Eurodollar University

Jeff Snider

Jeff Snider will guide you through the realm of monetary science. Multiple episodes uploaded each week, discussing big news and key current events, the state of markets and what they are telling you, as well as historical summaries and deep background material so that you can understand what’s really going on in this eurodollar’s world.

Episodes

Mentioned books

Sep 21, 2021 • 16min

Reading Jeff Snider: The Caribbean's Dollar Warning [Ep. 102]

Central bankers had a choice in the 1970s: follow the offshore money, diving headfirst down the rabbit hole; or, ignore it entirely, pretend none of this exists, and then hope by stroke of luck it won’t matter. We’re still paying for the ignorance and dereliction. A reading, by Emil Kalinowski.----------WHO----------Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Born in the 90's" by Ameryh at Epidemic Sound.----------WHAT----------Dollar Warning Update From The Islands Which Started It: https://bit.ly/3zBCezn----------WHERE----------Jeff's Alhambra Blog: https://bit.ly/2VIC2wWJeff's RealClearMarkets Essays: https://bit.ly/38tL5a7Jeff's Twitter: https://twitter.com/JeffSnider_AIPEmil's Twitter: https://twitter.com/EmilKalinowskiDavid's Art: https://davidparkins.com/---------HEAR IT----------Vurbl: https://bit.ly/3rq4dPn Apple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr

Sep 20, 2021 • 21min

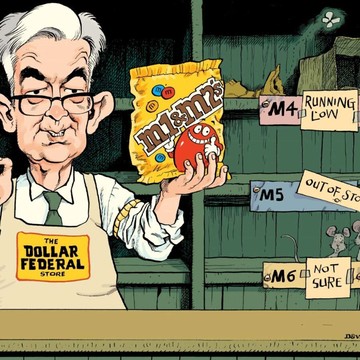

Reading Jeff Snider: There's Too Little Money Now [Ep. 101]

It’s becoming too obvious to keep overlooking Keynes' statement when little credit-collateral-money, "is...available our wealth suffers stagnation or decline.” The problem is hardly anyone knows what just why there might be so little. A reading, by Emil Kalinowski.----------WHO----------Jeff Snider of Alhambra Investments. Read by Emil Kalinowski. Art by David Parkins. Intro/outro is "Born in the 90's" by Ameryh at Epidemic Sound.----------WHAT----------They're Ignoring That There's Too Little Money Now: https://bit.ly/3u7So2l----------WHERE----------Jeff's Alhambra Blog: https://bit.ly/2VIC2wWJeff's RealClearMarkets Essays: https://bit.ly/38tL5a7Jeff's Twitter: https://twitter.com/JeffSnider_AIPEmil's Twitter: https://twitter.com/EmilKalinowskiDavid's Art: https://davidparkins.com/---------HEAR IT----------Vurbl: https://bit.ly/3rq4dPn Apple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr

Sep 19, 2021 • 1h 8min

Inflation is not a Price Increase [Ep. 100]

PART 01: Producer prices in the US are elevated, but decelerating. They're elevated because of demand surges, supply shocks and logistics snarls - all TRANSITORY factors. Producer prices ARE NOT elevated because of permanent, pervasive central bank or government inflationary action.PART 02: Consumer prices in the US are elevated, but decelerating. They're elevated because of demand surges, supply shocks and logistics snarls - all TRANSITORY factors. Consumer prices ARE NOT elevated because of permanent, pervasive central bank or government inflationary action.PART 03: Import and export prices are elevated in the US, but decelerating. They're high because of demand surges, supply shocks and logistics snarls - all TRANSITORY factors. Import/export prices ARE NOT elevated because of permanent, pervasive central bank or government inflationary action.-----SEE EPISODE 100------Alhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisL-----HEAR EPISODE 100----Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr----EP. 100a REFERENCES---The Non-Charitable economics of (Not) Inflation: https://bit.ly/3EpQA9rCPI Comes ‘Home’ To The Other Side of Inverted TIPS: https://bit.ly/3tPG3j5First Transitory In Producers, Then More For Consumers, Now A Negative For Import Prices: https://bit.ly/2YZ0uP1Alhambra Investments Blog: https://bit.ly/2VIC2wWlinRealClear Markets Essays: https://bit.ly/38tL5a7-----------WHO-------------Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by the complex pencil himself, David Parkins. Podcast intro/outro is "The Kill" by Particle House feat. Le June from Epidemic Sound.

