Eurodollar University

Eurodollar University This Student Loan Crisis Could Be the Tipping Point for the Economy

10 snips

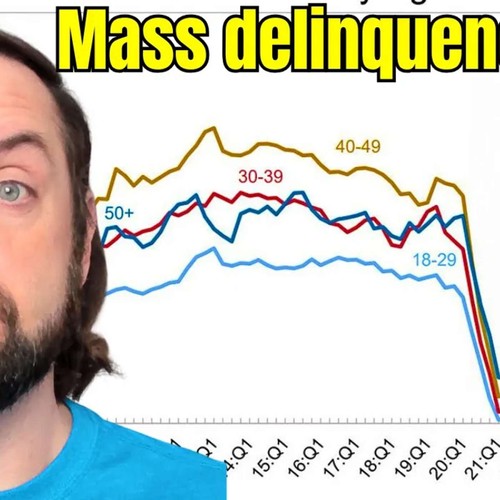

Aug 6, 2025 Student loan delinquencies have surged, signaling a troubling trend in consumer debt that reflects a broader economic decline. As households grapple with financial instability, the fear of job loss looms large. Despite optimistic economic reports, the reality in the labor market reveals shrinking job prospects and rising delinquency rates. This situation prompts questions about potential Federal Reserve rate cuts and the overall impact on economic growth. The combination of these factors could signify a significant tipping point for the economy.

AI Snips

Chapters

Transcript

Episode notes

Rising Delinquencies Signal Weak Economy

- Consumer debt delinquency rates are rising sharply, driven mainly by a surge in student loan delinquencies.

- This increase confirms weakening jobs and incomes as core economic issues.

Economy Points to Lower Interest Rates

- Economic indicators like ISM Services and Manufacturing PMIs fell below expectations, showing weak employment.

- These data support the outlook for substantially lower interest rates sustained for a long duration.

Non-mortgage Debts Show Distress

- Non-mortgage consumer debt: credit cards and auto loans show delinquency rates near decade highs, indicating growing financial distress.

- Mortgages keep overall delinquency lower, but other debts reveal worsening consumer struggles.