Eurodollar University

Jeff Snider

Jeff Snider will guide you through the realm of monetary science. Multiple episodes uploaded each week, discussing big news and key current events, the state of markets and what they are telling you, as well as historical summaries and deep background material so that you can understand what’s really going on in this eurodollar’s world.

Episodes

Mentioned books

Mar 3, 2021 • 17min

LIVE! Reaction: Answering Jon Hilsenrath

Should speculative ventures be included in calculations of inflation? What about productive investment? Housing? All transactions? Or just consumer prices?----------WHERE----------Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39XjrAlhambraTube: https://bit.ly/2Xp3roy ----------WHEN----------01:02 John Hilsenrath says the Fed has failed to hit its inflation target for "several" years.02:48 Is the Fed keeping interest rates low or is it the market? Which is the cart? The horse?03:31 Should asset price increases be included in measures of inflation? 05:08 How to interpret rising housing prices with falling apartment rental prices?08:15 Asset price bubbles - whose responsibility are they? The Fed? Other regulators?11:32 The TIPS market has inverted - near-term up, long-term trending down.13:13 Economists have long struggled whether / to what degree to include asset price inflation ----------WHAT----------Inflation Problems Depend on Where You Look for Them: https://on.wsj.com/3b1E9nBAlhambra Investments Blog: https://bit.ly/2VIC2wWRealClear Markets Essays: https://bit.ly/38tL5a7----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, not spending money on haircuts. Art by David Parkins. Podcast intro/outro is "About to Explode" by Daxten and Wai at Epidemic Sound.

Mar 1, 2021 • 57min

Anomalies? Or Triggers?

The theme of Making Sense Episode 52 is how an environment reacts to an anomaly. Resilient systems keep these aberrations constrained. But fragile ones can retroactively redefine what had earlier been labeled as an "irregularity", "oddity" or "operational error" to something altogether more unsettling: "cause", "spark", "trigger".In part one, Jeff Snider continues his multi-week review of historical breaks to the smooth functioning of interbank payment and messaging systems. This time a look at a sequence that led to a week-long disorder to Fedwire in August 1990. Part two, also a continuation of a multi-week review, ponders what may be causing the disquieting twist in the US Treasury yield curve. Is the demand for short-term collateral a disqualification of reflation, as was the case during 2013's so-called Taper Tantrum? Lastly, some words on oil and the developing Texas power market credit crisis, in which electric retailers failed to make $2.1 billion in required payments and put the largest power generation and transmission cooperative into bankruptcy. Fedwire "operational error[s]". Unsettling demand for Bills. Texas margin calls. An approaching quarter-end seasonal low point in liquidity. A looming regulation-mandated US Treasury cliff on April Fools' Day. All anomalies... in a resilient system.----------WHY----------PART 01: Fedwire, the interbank system that transmits billions between 9,000-plus members, broke on Wednesday. The Fed says, "operational error" implying mere technical trivia - an anomaly. Why do some breaks stay mere anomalies while others trigger volatile, systemic consequences?PART 02: The US yield curve has twisted as Bill yields fall and Bond yields rise. We review a similar situation in 2013 popularly known as "the Taper Tantrum", WHICH WAS NOT A TAPER TANTRUM! Then - like now - a collateral scramble in Bills and a relief sell-off in Bonds.PART 03: What does the oil market (production, demand, inventory) in the USA tell us about the economic recovery in early 2021? Also, is a power market credit crisis in Texas causing a national run on banking-system collateral?----------WHERE----------Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39XjrAlhambraTube: https://bit.ly/2Xp3roy----------WHAT----------Why Price Alone Does Not Render An Asset Class 'Safe': https://bit.ly/3suB0Td‘Operational error’ disrupts Federal Reserve payment system: https://on.ft.com/3stDlOeFed needs to ignore ‘taper tantrums’ and let longer rates rise: https://on.ft.com/2O5ECMmWhat Might Be In *Another* Market-based Yield Curve Twist?: https://bit.ly/2ZVz4qEHot Oil, Cold Weather, Uncle Sam’s Green: https://bit.ly/3sxGJb0Power market credit crisis looms as Texas bills come due: https://on.ft.com/3dOWoOYAlhambra Investments Blog: https://bit.ly/2VIC2wWRealClear Markets Essays: https://bit.ly/38tL5a7----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, anomaly. Art by Winterfell resident, David Parkins. Podcast intro/outro is "Some Thing" by Rambutan at Epidemic Sound.

