The SMB Deal Hunter Podcast

Helen Guo

Every week, Helen Guo interviews successful acquisition entrepreneurs, independent sponsors, and investors who have acquired businesses. Learn how to buy a business rather than starting one from scratch from those who have done it themselves.

Episodes

Mentioned books

Nov 7, 2025 • 51min

$50k → $5M buying declining healthcare businesses (here's how) | Devin Fitzgerald

Devin Fitzgerald acquired 2 declining home healthcare businesses in the Boston area over the last few years and successfully turned them around. He did it with some of the most creative financing we’ve seen on the show. And he’s already working on acquisition #3 (which is 4x bigger than all of his current businesses combined). At some points his story is nearly unbelievable. Here are just a few snippets from his interview...🔥 He bought his first two healthcare businesses making ~$5M in Revenue with only $50k down (and says he shouldn't have put down anything at all)🔥 He was negotiating six-figure deals while delivering pizzas—literally putting bankers on hold to hand off a pepperoni pizza for a $3 tip🔥 He bought a business declining 21.5% per year with zero healthcare experience (and turned it around in year one). Then did it again with business #2 (declining ~6% a year).And some of his insightful lessons: ❓ Why he bought declining businesses (one falling 21.5% annually) when most buyers would run away❓ The book that completely changed his integration strategy (hint: it's about Warren Buffett and John Malone)❓ How he's differentiating in healthcare where rates are often capped and everyone competes on the same playing field-------------------------------👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz💼 Connect with me on LinkedIn: https://www.linkedin.com/in/helen-guo-06674523/

Oct 16, 2025 • 1h 6min

He broke ALL the rules of acquisition and still succeeded | Walker Yarbrough

I’m very excited to share this week’s interview with Walker Yarbrough. He started off with long hours in Investment Banking until he looked up at his bosses and he realized he didn’t want their job (at all). "Even once they'd climbed the ladder, they still just didn't have a lot of control of their own time…They were doing great by a lot of standards, but in the office super late and working on weekends and traveling all the time. It was just a future I didn't see for myself."WalkerSo, Walker did what a lot of us do who want to get into ‘business’. They do literally everything under the sun, hoping something will work:$35,000 on an Amazon automation store. Started great—days with $1,000+ in sales selling Calvin Klein cologne. Then Amazon banned the store. Money gone.Print-on-demand t-shirts. His girlfriend had a successful Etsy shop, so why not? Too competitive. Went nowhere.Options trading. Sometimes worked. Mostly stressful. Never consistent.Sports betting analytics site. Got CLOSE. Almost signed the deal. Then Walker realized: "If something breaks, I don't think I'm gonna be able to fix it."Then, he decided to simplify and buy a business he could understand. A vending machine company with 7 locations in Atlanta. Fully owner-operated by a 75 year old who wanted to retire. But here’s where things get interesting: 💡 Walker had to beat out an experienced vending machine company competing for the same deal. 💡 The deal got held up for 2 MONTHS over a $200 bill. 💡 And when it DID close, Walker made a classic first-timers mistake. He hired an operator to run the business and went off on vacation. Aiming for a ‘passive’ investment. Until the operator quit 3 months later. The full story involves a panicked craiglist job hunt, Walker losing one of his biggest customers, and realizing that the business was practically run out of the previous owner’s car. It’s a wild ride. And at the end, Walker not only succeeded but excelled. So much so, that he’s one of our new M&A advisors. -------------------------------👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz

Oct 1, 2025 • 49min

From Laid Off & Mid-Divorce to a $1.3M / Year Business (with 100% Seller Financing) | Raj Kankaria

I’m very excited to share this week’s interview with Raj Kankaria. It is an absolute roller coaster involving layoffs, divorce, rappers, a quarter life crisis, and Raj buying a $1.3M / year business with 100% seller financing. Here’s a sneak peak:Raj was a former army vet who had gotten a job at Citi Bank as an investment banker. He had just been laid off. He was in the middle of a messy divorce. And one day, he opened the door to a process server who handed him his divorce papers.Out of curiosity, Raj asked the man how much he made for every delivery. The answer: Over $100 per deliverySo, Raj started digging in…and 18 months later, with a lot of twists and turns along the way, Raj ended up OWNING a company that did exactly that. But it gets crazier:💡Raj ended up negotiating a 100% seller financed deal (after his SBA loan fell through)💡He ended up building the biggest litigation support company in Harris County. With $1.3M in revenue. 1000+ contractor network. And a recession-proof business model. 💡 And before all that, Raj actually spent over a year working as a process server himself. (And he shares advice on why this was pivotal to his success later on)--------------------------------👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz

Sep 17, 2025 • 1h 23min

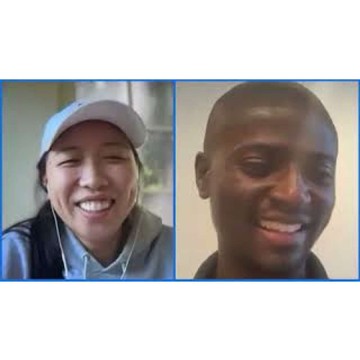

This Software Engineer Quit Tech & Bought A $3.2M+ Business (Now Buying His 2nd) | Kofi Acheampong

