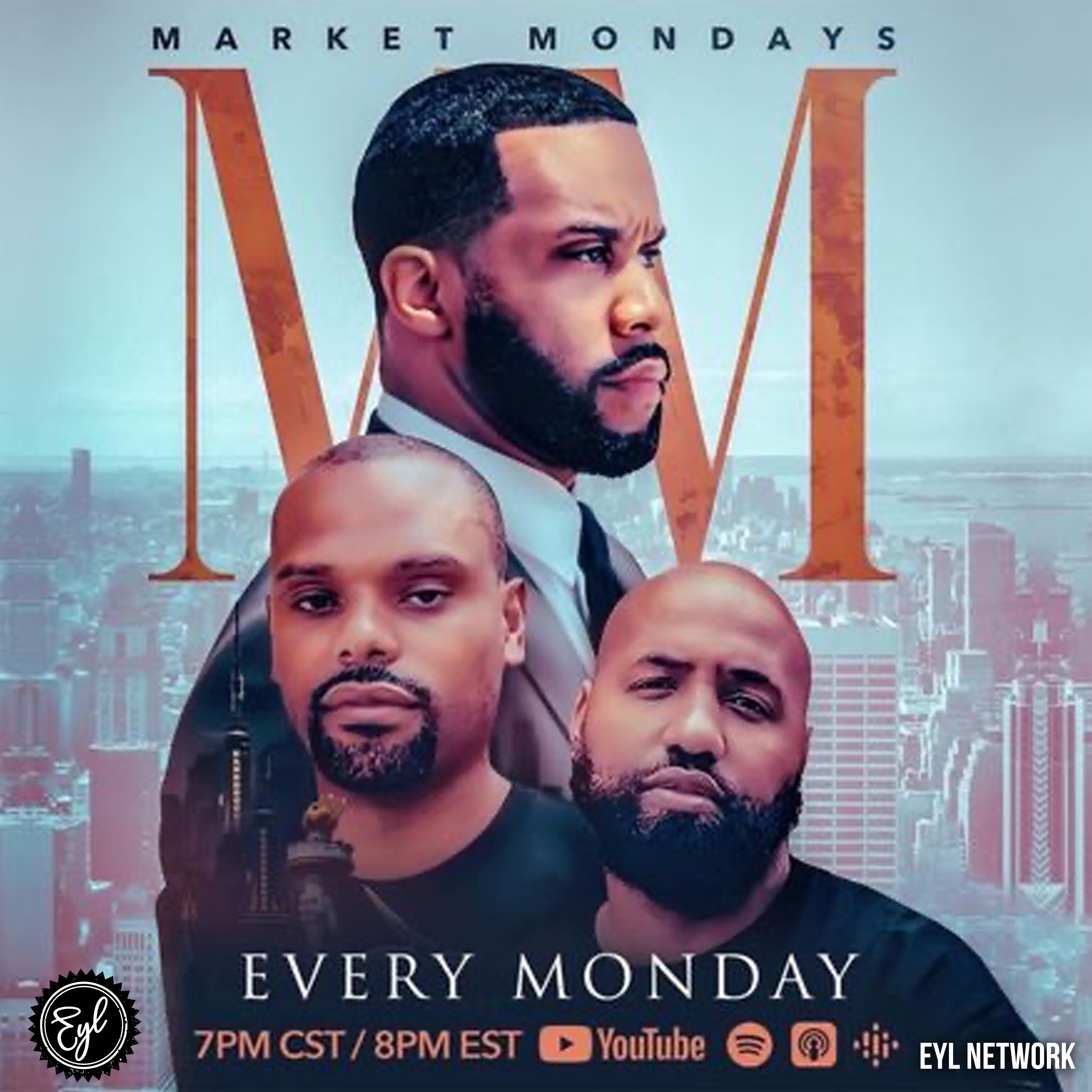

Market Mondays

EYL Network

On Market Mondays, Earn Your Leisure and Stock market expert Ian Dunlap discuss strategies to make money in the stock market under any circumstance. During Market Mondays, we also answered a variety of investment questions from live callers. Market Mondays is a new, exciting look into the world of investing and money management.

Episodes

Mentioned books

Jan 21, 2025 • 2h 17min

MAGA 2.0: Trump Meme Coin, TikTok Ban Reversal, Crypto Explosion & Top Trump Era Stocks ft 19 Keys

Special guest 19 Keys, a thought leader at the crossroads of politics, technology, and investing, joins the conversation. They dive into the controversial Trump Meme Coin and its implications for investors. The discussion also covers the TikTok ban reversal, shedding light on its future and impact. They analyze the ongoing tech wars and question the role of leaders like Mark Zuckerberg. Insights on key stock picks from Barron’s and the importance of financial education wrap up this engaging dialogue filled with actionable insights.

Jan 18, 2025 • 14min

Trump's Strategic Moves: Greenland, Panama Canal, and the Importance of Waterways

The discussion kicks off with Donald Trump's interest in Greenland and the Panama Canal, emphasizing their historical and strategic significance. The hosts explore how controlling waterways shapes global trade and power dynamics. As global warming introduces new trade routes, the geopolitical landscape is poised to shift. The conversation also dives into modern imperialism, highlighting the ongoing tussle for strategic territories among global powers. It's a fascinating look at how historical narratives inform current geopolitical ambitions.