Feb 26, 2021 • 24min

Reading Around: Pettis On Tariffs and US Jobs

Michael Pettis of Carnegie Endowment for International Peace. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "The Village Idiot" by Justnormal at Epidemic Sound.----------WHAT----------How Trump’s Tariffs Really Affected the U.S. Job Market: https://bit.ly/2P7qHWJ----------WHERE----------Pettis' Writings: https://carnegieendowment.org/experts/444Pettis' Twitter: https://twitter.com/michaelxpettisVurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr

Feb 22, 2021 • 1h 17min

FT: "Do Not Rule Out a Market Panic Next Month"

Part 01: (01:30 to 38:27) What are monetary technocrats / financiers doing to save the world economy? We review: yield curve control in Australia (and Japan!), American regulators tip-toeing away from a once-favored LIBOR alternative, and the ecstatic economic expectations of German financiers.Part 02: (38:27 to 1:05:19) A Financial Times column warns of a US Treasury Bill air-pocket in March. Learn the little-known history of a mid-market, 1970s German bank that compelled regulators to move towards capital and supplementary leverage ratios. The very ratios that may now trigger a panic.Part 03: (1:05:19 to 1:17:00) Learn how to reconcile a positive surge in retail sales with a nightmare string of 'record' jobless claims and lousy sentiment reported by the University of Michigan consumer survey. Perhaps pent up demand? Maybe. An unusual, poorly explained seasonal adjustment boost? Maybe too.----------SPONSOR----------But first, this from Eurodollar Enterprises! The motion picture event of the summer: (Con)Tango & Cash. When an international smuggling ring uses the local commodity exchange to send gold into backwardation, two macroeconomists take matters into their own hands... and onto the spot market. Starring Travis 'the President' Kimmel as Contango, "You can take delivery of lead -- punk." And Steven 'the Monarch' Van Metre as Cash, "You know how I promised to let you close out that trade?" "Yeah man, you did Cash! You did promise!" "I lied."With Grant Williams as the polite British guy, “Well chaps, you put the mockers on, didn’t you?” This motion picture will never be rated. Available only on-demand at Real Vision.----------WHERE----------Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39XjrAlhambraTube: https://bit.ly/2Xp3roy----------WHAT----------With YCC About To Come Back Up, A Look At It Down Under: https://bit.ly/3dvApMWAlready Tried: https://bit.ly/2ZwP9CPInsufferable SOFR, Suffering: https://bit.ly/3aAgla2Episode 34 All About SOFR: https://youtu.be/LH1wDUG-dEIReflation Patients, ‘Another’ Six Months: https://bit.ly/3pByiJFBeware, There's Another SLF 'Cliff' Coming At the End of Q1: https://bit.ly/2NdNpMvJohn Dizard's Do not rule out a market panic next month: https://on.ft.com/3pCGaLcForty-Seven Explains Much: https://bit.ly/3azo1teUncle Sam Was Back Having Consumers’ Backs: https://bit.ly/3dsHLAL----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, celebrates Towel Day on May 25. Art by the King of the North, David Parkins. Podcast intro/outro is "Zombie Raiders" by Wave Saver at Epidemic Sound.

Feb 21, 2021 • 21min

LIVE! Reaction: Answering Philip Stevens

After decades of market liberalism and fiscal fundamentalism, policymakers are returning to Keynes. Jeff Snider reacts to two recent articles: "Bond yields are not good predictors of inflation" (Peterson Institute for International Economics) and "Why economists kept getting the policies wrong" (Financial Times).----------WHERE----------Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39XjrAlhambraTube: https://bit.ly/2Xp3roy----------WHEN----------01:02 Two economists write that bond yields are not good predictors of inflation03:20 Bond yields have failed to predict inflation for 70 years in the US; three other countries 05:31 Why economists kept getting the policies wrong08:01 Was monetarism was derailed by poor philosophy? Or because measures of money failed?11:43 Monetarism ditched, so first came currency exchange targeting then inflation targeting.13:26 Positive Economics, econometrics promised wonderful, impossible things 16:11 Central Bankers use mathematics as a shield against criticism18:42 We are back where we started, time to dust off Keynes General Theory.----------WHAT----------Teenagers baffled by rotary phone: https://youtu.be/oHNEzndgiFIBond yields are not good predictors of inflation: https://bit.ly/2Zz7dwdWhy economists kept getting the policies wrong: https://on.ft.com/2ZwAgAwAlhambra Investments Blog: https://bit.ly/2VIC2wWRealClear Markets Essays: https://bit.ly/38tL5a7----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski. Art by the King of the North, David Parkins.