Join me as I interview Kofi Acheampong... Kofi’s interview is unique because he actually went through our Pro program and bought a Home Restoration business cash-flowing $715k+ / year in a record 5 months.But this interview goes a lot deeper into…💡 How Kofi actually launched a software startup that got to #3 on Product Hunt - and how he walked away when his wife got pregnant and he had no health insurance.💡 How he bought his $3.2M business with only 5% down and 8 months later, he’s already under LOI on a second deal with 67% seller financing.💡 How he succeeded in buying the business after 6-7 other people had already tried and failed (including the current GM…who also happened to be the seller’s son-in-law)👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz

Sep 5, 2025 • 39min

He turned $100k to $6M buying landscaping businesses (here's how) | Michael Loftus

I’m very excited to share this week’s interview with Michael Loftus.Michael really shows you how far you can go with a simple strategy. Here are just a few snippets from his interview…🔥 He bought his first 3 companies with no banks involved…with upwards of 50% seller financing…🔥 He’s acquired 7 landscaping businesses over the last five to six years (and talks about what makes them so recession resistant)🔥 He was able to take a 3 week honeymoon last year without taking a single phone call.And some of the juiciest lessons…⁉️ How Michael is able to retain 90% of the customers from each acquisition…⁉️ How he has built up to 80 full-time employees and $6M in revenue⁉️ His secret for hiring high quality employees (and how acquisitions are a big apart of it)👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz

Aug 21, 2025 • 50min

25 Year Old College Drop-Out Buys a $1.3M Auto Body Shop with $15k | Andres Martínez

Join me as I interview Andres Martínez... At some points his story is nearly unbelievable. Here are just a few snippets from his interview…🔥 He bought a $1.3M auto body shop making about $500k in EBITDA with 1% down. Yes, you read that right. $15,000 down for a $1.3M deal. 🔥 He came from Mexico in 2021, with no house for collateral, no real job, and bought his first business at 25. 🔥 He had dropped out of college and had failed at multiple businesses, mainly food trucks, leading up to his first big acquisition. And after all of those obstacles?…🚀 He is already on his way to buying his 2nd and 3rd companies in the Auto Body and Automation niches. 👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz

Aug 6, 2025 • 49min

"I Wanted to Throw Up" - How JD Beck Built A $4.6M HVAC/Plumbing Empire While Everything Went Wrong

Join me as I interview JD Beck, an entrepreneur who is rolling up HVAC and plumbing companies in Colorado. He's made 3 acquisitions to-date, scaling the business from $1.1M to $4.6M in revenue.👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz

Jul 24, 2025 • 56min

He Left Corporate to Buy a Pallet Company. Then He Doubled It. | Michael Kelker of GBR Riverdale

Join me as I sit down with Michael Kelker, a former corporate exec who spent 15 years in the aviation manufacturing industry before leaving to buy Timberline Pallet, a custom pallet and crating company in the Quad Cities.With no prior experience in pallets, Michael stepped in as an owner-operator, doubled the business in five years, and grew the team from 15 to 27 employees.Since then, he’s made two more acquisitions: an auto parts recycler and a manufacturing consultancy (which he exited).We dive into what it’s really like to run a blue-collar business, team building, why he says he’s “not a good employee anymore," and how he’s building a legacy business for his daughters (GBR Riverdale is named after them)._______________________________👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz

Jul 9, 2025 • 53min

Former Talent Agent Buys 40-Year-Old Trade Publication | Nathan Gregory of Auto Body News

Join me as I sit down with Nathan Gregory, a former talent agent in the entertainment industry who acquired Auto Body News, the leading trade publication in the collision repair industry.Nathan’s journey into entrepreneurship began with flipping raw land and investing in commercial real estate. After building and selling an Amazon-based product business, he spent over a year searching for the right company to buy, ultimately landing on a 42-year-old B2B media company serving auto repair shops and vendors nationwide. He used SBA financing, creative seller notes, and deep industry experience to close the deal.If you’re curious about how to buy your first business, why domain expertise gives you a competitive edge, or how to modernize a legacy business, you’ll love this episode._______________________________👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz

Jun 26, 2025 • 58min

Why This Startup Founder Bought an Electrical Contracting Business | Fred McGill of Bray Electrical

Join me as I sit down with Fred McGill from Atlanta, Georgia–a former startup founder who made the leap into small business acquisition.Exactly one year ago, Fred acquired Bray Electrical Services, an electrical contracting business. In just 12 months, he’s grown the top line by $650,000, while still running his real estate brokerage on the side.If you’re thinking about buying a business in the trades or want a real look at what it takes to scale one, don’t miss this story._______________________________👉 Subscribe to the SMB Deal Hunter Newsletter — free weekly deals & insights: https://join.smbdealhunter.xyz🤝 Work with me and my team 1-on-1 to find, finance, and close your acquisition in 6–12 months: https://pro.smbdealhunter.xyz