Jan 15, 2025 • 13min

Apple vs. Meta: Zuckerberg Goes at Tim Cook!

Mark Zuckerberg takes a bold stance against Apple, claiming the company has stagnated since the iPhone's launch. Discussions swirl around Donald Trump's suggestion for Zuckerberg to air his grievances on a popular podcast. The panel delves into the broader implications for Apple's stock amid critiques of its growth driven more by accessories than innovation. The rivalry between Apple and Meta highlights the need for fresh leadership in the tech arena and questions the future of consumer engagement with smartphones. Expect exciting developments in communication tech, too!

Jan 14, 2025 • 2h

LA Wildfire Insight, Stock Pullback, the Truth About DEI, Meta vs Apple, & How Low Will Bitcoin Go

Sigma Scott, an Altadena resident whose home was lost in the devastating Los Angeles wildfires, shares her inspiring story of resilience and community support. The conversation addresses the emotional toll of the disaster and the challenges of navigating insurance claims amidst such tragedy. The podcast also delves into the controversial end of Meta’s DEI programs, sparking debates about corporate accountability. Additionally, they explore the competitive tensions between tech giants Meta and Apple, as well as market predictions for Bitcoin and top-performing stocks like Nvidia.

5 snips

Jan 11, 2025 • 9min

MicroStrategy: All Hype or Unstoppable Bitcoin Giant?

Dive into the whirlwind of MicroStrategy's bold Bitcoin strategy! Hear Rashad's rollercoaster experience with options trading as he discusses navigating volatility. Get insights from Josh Brown on Michael Saylor's unique investment tactics, which have transformed MicroStrategy into a Bitcoin giant. Both highlight the high-stakes nature of options trading and the psychological grit needed to thrive. Learn about market premiums and the implications for investors, all packed into a lively discussion on daring market moves!

Jan 9, 2025 • 5min

The Future of Chip Stocks: Insights You Can't Miss

Dive into the world of chip stocks as market expert Josh Brown tackles the exciting yet volatile landscape of AI and semiconductor companies. With giants like AMD and Nvidia soaring, is there a real chip bubble or justified optimism? Uncover the astonishing 178% return on Nvidia and the cautious outlook on AI's impact on stock prices. Explore how these stocks hold significant sway over entire portfolios, even as past fluctuations raise eyebrows. Buckle up for insights that could shape your investment strategies!

Jan 7, 2025 • 2h 10min

Will Stocks Crash? Hottest Sectors, Top Companies Not on the Market & Best 2025 Stocks ft Josh Brown

Join us for an insightful episode of Market Mondays as we sit down with renowned financial expert Josh Brown to dissect the pivotal investing lessons of 2024 and explore the opportunities that lie ahead in 2025. In this engaging discussion, we cover reflections on 2024, analyzing key takeaways from the past year’s market dynamics; VIX analysis, understanding the implications of volatility and identifying potential buying opportunities.Stock picks and sector preferences, gaining insights into Josh Brown’s top stock selections and favored sectors for 2025; Advanced Micro Devices ($AMD) outlook, evaluating the prospects for AMD in the coming year; MicroStrategy trade strategies, delving into potential trading approaches for MicroStrategy; anticipated IPOs, highlighting three highly anticipated initial public offerings slated for 2025; oil & natural gas sector forecasts, identifying standout companies in the energy sector poised for growth.Amazon’s trajectory, discussing expectations for Amazon’s performance in a potentially bullish market environment; quantum stock pumps, debating whether these are a fleeting trend or a lasting market fixture; market correction predictions, assessing the likelihood and potential magnitude of market corrections; Target’s revival strategies, exploring actionable steps Target can take to regain market strength.MicroStrategy shorting considerations, contemplating the viability of shorting MicroStrategy in the latter part of the year; probability of a 20% market move, estimating the chances of significant market movements in 2025; and top private companies, showcasing leading unlisted companies to watch. Don’t miss this comprehensive analysis to equip yourself with the knowledge needed for informed investment decisions in 2025.Hashtags: #MarketMondays #JoshBrown #Investing2025 #StockMarketAnalysis #FinancialInsights #AMD #MicroStrategy #Amazon #IPOs2025 #OilAndGas #MarketOutlook #Target #QuantumStocks #MarketCorrection #PrivateCompaniesSupport this podcast at — https://redcircle.com/marketmondays/donationsAdvertising Inquiries: https://redcircle.com/brandsPrivacy & Opt-Out: https://redcircle.com/privacy

29 snips

Jan 5, 2025 • 7min

Troy's Stock Picks for 2025

Troy Millings unveils his top stock picks for 2025, spotlighting Taiwan Semiconductor Manufacturing Company as a key player in the AI revolution. ASML's monopoly on AI machinery and Amazon's chip production ventures are also covered. Broadcom's crucial role in data center connectivity and Eli Lilly's pharmaceutical innovations are highlighted as major opportunities. Nvidia and AMD are discussed as fierce competitors in the GPU and CPU markets, while firms like Micron Technology and Western Digital gear up for growth in memory storage.

