Curiosity Chronicle

Sahil Bloom

Delivering curiosity-inducing content every single week.

This is the audio version of my newsletter. Sign up at the bottom of the page!

This is the audio version of my newsletter. Sign up at the bottom of the page!

Episodes

Mentioned books

Jun 29, 2022 • 8min

Be Like Hank

Hank is a 95-year-old man who asked to spend a day at Harvard for his 90th birthday. He arrived early, sat in the front row, took notes, and asked questions. He learns with no end in mind. He learns because he loves learning.The forced structure of our formal education years often saps the innate curiosity and excitement for learning. New knowledge is crammed into closed containers in our brains--it's not allowed to mingle and network in a way that sparks new thinking pathways.5 core habits of highly-effective lifelong learners: stimulate dynamically, build learning circles, build a learning engine, consistently ask why, and read daily.

Jun 22, 2022 • 10min

Letter to Your Future Self

Episode at a glanceRead the full postThe letter to your future self is a 10x unlock for life. The process of writing a letter forces deep reflection on the present and thoughtful rumination on the future.Use a baseline time horizon of 5 years in the future, but adjust as you see fit. A basic letter structure to follow: (1) Reflections on the Present, (2) Changes to Make, (3) Goals for the Future, and (4) Fun & Crazy Predictions.I handwrite the letters and store them in a cabinet, but if you’re looking for a more technology-enabled solution, there are tools like FutureMe that should do the trick.