Feb 18, 2021 • 26min

Reading Around: Myrmikan on System-Critical Short Squeezes

Financial historian Daniel Oliver's essay on the systemic consequence of the 1907 short squeeze on United Copper Company and lessons for today. A reading, by Emil Kalinowski.----------WHO----------Daniel Oliver of Myrmikan Capital, LLC. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Alienated" by ELFL at Epidemic Sound.----------WHAT----------The Final Pop: https://bit.ly/37sfwOH----------WHERE----------Myrmikan's Writings: http://myrmikan.com/Myrmikan's Twitter: https://twitter.com/MyrmikanEmil's Twitter: https://twitter.com/EmilKalinowskiArt: https://davidparkins.com/Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr

Feb 16, 2021 • 1h 19min

Interbank Netting: The Pressure to Get to Zero

Having studied monetary policy for several years it was only natural that your podcaster spent considerable time contemplating the essential elements of fiction. Some experts say there are five components to it; others put the tally at six, even eight! But at the core it has always been the three elements: plot, setting and character. Plot was perfected, in the Western tradition at least, in the late 16th century by Shakespeare with the 5-act dramatic structure. Setting, given short-shrift for millennia, did not achieve co-equal status until the gothic novels of the mid-18th century. And character? Scholars point back 28 centuries to The Iliad: heroism, cowardice, pride, hubris - wrath. But the scholars are wrong. Character wasn't perfected first, but last. Not until the 1980s action drama The A-Team did this element of fiction reach its zenith.The American television masterpiece synthesized what the Great Books dared not imagine into the now classic quartet: Colonel John "Hannibal" Smith as the brains; Lieutenant Templeton "Faceman" Peck as the looks; Sergeant Bosco Baracus the muscle; Captain H.M. Murdock the wildcard. The casting blueprint can be observed most everywhere; in the arts, at the office; even family the dinner table. Central banking is no exception. In the role of the brains is Ben "Hannibal" Bernanke. The looks? Lady Lagarde. The muscle? Jay "Mad Dog" Powell. The wildcard? The audience will naturally point to Haruhiko Kuroda and, before January 28th, the audience would have been correct.On that day Isabel Schnabel, Member of the Executive Board of the European Central Bank, gave a speech extolling the virtues of the sovereign-bank-corporate nexus. That is technocrat-speak for the government-guaranteed private-bank loans to private enterprise. Schnabel endorsed these "crucial" national loan schemes and encouraged Europe's capitals to continue them, warning any premature end would be "destabilising". Put another way, the baton that represents the supervision of money creation, has been wrested away from Frankfurt and placed into the neatly manicured hands of politicians, seeking re-election.The new wildcard is not Isabel Schnabel but the Euro Area member state. All 19 of them.In this episode we touch upon 1980s television shows, like CHiPs and interbank clearing mechanisms, like CHIPS. Also, why are corporate elephants on the hunt for fast-moving gazelle enterprises? Why are these elephants being offered their own fiefdoms in Nevada? Lastly, a potpourri review of Jeff Snider's recent writing.----------WHY----------PART 01: Private banks fund global economic activity. But how do they move money among themselves? PART 02: Nevada Governor Sisolak is proposing to offer corporations to set up their own local government structures. PART 03: Cautionary sign posts that say this reflationary path may not be the road to recovery but a deflationary cul-de-sac.----------WHERE----------Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39XjrAlhambraTube: https://bit.ly/2Xp3roy----------WHAT----------There's Much More Going On Than You've Been Led to Believe: https://bit.ly/3qhFnAqThe Endangered Inflationary Species: Gazelles: https://bit.ly/3dbuIDqThe Cautionary Tale of Undocumented Insanity: https://bit.ly/3deHyRIPermanent Jobs, Permanent Job Losses: https://bit.ly/37fgD47Old Numbers Show Us Why There Will be New Checks: https://bit.ly/3b41FPM----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, Tyrell Corporation full-time equivalent. Art by David Parkins. Podcast intro/outro is "City Lights, City Dreams" by Forever Sunset at Epidemic Sound.

