century, some 8,000 episodes and numerous tournament of champions the American television game show Jeopardy! decided to hold its definitive contest to determine its ultimate victor. The trial featured three accomplished champions: Ken Jennings, Brad Rutter and James Holzhauer. The selection of these three remains one of sports' great scandals -- right up there with the Czechoslovakian judge in Lillehammer. The three contenders were fine, having won more than a 100 contests and $10.7 million dollars between them. That's not bad... as far as humans go. Who should have been in the tournament?The first contestant most clearly deserved to be Phil Connors. Connors, initially a Pittsburgh weatherman stuck in a time loop, eventually attained the status of god. Not the God - at least he didn't think so - but a god. And as a deity not only did Connors know every answer in "Lakes & Rivers" - What is Mexico? What are the Finger Lakes? What is Titicaca? - he knew the question before the answer was even given: What is the Rhône?The second contestant was god-like in its knowledge: Watson. The likely forerunner of HAL-9000, this question-answering computer system already beat both Jennings and Rutter in an exhibition match for a million dollars. A eurodollar realist and having no use for a pyramid of physical bills, Watson promptly set the money alight and was heard walking off stage saying, "It's not about the money - it's about sending a message."The third contestant inhabits that shimmering space between reality and myth called "legend": Clifford C. Clavin, Jr. The part-time Boston-area mailman and full-time bar patron appeared on Jeopardy! in 1990, where he feasted on the categories like a walrus in a bed of bivalve mollusks, which is the mammal's preferred food you know. "Civil Servants", "Stamps from Around The World", "Mothers and Sons", "Beer", "Bar Trivia", "Celibacy".It is in the spirit of these latter three - as legend, as eurodollar realist, as living through a monetary time-loop - that Jeff Snider confronts listener questions in a Jeopardy!-style show in this, the 16th episode of Making Sense.----------WHAT----------Alhambra Investments BlogRealClear Markets EssaysYield Cap History Is Rock Solid, Just Not At All In The Way They Are Telling You----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, the Vanna White of Eurodollar Jeopardy! Artwork by the Phil Connors-like, preternatural David Parkins. Podcast intro and outro is "Come 2gether" by Ooyy at Epidemic Sound.

Jun 27, 2020 • 47min

Hey Kid, Want Some Communism?

Published in 1862, Les Misérables by Victor Hugo is "the novel of the century" according to David Bellos, professor of French and comparative literature at Princeton University. When asked on The Great Books podcast what qualifies this novel to be on the show Bellos responded, "It tackles a huge range of human experience, with an enormous amount of passion. If there ever was a great book, it must be Les Misérables." The story focuses on 'the suffering ones', 'the humiliated'. It's set in the social, political and economic upheaval of early-nineteenth century France. 'The poor people who are worthy of our pity' were caught up in the consequences of what Jeff Snider calls the first modern business cycle. Michael Pettis, in his 2001 book The Volatility Machine, identifies it as the first modern deglobalization. And Friedrich Engels called it "the first general crisis". Engels is, of course, the co-author of the Communist Manifesto, published in 1848 in response to the shocking, worldwide disorder. Karl Marx and Engels are said to suggest that capitalism has an expiration date; that capitalism was an ahistorical phenomenon which would burn up the limited fuel of labor and then sputter. And at that point communism would take over and redistribute the existing wealth equitably because there was a limit to human wealth creation.This, over the long sweep of history, is a pessimistic view of human character and potential. But humans don't live across history, they have a handful of decades. And when capitalism does find itself in a cul-de-sac as it did during the first general crisis, and the Long Depression, and the Great Depression and now this -- Year 13 of the Silent Depression, well then terminal capitalism sounds perfectly reasonable. In this the 15th episode of Making Sense, Jeff Snider discusses the barricades and autonomous zones of Les Misérables, Marx and Engles' thesis, late-stage capitalism, the Soviet Union, and present-day China; but all in defense of capitalism without denying that it's going down the wrong road -- toward the barricades.----------WHERE----------Apple: https://apple.co/3czMcWNiHeart: https://ihr.fm/31jq7cICastro: https://bit.ly/30DMYzaTuneIn: http://tun.in/pjT2ZGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYCastbox: https://bit.ly/3fJR5xQStitcher: https://bit.ly/2C1M1GBOvercast: https://bit.ly/2YyDsLaPocketCast: https://pca.st/encarkdtPodcastAddict: https://bit.ly/2V39Xjr----------WHAT----------The Economic Boom You Heard About Never Really Was A Massive Problem That Has Them Searching For One----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, manning the barricades in the CHAZ (Cayman Highball Armorik Zone). Artwork by David Parkins, a modern-day Émile-Antoine Bayard. Music track "The Ministry" by Howard Harper-Barnes at Epidemic Sound.

