Credit Union Exam Solutions Presents With Flying Colors

Mark Treichel's Credit Union Exam Solutions

Tips for Credit Unions Success on the NCUA Examination. Brought to you by Mark Treichel's Credit Union Exam Solutions.

Episodes

Mentioned books

Apr 10, 2025 • 50min

NCUA's Net Economic Value (NEV) Framework with Todd Miller

Episode Summary: In this episode of With Flying Colors, host Mark Treichel is joined by former NCUA capital markets expert Todd Miller to discuss the latest updates to NCUA’s Interest Rate Risk (IRR) Supervisory Framework. Following NCUA’s recent stakeholder webinar, we break down key takeaways, including changes to risk categorization, the elimination of the extreme risk rating, and how these updates impact credit unions navigating today’s economic landscape.What You’ll Learn in This Episode: ✅ The history and evolution of NCUA’s NEV framework ✅ Why NCUA eliminated the “extreme risk” category and what it means for credit unions ✅ The role of examiner judgment in assessing interest rate risk under the new guidance ✅ How credit unions can mitigate risk and avoid a Document of Resolution (DOR) ✅ The growing importance of liquidity management and how credit unions should prepare ✅ Why examiner scrutiny of IRR is increasing, despite the removal of automatic DORsKey Takeaways from the NCUA Webinar: 🔹 NCUA clarified that interest rate risk remains a top supervisory priority for 2023 and beyond. 🔹 Credit unions must demonstrate strong risk management practices to avoid regulatory action. 🔹 Liquidity risks are increasing due to rising rates and market shifts—credit unions should reassess their funding strategies. 🔹 Open communication with examiners is essential—proactive discussions can help avoid surprises.Resources Mentioned in This Episode: 📄 NCUA’s Letter to Credit Unions (22-CU-09): [Insert link if available] 🎥 NCUA’s Stakeholder Webinar on Interest Rate Risk: [Insert link if available] 🔍 Learn more about Credit Union Exam Solutions: marktretchel.comSubscribe & Stay Connected

Apr 8, 2025 • 12min

Rodney Hood to FDIC, Retirement Rumors & Regulatory Rumblings

www.marktreichel.comhttps://www.linkedin.com/in/mark-treichel/A quick-hit episode this week! Mark shares thoughts on Duke’s March Madness collapse, the rise of Rodney Hood at OCC, Jim Nussle’s pending retirement, and NCUA’s buyout offers. Plus, a few takes on market volatility, sub debt approvals, and the ever-shifting dynamics at the NCUA Board.Topics Covered:Duke’s tourney loss and dynasty hateRodney Hood's possible FDIC moveJim Nussle’s retirement newsNCUA staff buyouts and exam slowdownsThe case for sub debtMarket drops and flight to quality

Apr 3, 2025 • 54min

NCUA: Can You Put That In an Examiners Finding Instead of a DOR?

Episode Title:NCUA: Can You Put That in an Examiner Finding, Not a DOR?Episode Summary:In this episode of With Flying Colors, host Mark Treichel is joined by Steve Farrar and Todd Miller to unpack the complexities of NCUA examinations, examiner findings, and documents of resolution (DOORS). They dive into what makes an issue rise to a DOOR, how credit unions can negotiate findings, and why corporate governance is becoming a focal point in exams.With their decades of experience inside NCUA, Mark, Steve, and Todd share insights on how credit unions can better navigate the regulatory process, avoid unnecessary compliance burdens, and strengthen their governance structures. If you've ever wondered why something lands in a DOOR rather than an examiner finding, this episode is for you!Key Topics Covered:✔️ What qualifies as an examiner finding vs. a DOOR? ✔️ How credit unions can respond to and negotiate with NCUA ✔️ The rising focus on corporate governance in examinations ✔️ How unresolved examiner findings escalate over time ✔️ The role of supplementary facts in the examination process ✔️ Understanding regional director letters and enforcement trendsGuest Information:🎙 Steve Farrar – Former NCUA official with 30+ years of experience in risk management, enforcement, and problem case resolution. 🎙 Todd Miller – Former NCUA examiner, capital market specialist, and director of special actions, with 35 years of regulatory expertise.Host Information:🎙 Mark Treichel – Former NCUA executive and credit union expert, dedicated to helping credit unions optimize their exam results.Resources Mentioned:🔗 MarkTreichel.com – Learn more about Credit Union Exam Solutions 🔗 NCUA CAMELS Rating System 🔗 FDIC Proposed Corporate Governance GuidanceSubscribe & Follow:🔔 Never miss an episode! Subscribe on Spotify, Apple Podcasts, Google Podcasts, or your favorite podcast app. 📩 ]👉 If you found this episode valuable, please leave us a rating and review!