Feb 15, 2021 • 18min

LIVE! Reaction: Answering The Economist

Jeff Snider reacts LIVE! to an article from The Economist. The magazine offers three arguments why the US economy might overheat in 2021: evidence that the downturn is temporary; generous fiscal stimulus; and the Federal Reserve’s monetary-policy strategy.----------WHERE----------Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39XjrAlhambraTube: https://bit.ly/2Xp3roy----------WHEN----------00:55 Why won't a large fiscal stimulus (e.g. Biden's 9% of US GDP) save a post-2008 economy?03:39 Why won't a large fiscal stimulus overheat a post-2008 economy?06:46 Why aren't the positive employment gains of July-December 2020 positive?08:13 Why isn't a pool of excess savings indicative of potential activity in a post-2008 economy?11:38 Did the Federal Reserve learn the right lesson from the 2013 "taper tantrum"?14:19 Why won't the Fed's new "average inflation" strategy not make save a post-2008 economy?----------WHAT----------The Economist, Fire without Fury: https://econ.st/3qnkWSuAlhambra Investments Blog: https://bit.ly/2VIC2wWRealClear Markets Essays: https://bit.ly/38tL5a7----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, seeing what the tide brought in. Art by David Parkins. Podcast intro/outro is "Chasing Visions" by vvano at Epidemic Sound.

Feb 8, 2021 • 1h 3min

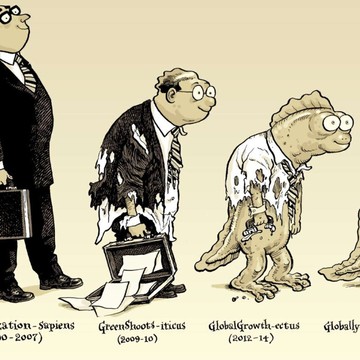

Devolution of Financial Memory

Sophocles won 24 of the 30 literary competitions he entered, placing second in the rest. Of his 120-plus plays, only seven survive. Eratosthenes, calculated the Earth's circumference with breathtaking accuracy. As Chief Librarian of the Library of Alexandria he oversaw the collation of hundreds of thousands of works. But not even his own "On the Measure of the Earth" survived the Library's progressive destruction by war, negligence and cultural revolution.Rashid-al-Din Hamadani created the first world history, taking advantage of his location at the crossroads of a Mongol empire with access to European, Arabic, Persian, Indian, Mongol and Chinese scholars. Hamadani, not wanting his masterpiece to be lost to time, arranged to have the work copied in Arabic and Persian every year and distributed. But his patron's death and royal intrigues cost him his station and us his work; no complete copy survives.Several scholars, dizzy by the thought of humanity's lost knowledge, tried their hand at wistful, melancholy catalogues of what might have been. Thomas Browne wrote Musaeum Clausum, "an imagined inventory of 'remarkable books, antiquities, pictures and rarities of several kinds, scarce or never seen by any man now living.'" Besides Seneca's epistles to St. Paul, this hidden library houses history's most famous box within which was the perfume of infection responsible for the 17th century Plague of Milan.Of course there's a difference between the tragedy of lost knowledge and the tomfoolery of what was willfully forgotten. It is the latter which financial market participants specialize in. John Kenneth Galbraith lamented that, "There can be few fields of human endeavor in which history counts so little as in the world of finance." James Grant concurs, laconically noting that, "Progress is cumulative in science and engineering, but cyclical in finance." And so, in Episode 45 the Rashid-al-Din of the Eurodollar will help us un-forget the three reflations since 2007 and how they compare to present-day. But first we review why US Treasury Bill Yields may be so low.----------WHY----------Part 01: There is a mainstream explanation for why US Treasury Bill rates are falling. There is also a Eurodollar / Shadow Money / Collateral System explanation. Jeff Snider reviews the two perspectives and looks ahead to where trouble may lay.Part 02: We look through the lenses of the dollar, Treasury yields, inflation breakevens, swap spreads to see how this Post-Covid reflation compares to the three economic recoveries of the past 13 years: Green Shoots (2009-10), Global Growth (2012-14) and Globally Synchronized Growth (2016-18).----------WHERE----------Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39XjrAlhambraTube: https://bit.ly/2Xp3roy----------WHAT----------Let’s Talk Bills (again): https://bit.ly/3q6tJs9Hey Bill, *What* Is It?: https://bit.ly/3rs3Ov3Hey Bill, *Why* Now?: https://bit.ly/2MGohxxReaching Half A Year, What’s The (Complete) Reflation Situation?: https://bit.ly/2OchADQAlhambra Investments Blog: https://bit.ly/2VIC2wWRealClear Markets Essays: https://bit.ly/38tL5a7----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, piling the bologna high and deep. Evolutionary sketches by David Parkins aboard the HMS Beagle. Podcast intro/outro is "Stand Divided" by Deskant at Epidemic Sound.