Sep 13, 2021 • 1h 13min

Labor Shortage: The Fed's Get Out Of Jail Free Card [Ep. 99]

PART 1: 'Maybe the economy isn't in as good a condition as you economists / academics / technocrats think it is,' says the labor force participation rate. 'The economy is in fantastic shape,' says the unemployment rate. Which one is correct?PART 2: Labor shortages are normal, at the microscale, from time to time, in this or that industry. Yet since 2008, establishment economists use "labor shortage" as an excuse to: A) support a misleadingly low unemployment rate and, B) explain away the participation problem.PART 3: In 1971, US Treasury Secretary John Connally told a group of European finance ministers that the US dollar "is our currency, but your problem." Half a century later, the problem has grown bigger encompassing the whole world. A world that is short of dollars.-----SEE EPISODE 99-------Alhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisL-----HEAR EPISODE 99-----Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr----EP. 99 REFERENCES----Just In Time For Labor Day: It’s Not Payrolls Missing The Mark By Such A Wide Margin: https://bit.ly/3lc1k2jBad-Monetary-Joke Twitter: https://bit.ly/3A3RHZNTurning The LABOR SHORTAGE Up to 11: https://bit.ly/3hifOwwThe Eurodollar’s Nose: https://bit.ly/2X6LApBAlhambra Investments Blog: https://bit.ly/2VIC2wWlinRealClear Markets Essays: https://bit.ly/38tL5a7-----------WHO-------------Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by the top hat of illustrated monetary satire, David Parkins. Podcast intro/outro is "Nite Glo" by Molife from Epidemic Sound.

Sep 5, 2021 • 1h 13min

Wisdom of the Crowds [Ep. 98]

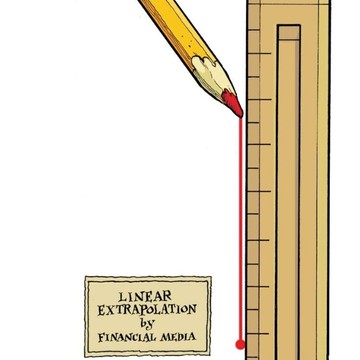

PART 01: A lousy labor market report for August is being blamed on a "labor shortage". Also, 'lazy Americans' and 'the delta'. But the real problem is that businesses will not pay a market-clearing wage to hire the workers they need. Why not? Because the economy is lousy.PART 02: A long-standing NBC News Survey shows John & Jane Q. Public perceive the economy's condition BETTER than economists who anchor to the unemployment rate. Since 2005, US citizens have sensed each global dollar squeeze. They may be noticing another one, right now.PART 03: Lightning round review of the: Australian dollar, Chinese yuan, gold-silver ratio, Federal Reserve's reverse repo program, European Central Bank's symmetric inflation target and natural gas. Also, the House of Lords questions the Bank of England's use of QE.-----SEE EPISODE 98-------Alhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisL-----HEAR EPISODE 98-----Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr----EP. 98a REFERENCES----Yes And No Taper To Labor (and inflation): https://bit.ly/38E77YJ----EP. 98b REFERENCES----They’ve Lost That Loving Feeling: https://bit.ly/3zJ6sB3NBC News Survey Study #210188: https://bit.ly/3n5o0Ec----EP. 98c REFERENCES----China, Australia, and The European Way Into Reverse Repo: https://bit.ly/2WYpuFrECB: The new monetary policy strategy: implications for rate forward guidance: https://bit.ly/3h2hlXmFinally, QuEstioning ‘Easy Money’: https://bit.ly/3h2hlXmQuantitative easing: a dangerous addiction?: https://bit.ly/3tmCUa7Alhambra Investments Blog: https://bit.ly/2VIC2wWlinRealClear Markets Essays: https://bit.ly/38tL5a7-----------WHO-------------Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by the pen of the people, David Parkins. Podcast intro/outro is "UntrainedEye" by _91nova from Epidemic Sound.

Aug 30, 2021 • 50min

Taper (but no) Tantrum! Why not? [Ep. 97]