Apr 1, 2025 • 38min

From the Base to Capitol Hill: Advocating for Credit Unions with Jason Stverak of DCUC

www.marktreichel.comhttps://www.linkedin.com/in/mark-treichel/In this episode of With Flying Colors, Mark Treichel is joined by Jason Stverak, Chief Advocacy Officer of the Defense Credit Union Council (DCUC), for a wide-ranging conversation on the unique role defense credit unions play in serving military members—and the policy battles threatening their ability to do so.Jason shares how DCUC advocates for military-affiliated credit unions across a rapidly evolving regulatory and political landscape. From the impact of the Credit Card Competition Act on interchange fees to the overdraft protection debate and the ongoing defense of the credit union tax exemption, this episode dives deep into the issues shaping the future of service-based financial institutions.You’ll also hear powerful real-world stories—including how Navy Federal helped a young Marine avoid a predatory car loan, and how Enbright Credit Union supports members battling cancer—that illustrate the mission-first, member-first mindset of credit unions in action.🔍 Topics Covered:What DCUC is and who it servesWhy interchange income matters, especially for defense credit unionsThe Credit Card Competition Act: risks and real-world impactsOverdraft protection and CFPB’s regulatory shiftsThe importance of preserving the credit union tax statusReal stories of credit unions stepping in when members need them most👤 Guest:Jason Stverak Chief Advocacy Officer, Defense Credit Union Council 🔗 DCUC.org

Mar 27, 2025 • 30min

The Harsh Realities of a CAMEL Code 4 Downgrade

www.marktreichel.comhttps://www.linkedin.com/in/mark-treichel/ Episode Summary: In this episode of With Flying Colors, host Mark Treichel is joined by Steve Farrar and Todd Miller from Credit Union Exam Solutions to discuss the serious implications of a CAMEL Code 4 rating. A downgrade to CAMEL 4 signals significant risk and increased regulatory scrutiny. What does this mean for your credit union? What immediate actions should management and the board take? How does this impact borrowing, liquidity, and operations? Get expert insights into navigating the challenges of CAMEL 4 and what steps to take to get back on track. What You’ll Learn in This Episode: ✅ What is a CAMEL Code 4? Understanding why it’s a major red flag ✅ How NCUA views CAMEL 4 credit unions and why they ramp up oversight ✅ The consequences of a downgrade – more frequent exams, lost privileges, and reputational risk ✅ NCUA’s administrative actions – what happens when you receive a Letter of Understanding & Agreement (LUA) ✅ How a CAMEL 4 affects your liquidity – Federal Reserve & Federal Home Loan Bank implications ✅ The impact on borrowing & collateral requirements ✅ The role of the board in a CAMEL 4 credit union – what’s expected of leadership ✅ Can a CAMEL 4 credit union recover? Strategies for improvement Key Takeaways: 🔹 CAMEL 4 credit unions face exams every 120 days, meaning examiners are always present 🔹 Expect Letters of Understanding & Agreements (LUAs) and preliminary warning letters 🔹 NCUA and federal agencies (like the Federal Reserve & FHLB) are notified, impacting borrowing & liquidity 🔹 The board and management face increased accountability, with NCUA requiring approval for senior leadership changes 🔹 A downgrade to CAMEL 4 means administrative oversight, and in some cases, public disclosure (depending on state regulations) 🔹 Credit unions in this category must act quickly to stabilize finances and demonstrate improvement to avoid further decline Resources Mentioned: 📌 NCUA’s National Supervision Policy Manual (for details on CAMEL 4 oversight) 📌 NCUA’s Share Insurance Briefing (for trends in CAMEL ratings) 📌 Credit Union Exam Solutions – Expert consulting for navigating NCUA exams Connect With Us: 🌐 Visit marktreichel.com for expert guidance on NCUA exams 📩 Have a question or topic suggestion? Email us at [your email/contact info] 📲 Follow us on LinkedIn, Twitter, or Facebook for more credit union insights