Jun 20, 2020 • 50min

Reading Tea Leaves

Your podcaster shunned traditional university education and instead sought a guild apprenticeship. Drawn to parapsychology and the occult even as a sma' one, it was natural this podcaster's inclinations were in alchemy, phrenology, gryphography, cryptozoology and economics. However, The Inquisition and Salem Trials had somewhat narrowed opportunities in these first options; opportunities which are now reserved for only the most gifted. With an aptitude optimistically scored by one high-school counselor as "average", your podcaster nevertheless found a welcome home in economics. That field was supplemented with a minor in tasseomancy.Sometimes called tassology or tasseography, it's the study of tea leaves for the purposes of divination, fortune telling and interpreting the political economy of China. Yes, any economist can tell you about last month's results for industrial production, retail sales and fixed asset investment. And Jeff Snider does, in this the fourteenth episode of Making Sense. We first steep and then drink West Lake's famous Dragon Well tea while discussing April's Treasury International Capital report, the echoes of 2013 and the Oktoberfest-in-June-like optimism of German Financiers. But then conversation turns to the political intrigue surrounding President Xi and Premier Li. Peering inside our porcelain cups the upward strokes of the leaves indicate a stabilized GDP level. The flourishes on the lower zone denote meticulous, yet highly creative accounting. But if one observes the overall slant and the pressure of the leaves there's a suggestion of acute overcapacity, a complete lack of recovery, and a pronounced inclination toward stagnation.If the monetary shadows are your fancy then the next time someone asks, 'Would you care for some tea or coffee? Something stronger perhaps?' - you know what to say.----------WHAT----------Still TIC’ed Off In The Shadows In AprilWhen Sentiment FliesA Chinese Outbreak (of Li v. Xi, Round 2)----------WHO----------Jeff Snider, Head of Global Research at Alhambra Investments with Emil Kalinowski, who prefers his tea by leaf not by the bag. Artwork by the Yellow Mountain Fur Peak of the paintbrush, David Parkins. Song "Asian Fork Fight" by Lenzer at Epidemic Sound. Apologies to Michele Mulroney and Kieran Mulroney, screenwriters for Warner Bros' Sherlock Holmes: A Game of Shadows.

Jun 12, 2020 • 38min

The Great Portnoy

Upon its release the book was met with popular indifference. And no wonder. A cautionary tale about indulgence, extravagance and social upheaval? Right into the racing heart of the Roaring Twenties and its cloche hat wearing flappers, smoking Lucky Strikes and listening to jazz? No thanks. When Fitzgerald asked his editor about the book's reception he was told, "Sales situation doubtful, but excellent reviews." The author, in response, closed with, "Yours in great depression." It wasn't until the consequences of the Great Depression that the book achieved the acclaim it holds today. Only in retrospect did perception resonate with plot. Only in retrospect did the era seem an empty phantasm.Our own 'Roaring Twenty' has no such excuse. Unlike 1925 when economic depression was five years in front of those enormous yellow spectacles, our economy is 13 years in Daisy's rear-view mirror -- run over, killed. But you wouldn't know it if your radio was tuned to the business network. When it was reported in early June that the US economy unexpectedly added 2.5 million jobs for the month of May it set off an orgy of dip buying, lest there be no dip left to buy. David Portnoy, the Gatsby of our day and host of this stock market party leaves the invitation open to all via livestream and will tell you stocks only go, "Up! Up! Up! Up! Up!"In this episode we discuss how even establishment-economist forecasts -- forecasts in which the economy runs pure -- implicitly anticipate a worse experience than 2008. An experience from which the world never recovered; not really. In this episode we emerge from sheltering in place and survey the landscape. We see the Great Portnoy, hosting an elaborate party, in the Valley of Ashes.----------WHEN----------00:32 US Employment | Establishment / Household Survey02:52 US Employment | Initial & Continuing Jobless Benefit Claims04:59 US Employment | Economically Unemployed vs. Exogenous Shock Unemployment12:51 World Economy | Consensus Two-Year Outlook for GDP 16:38 World Economy | The OECD W-Shaped Recovery Doesn't Factor in a Second Economic Wave19:04 World Economy | World Bank Forecast as Warning that V is very L22:09 US Consumers | Revolving Consumer Credit Being Extinguished by Consumers27:22 US Yield Caps | Talk of Yield Curve Caps and What About Yield Curve Control in Japan32:01 US Yield Caps | World War II Experience with Yield Curve Ceilings35:31 World Economy | The Worst is Behind Us Now We Survey the Damage----------WHAT----------What Did Everyone Think Was Going To Happen?This Thing Is Only Getting Started; Or, *All* The V’s Are Light On The RightAttention All “V” PeopleA Second Against Consumer Credit And Interest ‘Stimulus’OMG The 30s!!!From QE to Eternity: The Backdoor Yield Caps----------WHO----------Jeff Snider, Head of Global Research at Alhambra Investments with Emil Kalinowski, someone that's not invited to the party. Artwork by David Parkins, the Francis Cugat of our Roaring Twenties.