Jay Powell announced his central bank is satisfied (enough) with the economy's direction. Thus, the Fed will soon be 'tapering'; lessening the 'monetary stimulus'. What did bond-money markets say? Did they have a tantrum? No, because they don't believe what Jay believes.-----SEE EPISODE 97-------Alhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisL-----HEAR EPISODE 97-----Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr----EP. 97 TOPICS--------00:10 Intro: Jay Powell announced it anticipates its purchases of US Treasury bonds will slow.00:48 Financial press puts the Federal Reserve upon a pedestal of omnipotence, competence.03:29 A previous Fed "taper", in 2013, resulted in a so-called tantrum. But was it, really?08:13 Knut Wicksell told us 114 years ago that rising interest rates signal a healthy economy.10:34 Markets are not considered reliable leading indicators by technocrats at the Fed.13:24 Leading market indicators include: sovereign bonds, eurodollar futures, the US dollar.14:57 In mid-August it was clear there would be no tantrum if there ever was a taper.18:16 Fed officials demurred to define what maximum employment is last year, but now... 20:11 (Fed officials believe that inflation surges are and will be transitory; so does Jeff).21:01 ...but now, Fed officials believe maximum employment is within sight; achievable.22:34 Maximum employment will be considered only after Fed inflationary targets are achieved.25:42 The US labor force participation rate may not return to pre-pandemic conditions. 29:49 The US unemployment rate has detached itself from the US participation rate.32:31 Mainstream expectations were for rising US Treasury yields after the Fed's taper news.38:30 Bond yields did not rise after the taper announcement -- no tantrum.40:38 US debt ceiling deadlines (2011, 2013, 217) caused/correlated with monetary turbulence.----EP. 97 REFERENCES----Tapering The Truth: https://bit.ly/38oyvcWTaper *Without* Tantrum: https://bit.ly/38sdMVHThe Fed’s True Love: He Tapers Me, He Tapers Me Not: https://bit.ly/3yrOaCTAs Fed Focuses on Taper, It’s About To Get (a lot?) More Interesting In Bills: https://bit.ly/38n2Sk8Alhambra Investments Blog: https://bit.ly/2VIC2wWlinRealClear Markets Essays: https://bit.ly/38tL5a7-----------WHO-------------Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by David Parkins. Podcast intro/outro is "1AM OMW" by Ballpoint from Epidemic Sound.

Aug 22, 2021 • 1h 16min

The dogs bark, but the caravan goes on... [Ep. 96]

PART 01: What did the Federal Reserve think about gold and the Nixon Shock in 1971? According to the transcripts they didn't think much about gold, neither pre- nor post-announcement. The Fed did not see the move as a release from its 'golden fetters' so as to dominate the monetary order.PART 02: The US Treasury Department released their Treasury International Capital, one of the keyholes analysts can look through to get a sense what is happening in the eurodollar system. Jeff Snider explains three items that caught his attention. Three concerns.PART 03: German financiers and American consumers reported HISTORIC DROPS in optimism in August. Meanwhile, in Britain and Japan, consumer confidence remains steady though both nations are reporting they intend to consume less. 'Not great, Bob!'-----SEE EPISODE 96-------Alhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisL-----HEAR EPISODE 96-----Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr-----EP. 96 REFERENCES----The Two Big Anniversaries of August: The Lost Decade (plus) Of The ‘Fiat’ Half Century: https://bit.ly/3gkpENPA TIC Trio of More Serious Deflation Potential: Asset Rebound, Banks Can’t Borrow T-bills From Foreigners, And The China Cringe Which Goes Along: https://bit.ly/3zjhBs0Germans Got Global: https://bit.ly/3D6sCPWThe Third Of The Transitory Inflation Trifecta And Today’s Surprisingly Consistent Ugly Surprise: https://bit.ly/3mmSoJYAlhambra Investments Blog: https://bit.ly/2VIC2wWlinRealClear Markets Essays: https://bit.ly/38tL5a7-----------WHO-------------Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by lead Bedouin driving the camel train of monetary satire, David Parkins. Podcast intro/outro is "Multidimensional" by Sarah, the Illstrumentalist from Epidemic Sound.

Aug 16, 2021 • 1h 12min

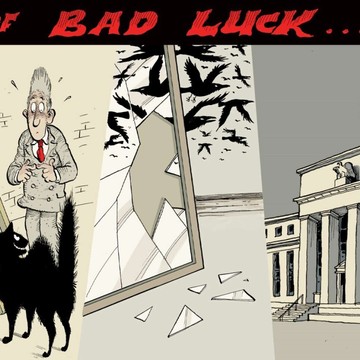

Omens of Bad Luck [Ep. 95]

PART 01: Inflation is a broad, sustained monetary phenomenon. Price deviations in a narrow set of economic sectors, though they last months, are just that: price deviations. Today's high CPI-readings will in all likelihood subsumed by the global monetary disorder, like in 2008 and 2011.PART 02: A review of July's HUGE increase in consumer prices. We conclude these price surges are due to supply problems, base comparison effects and mostly Uncle Sam stimmy checks. None of which are permanent changes to the situation of monetary malfunction and economic depression.PART 03: In 1998 the Bank of England completed its transformation from "central bank" to "economist club" - the two are not synonymous. The former defines, identifies, measures and maps money-credit-collateral. The latter is a narrative machine.-----SEE EPISODE 95-------Alhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisL-----HEAR EPISODE 95-----Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr-----EP. 95 REFERENCES----There Is So Much, Too Much, Just Enough the Same: https://bit.ly/37IluusInflation More Than Hints ‘Transitory’: https://bit.ly/3iQc9aDThe Money Is 'Double Missing' Thanks to Economists: https://bit.ly/3yHqKKRAlhambra Investments Blog: https://bit.ly/2VIC2wWlinRealClear Markets Essays: https://bit.ly/38tL5a7-----------WHO-------------Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by David Parkins. Podcast intro/outro is "Dress Code: Black" by oomiee from Epidemic Sound.