Jun 15, 2022 • 9min

The 30-for-30 Challenge

Welcome to the 1,070 new members of the curiosity tribe who have joined us since Friday. Join the 100,000 others who are receiving high-signal, curiosity-inducing content every single week.Thank you to all the subscribers that have joined me on this journey. 100,000 is an amazing milestone—but to be honest, I feel like we’re still at the starting line. Let’s go!Today’s newsletter is brought to you by Flatfile!Personally, I have spent enough time in spreadsheets to get my excel PHD. This also means I’ve spent enough time pounding my face into my keyboard in frustration while trying to import spreadsheets.Data onboarding is a MASSIVE headache. Flatfile fixes this.Flatfile is an unmatched toolkit for data import that is helping teams save precious time to focus on the business tasks that matter. Instead of staring at cell D47 and wondering how a missing comma just caused you to miss your lunch break, Flatfile does the work for you and sends you on your way. With over $44 million in funding and blue chip clients like Square, Zuora, and Clickup, Flatfile is making serious waves. To level up your data onboarding and improve your customer experience, schedule a risk-free demo of Flatfile today!Today at a Glance:Our minds tend to overcomplicate the process required to achieve forward progress. We incorrectly assume that it requires herculean effort or intensity.The reality? Giant leaps forward are simply the macro output of tens, hundreds, or thousands of tiny daily steps.The Seinfeld Calendar Framework: (1) Hang a big calendar on the wall; (2) Use a big red marker to put an X over every day that you complete your daily habit; and (3) Don’t break the chain of Xs!The 30-for-30 Challenge: Choose the arena, commit to 30 days of 30 minutes per day, create pressure loops by stating your intentions publicly, and use a calendar or tool to track your daily execution.If you’re interested in being a part of a 30-for-30 Challenge community, fill out the form here to get exclusive first access when it’s launched.The 30-for-30 ChallengeI spend a lot of time thinking about progress.I find happiness and fulfillment in progression—in the feeling of being one step further down the path from where I was yesterday.I’m not quite sure where that path is headed, but I am sure that the only way I want to progress along it is forward.Over time, I’ve observed that our minds tend to overcomplicate the process required to achieve this forward progression. We incorrectly assume that it requires herculean effort or intensity.The reality? Giant leaps forward are simply the macro output of tens, hundreds, or thousands of tiny daily steps.My goal with my writing is always the same: take the complex and make it simple. So today, I’d like to share my simple, tactical approach for making forward progress.Seinfeld’s SecretJerry Seinfeld is an absolute legend—an inspiring figure to study for creatives and non-creatives alike.He is considered one of the top comedians of all time and has amassed a reported financial fortune of nearly $1 billion. He earned a total of $100,000 for the entire first season of Seinfeld. By season 9, he was earning over $1 million per episode.Jerry Seinfeld is impressive in many ways, but perhaps most impressive is the fact that he has exhibited such tremendous creative consistency over the years. As he is quick to point out in a number of interviews, this was not some gift he was simply born with.It was—at least partially—engineered.An up-and-coming comedian named Brad Isaac had a famous interaction with Jerry Seinfeld that revealed his strategy for hacking consistency and growth:He said the way to be a better comic was to create better jokes and the way to create better jokes was to write every day.He told me to get a big wall calendar that has a whole year on one page and hang it on a prominent wall. The next step was to get a big red magic marker. He said for each day that I do my task of writing, I get to put a big red X over that day.“After a few days you'll have a chain. Just keep at it and the chain will grow longer every day. You'll like seeing that chain, especially when you get a few weeks under your belt. Your only job is to not break the chain.”I call this the Seinfeld Calendar Framework:Hang a big calendar on the wall.Use a big red marker to put an X over every day that you complete your daily [insert habit]. The habit should be simple and manageable to complete.Don’t break the chain of Xs!Importantly, it was not about the writing or jokes being high quality—it was about the consistency of the daily practice.The beauty in this system was in its sheer simplicity. It emphasized a manageable daily practice that would compound effectively.Seinfeld knew: With daily practice comes long-term prowess.30-for-30 ChallengeAfter reading about Seinfeld’s calendar hack, I adapted it to create my own improvement approach.I call it the 30-for-30 Challenge: 30 days, 30 minutes per day.The mechanics are simple:Choose your arena for progress. This can be any new skill, habit, or an existing area of competency you are looking to improve.Commit to focused effort in that arena for 30 minutes per day for 30 consecutive days.Create a positive pressure loop. State your intention publicly or tell a friend or family member about your plan. This subtle decision makes it more costly to quit.Track the daily execution with a calendar.The 30-for-30 Challenge has three core advantages:Meaningful CommitmentChoosing a single arena for progress requires clear commitment that reveals whether you are physically and psychologically invested in the thing you want to improve at.30 days of effort is meaningful.If you’re half-in, you won’t want to take it on and commit to the full scope 30 days.It’s a commitment razor.Light IntimidationWhile 30 days is long enough to require a real commitment, 30 minutes is short enough that it removes intimidation and allows you to mentally attack it.Pre-start self-intimidation is one of the biggest drivers of stagnation. We make something too daunting, so we don’t take it on. New habits and improvement initiatives can often feel that way.Remember: When you’re staring at a cold lake, jumping in is the hardest part—once you’re in it, it’s not so bad!A lot of people say they want to get into great cardio shape, but if they’re currently out of shape, it can feel like a daunting task. 30-for-30 breaks the intimidation down into something simple, reasonable, and manageable.Just punch the clock for 30 minutes today. That’s it.Effective Compounding30 days of 30 minutes per day is 900 total minutes of accumulated effort.900 minutes of focused effort can have surprisingly significant results. There’s almost nothing in the world that you won’t improve at if you spend 900 minutes of focused, dedicated effort on it.A few examples:900 minutes of Zone 2 cardio puts you in much better cardio...

