Eurodollar University

Jeff Snider

Jeff Snider will guide you through the realm of monetary science. Multiple episodes uploaded each week, discussing big news and key current events, the state of markets and what they are telling you, as well as historical summaries and deep background material so that you can understand what’s really going on in this eurodollar’s world.

Episodes

Mentioned books

Mar 27, 2020 • 37min

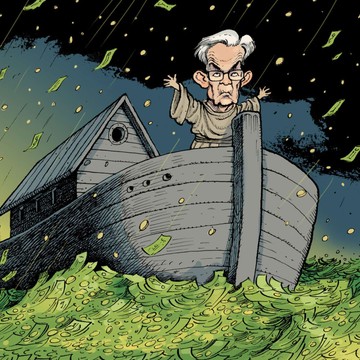

Greatest Liquidity Event Since Noah?

Jeff Snider, Alhambra Investments Chief Investment Officer (@JeffSnider_AIP) and Emil Kalinowski (@EmilKalinowski) review three topics. We review three articles Jeff wrote this week, trying to explain them a bit more than perhaps may be apparent at first glance. Firstly, why repurchase agreement stresses materialize prior to quarter-end. Secondly, why low-low-low-limbo-proof interest rates (e.g. effective Federal Funds, overnight repo market rates) are not signalling success but further interbank stress. Thirdly, why LIBOR and near-month Eurodollar futures are rising despite the "greatest liquidity event since Noah".

Mar 23, 2020 • 37min

QE-Infinity is a Laundromat Token

This inaugural episode discusses the goal of building a collaborative, educational community to discuss the creation, destruction and redistribution of modern monetary formats throughout the global economy. A strange kind of money, so unlike what we're used to seeing in our pockets, but a money that is needed to finance activity, trade and progress. We briefly touched upon the nature of money, the un-centralness of central banks and identified the financial collateral markets - not cash or bank reserves - as the source of the monetary disorder that has spilled out into the broader economy in conjunction with the developing international health emergency. The disorder is in the repurchase agreement market and it lies with collateral, specifically there's not enough of it. Hence, these intermittent liquidity squeezes that have over the past 12 years spread like contagion into the wider economy. "You can't take out your spine and hope to stand up; that's really what the [repurchase agreement] market is. The way the repo market functions is more collateral-based than it is bank reserves or cash. The lack of collateral is a massive, massive problem."