Mar 25, 2025 • 39min

Year End Industry Data and Credit Union Trends: A Deep Dive with Todd Miller and Steve Farrar

www.marktreichel.comhttps://www.linkedin.com/in/mark-treichel/In this episode of With Flying Colors, host Mark Treichel is joined by Steve Farrar and Todd Miller to analyze the latest trends shaping the credit union industry in 2024. They dive into the recently released NCUA data, discussing multi-year trends, economic pressures, and how credit unions are navigating challenges such as rising delinquencies, declining net income, and shifting liquidity conditions.Key Topics Covered:✅ Multi-Year Credit Union Trends – How decisions made during COVID-19 continue to impact the industry today ✅ Rising Credit Risk & Loan Performance – What’s driving the surge in credit card and auto loan delinquencies? ✅ NCUA’s Supervisory Priorities – Where examiners are focusing their attention in 2024 ✅ Liquidity & Interest Rate Risk – How credit unions are adjusting to changing market conditions ✅ Earnings & Profitability Pressures – Understanding the impact of fee income declines, provision for loan losses, and economic uncertainty ✅ Regulatory Challenges & Mergers – The latest data on credit union consolidations and how they compare to community banksRecent Exam Trends:🔹 Increased scrutiny on commercial lending programs and credit concentration limits 🔹 More emphasis on profitability analysis at the loan program level 🔹 Examiners pushing for stronger liquidity contingency funding plans 🔹 Greater focus on enterprise risk management in larger credit unions🎧 Listen now to get the full breakdown of the latest trends and how they could impact your credit union’s operations.Resources & Related Episodes:📌 Want to learn more about specific regulatory issues? Check out our past episodes on: 🔹 Commercial Lending Risks & Best Practices 🔹 Managing Interest Rate & Liquidity Risk 🔹 Navigating NCUA’s Supervisory Priorities🔗 Subscribe to With Flying Colors for the latest insights into credit union regulations and strategy!

Mar 20, 2025 • 26min

The Road to Recovery: Managing a CAMELS 3 Rating

So You're a CAMEL Code 3 – Now What? 🎙 Episode Title: So You’re a CAMEL Code 3 – Now What? Episode Summary: In this episode of With Flying Colors, host Mark Treichel is joined by Steve Farrar and Todd Miller from Credit Union Exam Solutions to discuss what happens when a credit union is downgraded to a CAMEL Code 3. They break down the implications of this rating, what it means for credit union management, and how to navigate increased NCUA supervision effectively. What You’ll Learn in This Episode: ✅ What is a CAMEL Code 3? Understanding the rating and why it matters ✅ How NCUA views CAMEL 3 credit unions and what it means for supervision ✅ The impact of a CAMEL 3 downgrade on credit union operations and oversight ✅ What to expect during follow-up exams and how often NCUA will visit ✅ Documents of Resolution (DORs): What they are and how to handle them ✅ Regional Director Letters (RDLs): Why you might receive one and how to respond ✅ State vs. Federal Charters: Differences in how NCUA approaches CAMEL 3 credit unions ✅ The path back to a better rating: Steps credit unions can take to return to a CAMEL 2 Key Takeaways: 🔹 Credit unions rated CAMEL 3 face increased supervision, typically two visits per year 🔹 Documents of Resolution (DORs) set deadlines for corrective actions, often tied to follow-up exams 🔹 Regional Director Letters (RDLs) are common and signal heightened regulatory concerns 🔹 Management and boards must track and report progress on corrective actions to avoid further downgrades 🔹 Follow-up exams rarely lead to an immediate upgrade, so credit unions should plan for at least 20 months of heightened oversight 🔹 Recordkeeping and BSA violations trigger even more frequent exams, sometimes every 90 days Resources Mentioned: 📌 NCUA’s National Supervision Policy Manual (for details on CAMEL 3 oversight) 📌 NCUA’s Share Insurance Briefing (for trends in CAMEL ratings) 📌 Credit Union Exam Solutions – Learn more about expert consulting to help navigate NCUA exams