Jan 24, 2021 • 48min

Modern Monetary Hypnosis

As many listeners have long suspected, your podcast host did, as a child, run away and join the circus. Not dissimilar from a traditional childhood, it was your classic Gypsy camp. If children misbehaved, we would be "lock[ed]... into stocks, or throw[n]... into a cage and hoist[ed]... into the flytower... dangling precariously over the stage." Our ringmaster, Giuseppe Grimaldi "was horribly morbid, living in perpetual fear of death, and especially of being buried alive. When he finally died... his will directed that his eldest daughter cut his head from his corpse just to be certain." Sure, perhaps quirky, but certainly not the oddest troupe - not Pandemonium Carnival. So, looking to make a career of it your podcaster tried his hand at clownship. But, by that time, famous clowns like Pagliacci, Pennywise and Pogo were, despite slaying their audience with their routines, giving a bad name to the profession. So then, this host turned to tarot card reading and hypnosis. Despite earning some minor acclaim in London as Madame Simza, your host simply didn't have the chops and was forced to turn to the only option left: a Masters in Business Administration. Surprisingly, it was an easy fit. Tarot cards - which "illuminate your past, clarify [the] present, show... the future" - had taught me everything I needed to know about finance. The card "Temperance, [when] inverted [is] indicative of volatility." If one draws "The Fool, someone has been led astray" - an investment fraud. "The Two of Cups?" It represents "a powerful bond" - a sovereign bond. Your podcaster learned about hypnosis too, except that the economics professors used different terms for it: expectations policy, forward guidance, moral suasion.----------WHY----------Part 01: Central banks cannot define, identify, measure or map modern money. And they haven't been able to since the 1970s. So instead they offer "moral suasion". That's a fancy word for threats, posturing and coercion. That's all fine and well until the global economy requires money.Part 02: How does one define an asset bubble? Might there be fundamental, non-speculative reasons why prices are persistently high? Also, why did money-financed fiscal expansion fail in Japan? What does that experience tell us about the present?----------SPONSOR----------But first, this from Eurodollar Enterprises! Friends, are you worried your monetary policies are causing lurid levels of inequality? Are you concerned civil war, its hour come round at last, slouches toward K Street? Do you worry how your supple neck will fare when the blood-dimmed tide is loosed? Then the new Eurodollar Enterprises Second Skin Neck Brace is for you! Yes, strut through The Waste Land knowing that marauding lynch mobs of War Boys pose no danger. The carbon-fibre nanoweave is comfortable, flexible and the ultimate luxury in an April dystopia you hastened. Barter aquacola for guzzoline at Thunderdome with no concern of the guillotine. Is that the Road Warrior with a chainsaw? Then save your skin... with your Second Skin Neck Brace. New! From Eurodollar Enterprises.----------WHERE----------Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39XjrAlhambraTube: https://bit.ly/2Xp3roy----------WHAT----------Suasion, Sure, But Is It Really Moral?: https://bit.ly/3bXMsBQIf the Fed’s Not In Consumer Prices, Then How About Producer Prices?: https://bit.ly/2NomiOd(Reinhart & Sbrancia) The Liquidation of Government Debt: https://bit.ly/363NUih(Van Metre & Ashton) Everything You Wanted to Know About Inflation: https://bit.ly/2LZ8OZ5The Fundamentals of the Bond ‘Bubble’: https://bit.ly/3qI1D6cWhen They Introduced An Even Longer Gov’t Bond: https://bit.ly/3qCYhBwThey Keep Assuring Us Japan Can't Happen Here: https://bit.ly/39UfwHPWhat is a Concentration Camp?: https://bit.ly/3iCN6G2Alhambra Investments Blog: https://bit.ly/2VIC2wWRealClear Markets Essays: https://bit.ly/38tL5a7----------WHO----------Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, troubled by definitions. Artwork by David Parkins. Podcast intro/outro is "Whispering of the Stars" by Luella Gren at Epidemic Sound.