Eurodollar University

Jeff Snider

Jeff Snider will guide you through the realm of monetary science. Multiple episodes uploaded each week, discussing big news and key current events, the state of markets and what they are telling you, as well as historical summaries and deep background material so that you can understand what’s really going on in this eurodollar’s world.

Episodes

Mentioned books

Oct 29, 2023 • 18min

Holy Sh*t! New Data Reveals Everything

#recession #money #recession2023 #money #inflation #deflation #interestrates #dollar #economy #credit #interestrates #eurodollar #collateral #repo #yieldcurve #income #jobs The 2-year US Treasury continues to press a fundamental case for the US economy that looks nothing like the last GDP number. Despite an official narrative for a strong labor market, the evidence instead shows serious and growing weakness where it counts the most - incomes. That major deficiency has been masked by the remnants of the supply shock. Now the leftover economy from that era is on a collision course with incomes. Eurodollar University's Money & Macro AnalysisFOMC Minutes September 19-20, 2023https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20230920.pdfTwitter: https://twitter.com/JeffSnider_AIPhttps://www.eurodollar.universityRealClearMarkets Essays: https://bit.ly/38tL5a7

Oct 27, 2023 • 18min

We Need To Discuss The New GDP Data IMMEDIATELY

US GDP surged in Q3 despite low market reaction, highlighting temporary optimism overshadowing a banking crisis. Analysis of the market's response and implications for US Treasuries and crude oil prices. Detailed analysis of third quarter GDP data, highlighting contributions of goods and services, and concerns over global economy. Discussion on labor market warning signs and concerns for the economy, including increase in initial jobless claims.

Oct 26, 2023 • 21min

The Secret $15 Trillion Asset Shaping The Global

Explore the significance of financial collateral in the euro dollar system and its impact on the monetary system and financial markets. Learn about the complex nature of securities lending and the circulation of collateral. Understand the role of treasury securities in collateral swaps and derivative transactions. Discover the importance and risks of securities lending practices, including the influence on the failure of Lehman Brothers and AIG. Lastly, delve into the significance of collateral in the reserve currency system and its impact on hedge funds and insurance companies.

Oct 25, 2023 • 19min

Wall Street Insiders Are Making HUGE Moves

#recession #money #recession2023 #money #inflation #deflation #interestrates #dollar #economy #credit #interestrates #eurodollar #collateral #repo #yieldcurve All of a sudden, two of the biggest bond bears on the planet have turned bearish on the economy and now bullish on bonds. The timing is suspect at least in terms of the "September effect" which is coming off. That leads Treasuries and global bonds back to fundamentals which are looking worse by the datapoint - and we got a bunch of those today. They simply reinforce why bond bears are now economy bears being bullish on bonds. Eurodollar University's Money & Macro AnalysisAckman tweetshttps://twitter.com/BillAckman/status/1716453006344921298Gross tweetshttps://twitter.com/real_bill_gross/status/1716472972113051665S&P Global Flash US Composite PMIhttps://www.pmi.spglobal.com/Public/Home/PressRelease/800861276eb949fc9646061f8eb2ffb4HCOB Flash Eurozone PMIhttps://www.pmi.spglobal.com/Public/Home/PressRelease/8dc7347e38ad43e88d81531f437243aaHCOB Flash Germany PMIhttps://www.pmi.spglobal.com/Public/Home/PressRelease/bdd9a44d333a46a9bd5c66cd7fd32090au Jibun Bank Flash Japan Composite PMIhttps://www.pmi.spglobal.com/Public/Home/PressRelease/4b3aea7d614f4e47aa7a4b108bead4b9Twitter: https://twitter.com/JeffSnider_AIPhttps://www.eurodollar.universityRealClearMarkets Essays: https://bit.ly/38tL5a7

Oct 24, 2023 • 20min

HOLY SH*T! Swap Spreads Just...

The podcast discusses the recent big move in interest rate swap spreads and their significance in understanding the euro dollar system. It explores the opaque world of the euro dollar system and its inner workings through yield curves, money curves, and interest rate swap spreads. The impact of dealer capacity constraints on swap spreads is explored, along with the concept of negative swap spreads and their implications for risk management. The podcast also highlights the importance of negative swap spreads and their potential spillover effects in the market.

Oct 22, 2023 • 22min

We Need To Discuss The New Repo Market Data ASAP

The podcast discusses the current state of the repo market and the unusual decrease in the use of UST collateral. It emphasizes the role of collateral in the monetary system and the persistent issue of safe asset shortages. The consequences of accepting lower quality collateral and the increase in agency MBS usage in the repo market are also explored.