Aug 8, 2021 • 1h 4min

Let them Eat SDRs

PART 01: Fifty years ago the "Nixon Shock" closed the 'Gold Window' on "international speculators" and killed the Bretton Woods gold exchange era. That's what we're told. Actually, Bretton Woods died a decade (or more!) earlier; it's just that we only noticed in 1971.PART 02: The IMF will 'print' $650 billion -- BILLION! -- in SDR-money to help with global liquidity. BIG numbers! BIG Deal! But we've heard this before from the IMF, like in 2009, their last BIGGEST EVER allocation, which was as effective as QE1, QE2, QE3, QE4, QE5, QE6... PART 03: "This might be one of the biggest downward revisions I have ever observed," says Jeff Snider. The benchmark revision to Real Personal Income ERASED billions of dollars in presumed earnings from US workers since 2015, and especially in 2020 to 2021. "Truly stunning."-----SEE EPISODE 94-------Alhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisL-----HEAR EPISODE 94-----Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr----EP. 94a REFERENCES----No Matter What They Say, the Future Isn't Inflationary: https://bit.ly/3AjfK6NRealClear Markets Essays: https://bit.ly/38tL5a7----EP. 94b REFERENCES----Sophistry Dressed (as) Reallocation: https://bit.ly/3rZOhUMAlhambra Investments Blog: https://bit.ly/2VIC2wWlin----EP. 94c REFERENCES----Inflation Estimates (PCE) *Totally* Overshadowed By Benchmark Income Revisions, And The (Deflationary) Implications of Them: https://bit.ly/3yB5JkY-----------WHO-------------Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by David Parkins. Podcast intro/outro is "Sweet Distraction" by Ealot from Epidemic Sound.

Aug 2, 2021 • 1h 29min

Out of the Frying Pan Recession and into...

PART 01: Gold Slams! Rapid, huge sales in early morning hours are warnings about a malfunction deep within the plumbing of global capital flows. They're also multi-week, precipitous price declines. We review the last few months of gold price to triangulate if the pipes are rattling warnings.PART 02: Foreigners were heavily selling US Treasuries in May 2021. Is this a GEOPOLITICAL plot? Is America's BANKRUPTCY imminent?!? Almost certainly not. We review the LONG HISTORY of foreigners selling US Treasuries in acute periods of dollar shortage. May's selling is a monetary warning.PART 03: America's Covids Recession lasted only two months, says the National Bureau of Economic Research. But what if it wasn't a recession? What if 2007-09 wasn't a recession either? What if 2007-21 has been a depression? The Silent Depression.-----SEE EPISODE 93-------Alhambra YouTube: https://bit.ly/2Xp3royEmil YouTube: https://bit.ly/310yisL-----HEAR EPISODE 93-----Vurbl: https://bit.ly/3rq4dPnApple: https://apple.co/3czMcWNDeezer: https://bit.ly/3ndoVPEiHeart: https://ihr.fm/31jq7cITuneIn: http://tun.in/pjT2ZCastro: https://bit.ly/30DMYzaGoogle: https://bit.ly/3e2Z48MSpotify: https://spoti.fi/3arP8mYPandora: https://pdora.co/2GQL3QgBreaker: https://bit.ly/2CpHAFOCastbox: https://bit.ly/3fJR5xQPodbean: https://bit.ly/2QpaDghStitcher: https://bit.ly/2C1M1GBPlayerFM: https://bit.ly/3piLtjVPodchaser: https://bit.ly/3oFCrwNPocketCast: https://pca.st/encarkdtSoundCloud: https://bit.ly/3l0yFfKListenNotes: https://bit.ly/38xY7pbAmazonMusic: https://amzn.to/2UpEk2PPodcastAddict: https://bit.ly/2V39Xjr----EP. 93a REFERENCES----Golden Collateral Checking: https://bit.ly/3j7HKmSAlhambra Investments Blog: https://bit.ly/2VIC2wWlin----EP. 93b REFERENCES----Yet Another Key Warning Sign, Piece Of Strong Evidence: TIC & The Long Misunderstood History of Selling Treasuries: https://bit.ly/3yezqrVRealClear Markets Essays: https://bit.ly/38tL5a7----EP. 93c REFERENCES----The Contraction Is Over, Which Means The Hard Part Only BeginsNBER Business Cycle FAQ: https://bit.ly/2TQqIkM-----------WHO-------------Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by David Parkins. Podcast intro/outro is "MUNEY" by Beiba from Epidemic Sound.