Jun 8, 2022 • 21min

The Logical Fallacy Guide

Welcome to the 675 new members of the curiosity tribe who have joined us since Friday. Join the 98,027 others who are receiving high-signal, curiosity-inducing content every single week.Today’s newsletter is brought to you by Trends!Trends is my personal cheat code for generating new business and content ideas.It’s a premium newsletter from The Hustle that deconstructs the secret sauce of interesting businesses, side hustles, and emerging opportunities—and gives you the playbook to pounce on them. Even better, membership provides instant access to an exclusive community of 15,000+ entrepreneurs who are building the future.I learn something new from every single issue—it has become a core part of my content and learning engine. A true must-read. I can’t recommend it highly enough.Use the link below to join—no commitment, no catch, cancel anytime!Today at a Glance:Logical fallacies are errors in reasoning that undermine the quality of an argument.Combatting them relies first and foremost on establishing a level of awareness—both academically and practically.The Logical Fallacy Guide covers 20 common logical fallacies: Ad Hominem, Texas Sharpshooter, Sunk Cost Fallacy, Bandwagon Fallacy, Straw Man, Appeal to Authority, Post Hoc Ergo Propter Hoc, Personal Incredulity, False Dilemma, Burden of Proof, Red Herring, No True Scotsman, Hasty Generalization, Non-Sequitur, Tu Quoque, Slippery Slope, Begging the Question, Loaded Question, Equivocation, and Fallacy Fallacy.The Logical Fallacy GuideIf you’ve been reading this newsletter, you know that I like to say that humans are fascinating creatures.We possess the capacity to accomplish some complex feat of technology and engineering, and subsequently fall victim to the most obviously flawed base logic.Logical fallacies—errors in reasoning that undermine the quality of an argument—are classic examples of this fact.The Merriam-Webster Dictionary defines fallacy as a false or misleading idea. A logical fallacy, therefore, can simply be thought of as logic based on a false or misleading idea.Unfortunately, unless you went to law school—or took a robust philosophy course load in college—you’ve likely been minimally exposed to them in a formal context.Accordingly, we frequently fall victim to logical fallacies—our own emotional, psychological, and intellectual blindspots create the cracks and we fall right into them.There is no such thing as a perfect logician, but we can all strive to cover our blindspots and craft better arguments. Similar to the study of cognitive biases—which I’ve written about recently here and here—the first step in avoiding logical fallacies is developing an awareness of them.In that vein, today’s piece will cover 20 common logical fallacies to learn, identify, and avoid.Without further ado, let’s dive in…Ad HominemLatin phrase for "to the person”—an ad hominem attack is an attack of the individual rather than the argument.Instead of addressing the argument—its structure, logic, and merits—the offender attempts to refute the opposition on the basis of personal characteristics.It may be overt—openly attacking the person’s character or personality—or covert—subtly doing the same—but it always focuses on the person, not the argument.Often referred to as “mud-slinging” in political circles, if you’ve ever watched a political debate or political campaign ads, you’re already familiar with this one. It’s all-too-common on Twitter and other online discourse, as well.ExampleCandidate 1: “…and this is why I believe we need to implement a much more aggressive set of climate change regulations.”Candidate 2: “I’m sorry, but are we really expected to believe anything coming from a known liar who cheated on his college entrance exams to get to this position?”The offender (Candidate 2) has attacked Candidate 1 the individual, rather than the argument itself.The Texas SharpshooterThe name of this fallacy is based on a fable:A Texan fires a gun multiple times at a barn wall. He then walks over to the bullet-riddled wall and paints a target around the closest cluster of bullet holes to create the appearance of impressive marksmanship.Think of this as cherry-picking—selecting and highlighting evidence that supports the conclusion and systematically ignoring evidence that may refute it.Example“Tara is a really impressive and successful restauranteur. Her restaurant on Park Avenue is always full and gets really high ratings on Yelp.”This may be true, but it ignores the fact that Tara’s five other restaurant openings have failed. The cherry-picked data—the successful Park Avenue restaurant—is used to draw a broad conclusion about Tara’s quality as a restauranteur that may be inaccurate.Sunk Cost FallacyA favorite of behavioral economics.Sunk costs are the economic costs already invested in an activity that cannot be recovered. Money spent on non-refundable flights and hotels, time invested in a project, or energy put towards a relationship all qualify as sunk costs.The fallacy is found in thinking that you should continue with something on the basis of all that you've put in, with no regard given for future costs or likelihood of ultimate success.The reality: sunk costs are irrecoverable, so should not factor into the decision about the future.Example“The hopes for the space project appear slim, but we have already invested so much, so we have to finish.”If the space project appears unlikely to achieve its stated objectives, any additional investment in the project may be irrational. The fact that a lot has been invested in it has no bearing on what should rationally be invested in its future.“I really don’t want to go on this vacation—I’m so busy at work—but I already paid for the flights, so I might as well go.”The cost of the flights is a sunk cost. If going on the vacation is going to bring you negative utility, that should be the only factor in your decision of whether or not to make the trip.Bandwagon FallacyAn assumption of truth on the basis of the majority of people believing it to be true."Everyone believes X, so obviously X is true."The assumption is typically made without regard for the qualifications or ability of the people in question to validate the claim.Common in the workplace, where a collective belief—“this is how everyone does it”—can lead to broken processes and systems.Example"Well, the majority of people we talk to say that integrating chip design and manufacturing is important, so clearly you should get onboard so we can continue forward with our integrated solution, rather than switching to something modular.”The over-reliance on the majority—with no regard for whether these people are qualified to make this decision—may lead to poor judgement. This is where first principles thinking goes to die.Straw ManSetup a straw man to tear down.The offender ignores the...