Oct 20, 2023 • 20min

The Monetary System: Something HUGE Changed in July

Explore the impact of Eurodollar cycles on Mexico's peso and how it defied expectations by surging against the global trend. Discover the economic effects of money flowing into Mexico, leading to a construction boom and near-shoring. Uncover the connection between the peso's changing fortunes and the disruption in the Eurodollar system.

Oct 19, 2023 • 20min

China Just Shocked The World With This Move

Special Announcement 🚨 For those wanting a deeper dive and actionable insights, join me for an exclusive webinar on October 20th. Secure your spot here:https://event.webinarjam.com/channel/eurodollar#recession #money #recession2023 #money #inflation #deflation #interestrates #dollar #economy #credit #interestrates #eurodollar #collateral #china #yuan The Chinese government is trying to the sell the world on its attempt at stabilizing China's economy. Of course, it easily finds willing buyers among Western media and audiences - some things never change. But the Chinese "stability" means something very different from "stability" as it is being described outside the country. People are being given an idea of recovery where there just isn't one. Eurodollar University's Money & Macro AnalysisTwitter: https://twitter.com/JeffSnider_AIPhttps://www.eurodollar.universityRealClearMarkets Essays: https://bit.ly/38tL5a7

Oct 18, 2023 • 22min

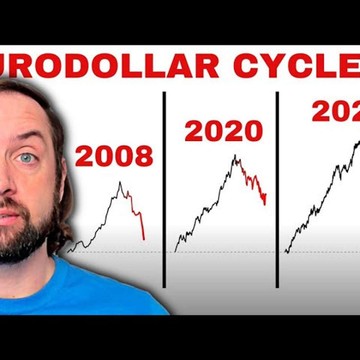

The Hidden Indicators EVERY INVESTOR Should Watch Out For

Special Announcement 🚨 For those wanting a deeper dive and actionable insights, join me for an exclusive webinar on October 20th. Secure your spot here:https://event.webinarjam.com/channel/eurodollar#recession #money #recession2023 #money #inflation #deflation #interestrates #dollar #economy #credit #interestrates #eurodollar #collateral Eurodollar cycles are periods when crucial financial indications align in either one direction or the other. On the one side, it's reflation and better conditions in money and macro. The other, though, that's deflation and recession. If we find more than a few market prices and changes which align like the downside to eurodollar cycles, that's a powerful signal for which way the entire world is going to be heading - or continuing. Eurodollar University's Money & Macro AnalysisTwitter: https://twitter.com/JeffSnider_AIPhttps://www.eurodollar.universityRealClearMarkets Essays: https://bit.ly/38tL5a7

Oct 17, 2023 • 18min

Did Jamie Dimon Just Play His Trump Card?!

Special Announcement 🚨 For those wanting a deeper dive and actionable insights, join me for an exclusive webinar on October 20th. Secure your spot here:https://event.webinarjam.com/channel/eurodollar#recession #money #recession2023 #money #inflation #deflation #interestrates #dollar #economy #credit #interestrates #eurodollar #jpmorgan JP Morgan's CEO Jamie Dimon says to prepare for higher interest rates. JP Morgan's asset management division says to prepare for lower interest rates. What? Trying to figure out which is why, and what fundamental values might actually determine future interest rate levels while looking to the US banking system for crucial clues. Beyond each side of JPM, of course. Eurodollar University's Money & Macro AnalysisBloomberg: Dimon Warns 7% Fed Rate Still Possible, Times of India Sayshttps://www.bloomberg.com/news/articles/2023-09-26/dimon-warns-world-may-not-be-prepared-for-fed-at-7-toi-lmzl7raoReuters: J.P. Morgan Asset Management bullish on Treasuries as Fed done with hikeshttps://www.reuters.com/article/usa-bonds-jp-morgan/j-p-morgan-asset-management-bullish-on-treasuries-as-fed-done-with-hikes-idINL8N3AQ5MUCNBC: Jamie Dimon cautions the 10-year Treasury yield could hit 5%: ‘It’s a higher probability than most people think’https://www.cnbc.com/2018/08/06/jp-morgans-jamie-dimon-cautions-10-year-treasury-note-rate-to-hit-5-percent.htmlTwitter: https://twitter.com/JeffSnider_AIPhttps://www.eurodollar.universityRealClearMarkets Essays: https://bit.ly/38tL5a7