Jan 2, 2025 • 4min

Time in the Market is Better Than Timing the Market w/ Caleb Silver

Welcome back to another clip of Market Mondays! In today's clip, your host Rashad Bilal invites special guest Caleb Silver, a financial expert with decades of experience. They dive deep into the current state of the U.S. economy, discussing everything from the stock market and asset bubbles to economic bailouts and predictions for the future.⭐ *Highlights in This Episode:* *U.S. Economy Analysis:* Caleb shares his personal perspective on whether the U.S. economy is poised for a pullback, recession, or continued growth. He explains how the lack of moral hazard and frequent bailouts benefit asset holders and stockholders, while also touching on the impact of government policies. *Stock Market Trends:* Reflecting on past predictions, Caleb admits his mistake in underestimating the market's performance in 2024. He points out how ultra-profitable companies and the relentless bullish trend in key indexes like NASDAQ and S&P 500 have defied expectations.*Investment Strategies:* Caleb provides practical advice on staying invested, rebalancing portfolios, and the importance of time in the market versus timing the market. He emphasizes that consistent investing and long-term perspectives often yield the best results, even when economic conditions seem uncertain. *Lessons Learned:* Caleb shares his biggest lessons from the past half-decade, including the importance of continuous learning and adapting investment strategies based on economic shifts.Whether you're a seasoned investor or just starting out, this episode is packed with invaluable insights and actionable advice. Don't miss out on Caleb Silver's expert take on navigating the complexities of today's financial landscape.*Don't Forget to Like, Comment, and Subscribe!*🔔 *Stay Updated:* Click the bell icon to receive notifications about our latest videos.*#MarketMondays #StockMarket #USEconomy #InvestingTips #CalebSilver #FinancialInsights #StockMarketTrends #InvestmentStrategies #EconomicAnalysis #StayInvested*Tune in now and join the conversation in the comments below!Support this podcast at — https://redcircle.com/marketmondays/donationsAdvertising Inquiries: https://redcircle.com/brandsPrivacy & Opt-Out: https://redcircle.com/privacy

Dec 29, 2024 • 6min

Chris Gotti Exposes the Truth About Corporate Deals in ‘Hood Business’

In this captivating clip from Market Mondays, we delve deep into the grit and grind of the music industry with none other than Chris Gotti. As a key player and star finder in the realm of rap music, Chris Gotti offers an unfiltered perspective on what he terms "hood business." From the racial prejudices that overshadow the business side of music to the undervaluation of talent in industries like sports, Chris lays it all out.Join hosts Rashad Bilal, Troy Millings, and Ian Dunlap as they navigate through the intricate layers of the music and entertainment industry with their distinguished guest.*Key Highlights:**Hood Business Explained:* Chris Gotti breaks down the concept of hood business, drawing distinctions between rap music and the broader music industry.*Racial Challenges:* Chris shares personal experiences of racial bias in the business, highlighting the disrespect and undervaluation that artists from underprivileged backgrounds often face.*Corporate Exploitation:* Whether in music or sports, Chris discusses how major corporations often exploit talent, paying them far less than their true worth.*The Role of Platforms:* Learn about Clash TV and how it aims to disrupt the traditional ways of generating revenue and exposure in the industry.*Unyielding Integrity:* Chris emphasizes the importance of sticking to one's principles and not settling for less than what you're worth, citing his own refusals to accept undervalued deals.*Star Quality:* In response to Ian's probing questions, Chris provides a nuanced take on what makes someone a star, whether they are born with it or can develop it through hard work.Whether you're an aspiring artist, a business enthusiast, or just curious about the real dynamics behind the glitz and glamour, this clip offers invaluable insights you won't want to miss.*Tune in to discover:*The harsh realities and unspoken truths of hood business.The inventive solutions like Clash TV that are changing the game.What truly makes a person a superstar, from talent to sheer determination.Don't just listen; absorb these truths and arm yourself with the knowledge that could change your approach to business and life.*Watch now and let Chris Gotti, along with Rashad Bilal, Troy Millings, and Ian Dunlap, peel back the layers of an industry that few understand but many aspire to join.*Subscribe for more eye-opening content and hit the notification bell so you never miss an update from Market Mondays!*#MarketMondays #ChrisGotti #HoodBusiness #MusicIndustry #RapMusic #RacialPrejudice #CorporateExploitation #StarQuality #ClashTV #Superstar #BusinessEthics*---Don’t forget to like, comment, and share your thoughts on what makes a true star. Is it inherent talent, or can it be developed through hard work? Let us know your take in the comments below!Stay tuned for more inspiring and educational content from Market Mondays, where we uncover the truths and strategies of successful individuals across various industries.Support this podcast at — https://redcircle.com/marketmondays/donationsAdvertising Inquiries: https://redcircle.com/brandsPrivacy & Opt-Out: https://redcircle.com/privacy