Mar 18, 2025 • 21min

NCUA in 2025: What to Expect & How It Affects You

www.marktreichel.comhttps://www.linkedin.com/in/mark-treichel/NCUA Predictions: What Will the Do in 2025?Treichel: [00:00:00] Hey everyone, this is Mark Treichel with another episode of With Flying Colors. Today I am flying solo and I am calling this podcast something like what I expect from NCUA in 2025. In preparing for today's show, I took some notes going back and looking at NCUA's Agenda from their board action taken in 2025 and am gleaning based on the Trump administration and the Helpman leadership.What may or what may not happen in 2025 compared to 2024. When you go back and look at 2025. They had canceled two board meetings. So that was one takeaway. They canceled the March, 2024 board meeting, which was the first time in a long time that that had happened. And they canceled the June, 2024 meeting.So this was under then [00:01:00] chairman Todd Harper, who is now a board member at large, although he came close to being named vice chair, and you can check out some of my past podcasts for discussions on why that may have blown up anyway. It things continue to blow up at the board level, but I'll get to that here shortly.All right. They canceled 2 board meetings and they held for N. C. U. S. I. F. share insurance fund briefings. I report on those quite a bit here and on linked in because that's 1 of the few windows to generic camel code ratings. You can see when camel code ratings go up and they did 4 of those. in 2024.I'm expecting they'll do four of those in 2025. They did one cyber security update briefing and they did a new charter update and briefing and tip to what I might say in the future. I think there will be more briefings because I don't think the board will be acting on much because I don't think the board [00:02:00] is currently getting along because of the kerfuffle on NSF and overdraft fees.All right. So other things they did they did a proposed succession planning rule and a final succession planning rule. They did an incentive based compensation proposal, which I think will go nowhere in 2025. That was put out there because Biden's administration required it from all. Banking agencies and under the Trump administration there will be less or zero regulation.And I don't see them wanting to put proposals in on incentives. If you'd know what I mean. In July, there was a loan rate ceiling approval to. re approve utilization of the 18 percent rate. That's what they do every time. The trade associations come out saying you should allow that to go up or you should make it based on variability.If NCOA was ever going to raise it, it would have been last year and or the year before. They [00:03:00] didn't seize that opportunity because they thought it would have been egregiously harmful to credit unions and credit union members. I disagree with that, but they will vote on that again because they have to vote on it and they will likely just do what they've done umpteen years in a row, which is reaffirmed the 18%.I expect that to happen in July again. All right. What else is going to be happening? Potentially, they did have a board appeal in August. By the way, they typically don't have open board meetings in August. That was a closed a closed item where a credit union appealed something without revealing what I know relative to that.That was a field of membership appeal. There was a fair hiring and banking proposal, which doesn't need to repeat in 2025. They simplified the insurance rules. And then when you get close to the end of the year, what happens at the end of the year and CUA approves their budget. But before they approve their budget, they do a budget briefing.A little [00:04:00] bit of history on the budget briefings. The budget briefing started when I was the deputy executive director and they were started by Dennis Dollar. And I remember saying to that executive director, Len Skiles, if you do this, Make sure you want to do it and it was for transparency. But once you start something, it's very difficult to stop it.And I'll get to that and why I'm making that point. I'll get to it now, but I'll refer to it again. So NCOA did stop it. I believe it was under the Matt's administration and the trade associations got upset because that was their opportunity. One of their opportunities to show value saying your budget's too high.Here's why we think it's too high. And through assistance from Senator Mark Warner in Virginia, they were able to get the Federal Credit Union Act proposed, requiring NCUA to do a budget briefing. They are required to do a budget briefing. I believe they will do a budget briefing. I'm not so sure they will do a budget.They're not [00:05:00] required to do a budget, and they are required to do a budget briefing. They're not required to do a budget, and that's because there is a two year budget. So I'll get to that and why I think that they may not do a budget when we walk through what I think will happen in totality in 2025. The NCOA approved their annual performance plan, which is linked to their strategic plan, already in January.That was one of the last things they did prior to Hauptmann taking over. So they don't need to do that annual plan, but they do need to do another strategic plan, and that would be due by the end of 2025 for the years 2026 through 2030. Will they do that? We will see. All right. So when you look at what is going to happen and what I predict will happen in 2024, that's a little bit about what happened.What I'm predicting in 2024 is that the theme of canceling board meetings will continue. They, as I mentioned, they canceled March and June. I'm [00:06:00] expecting that they may cancel April or May. Or June or July, I don't believe they're going to have enough briefings to keep an agenda full. I don't believe they're going to agree on enough things because of the arguments they're having about about NSF fees and overdraft fees being reported by over a billion dollar credit unions.There's two approaches here. Kyle Hauptman canceled and changed the. Way that billion dollar plus credit unions were going were reporting for three quarters on NSFs and overdrafts saying that it's overkill and it's onerous on the credit unions, et cetera, et cetera, and that they would be looking at that during part of the examinations and then after he announced that at GAC and then.Board member Harper and board member Otsuka came out with their own press releases, and I understand they did a full court press on [00:07:00] Capitol Hill on the topic and came out saying that what's wrong with transparency? There should be transparency here. Why are you stopping something that was started and that credit unions had been providing and that's bad for members?So that's the nexus I wanted to say where I mentioned with Dennis Dollar that when he started the budget briefings, I thought they would never be stopped. And it's hard to stop something when you do. What happened? Debbie Matt stopped the budget briefings, and then lo and behold, the Federal Credit Union Act was changed and INSU 8 was required.to do that. So at some point, whether it's when the next time there's a D in the White House or there's a D in running the Dems have control of Congress. And the White House, you're going to see more on the fee situation. You're going to see NCOA go back to collecting this data. Will it be in 4 years?Will it be in 8 years? Will it be sometime sooner than that? [00:08:00] My guess is not before the four year period. I can't see how it went flip floppi...

