Modern Capital: The Private Markets Podcast

Marc Andrew

Conversations with leaders building the infrastructure of private markets.

Episodes

Mentioned books

5 snips

Jan 23, 2026 • 59min

What "Done" Looks Like in Private Markets: A conversation with Alex Robinson

Alex Robinson, founder and CEO of Juniper Square, who built infrastructure used by thousands of private markets managers. He recounts a FedEx moment that launched the company. He maps where private markets infrastructure is headed, from AI and retail-driven change to next-gen fund administration. He outlines signs of maturity like factorized products, ETFs for private assets, manager FICO scores, and near-zero trading costs.

5 snips

Dec 15, 2025 • 32min

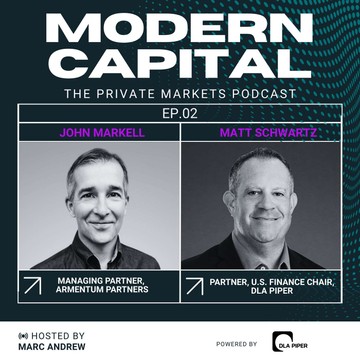

Private Credit Meets the Valley, with John Markell and Matt Schwartz

Join John Markell, a growth credit specialist from Armentum Partners, and Matt Schwartz, Head of U.S. Finance at DLA Piper, as they explore the revolution in private credit. They discuss the rise of growth credit for cash-flow negative businesses and how the collapse of SVB reshaped lender practices. Discover why enterprise software lending is oversaturated and where opportunities lie. Markell shares essential advice for founders on leveraging debt effectively, while Schwartz highlights the risks and nuances in today’s lending landscape.

Dec 2, 2025 • 1min

Modern Capital | trailer

Introducing: Modern Capital, The Private Markets Podcast. Conversations with the leaders building the infrastructure of modern private markets.

Nov 27, 2025 • 42min

The Plumber of Private Markets: A conversation with Rob Heyvaert

Rob Heyvaert, founder and managing partner of Motive Partners, is a serial entrepreneur who has reshaped private markets infrastructure. He shares insights on why private markets are approaching a transformative 'Bezos moment,' emphasizing the need for interoperable systems to enhance customer experience. Rob discusses the infrastructure hygiene blocking innovation and advocates for individual ownership of data. He predicts a future with super apps and stresses that the success of private markets depends on adapting to massive transaction volumes.