Two by Two

Two by Two What killed India’s first fintech lenders?

Oct 2, 2025

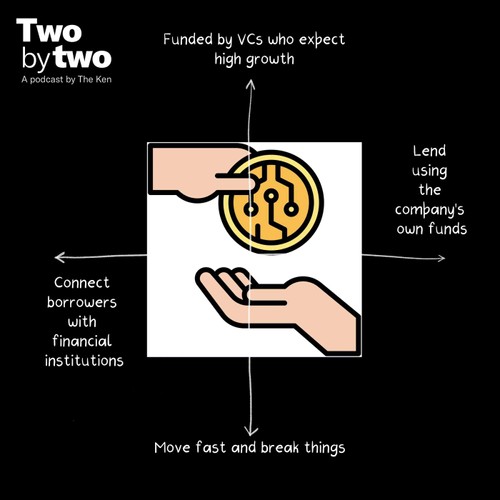

Shivashish Chatterjee, CEO of DMI Finance, and Arundhati Ramanathan, Deputy Editor at The Ken, delve into the rise and struggles of India's early fintech lenders. They discuss the contrasting business models of balance-sheet lending versus platform-based approaches. Arundhati highlights the challenges faced by ZestMoney's BNPL model, while Shiv explains how rapid growth led to significant risks. They reflect on the lessons learned regarding regulation, financial prudence, and the need for fintechs to partner with established entities for future success.

AI Snips

Chapters

Transcript

Episode notes

Alternate Data Promise And Overhyped Expectations

- Early fintech lenders raised big VC money and promised alternate-data underwriting to displace banks.

- That promise created high expectations but did not guarantee sustainable economics.

ZestMoney's BNPL Checkout Play

- ZestMoney rode the BNPL checkout wave on e-commerce and grew via merchant integration.

- It offered short-term interest-free loans and earned commissions while collecting repayments itself.

FLDGs Hid Implicit Leverage

- Many fintechs used FLDGs to convince regulated lenders to put risk on their books.

- That transferred hidden leverage and risk into undercapitalized, unregulated entities.