Mar 13, 2025 • 30min

What It Means If NCUA Asks To Meet With Your Board Without You

Episode Summary:In this episode of With Flying Colors, Mark Treichel, along with industry experts Steve Farrar and Todd Miller, discuss a growing trend—NCUA requesting private meetings with credit union boards. What does it mean when regulators ask to meet without management present? Should boards be concerned? And how should they prepare?With decades of NCUA experience, Steve and Todd share insights into:✅ Common reasons why NCUA requests board-only meetings✅ When a meeting with the board chair is routine vs. when it’s a red flag✅ The importance of listening, but not committing to actions during these meetings✅ Why legal counsel might be necessary in certain situations✅ Whether you should record the meeting—and if NCUA will allow itMark, Steve, and Todd also share real-world examples of how these meetings have played out, including situations where state regulators took a more aggressive approach.Whether you're a board member, CEO, or concerned about your next NCUA exam, this episode provides essential insights to ensure you're prepared if NCUA makes the call.Resources Mentioned:📌 Learn more about Credit Union Exam Solutions: marktreichel.com📌 Subscribe for future episodes and expert insights on navigating NCUA exams.

Mar 12, 2025 • 9min

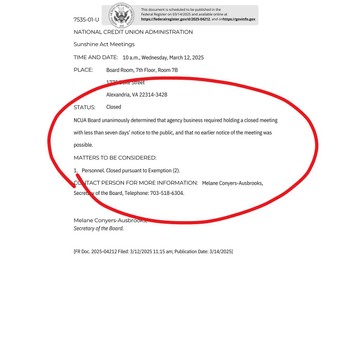

Emergency Pod: Did NCUA Just Vote On It's Trump Mandated Restructuring Plan?

www.marktreichel.comhttps://www.linkedin.com/in/mark-treichel/Did NCUA just vote on its reorganization plan? Time will tell.https://www.opm.gov/policy-data-oversight/latest-memos/guidance-on-agency-rif-and-reorganization-plans-requested-by-implementing-the-president-s-department-of-government-efficiency-workforce-optimization-initiative.pdf