Jun 1, 2022 • 14min

Bad Habits Holding You Back

Welcome to the 853 new members of the curiosity tribe who have joined us since Friday. Join the 96,549 others who are receiving high-signal, curiosity-inducing content every single week.Today’s newsletter is brought to you by The Hustle!See why 2m+ professionals start their day with The Hustle newsletter.Anyone can regurgitate the news, few can make it interesting and entertaining. The Hustle does just that. Be the most interesting person in the room from reading The Hustle each day. While their Monday - Friday coverage is 5 star, their Sunday Deep Dives are epic. Ever wondered how all-you-can-eat-buffets make money? Or what happened to the 250K American Airlines lifetime pass? It’s free, it’s fun, and it’s ad free!Today at a Glance:There’s no such thing as an overnight success. Extraordinary success is simply the byproduct of a large volume of ordinary actions. The quality of our daily habits governs the ultimate quality of our long-term outcomes.I frequently write and speak about the good habits—the ones that positively contribute to your desired outcomes. But what about the bad habits? Just as we want to identify what will propel us forward, isn’t it at least as important to know that which is holding us back?Today’s piece covers 20 bad habits that are holding you back from reaching your potential. All of these are bad habits I have—or currently am—struggling with, so you definitely aren’t alone in this fight.Bad Habits Holding You BackI’m mildly obsessed with the myth of the overnight success.There’s a story I love about Spanish painter Pablo Picasso that captures the essence of the myth very well:Picasso was walking through the market one day when a woman approached him.She pulled out a piece of paper and said, “Mr. Picasso, I am a fan of your work. Please, could you do a little drawing for me?”Picasso smiled and quickly drew a small, but beautiful piece of art on the paper. He handed it back to her.“That will be one million dollars.”“But Mr. Picasso,” the woman protested, “It only took you thirty seconds to draw this little masterpiece.”Picasso smiled, “On the contrary, it took me thirty years to draw that masterpiece in thirty seconds.”The lesson: extraordinary success is simply the byproduct of a large volume of ordinary actions.The quality of our daily habits governs the ultimate quality of our long-term outcomes.I frequently write and speak about the good habits—the ones that positively contribute to your desired outcomes.But what about the bad habits?Just as we want to identify that which will propel us forward, isn’t it at least as important to know that which is holding us back?In that vein, today’s piece will cover 18 bad habits that are holding you back from reaching your potential. All of these are bad habits I have—or currently am—struggling with, so you definitely aren’t alone in this fight!These are designed to be short, punchy insights—I would encourage you to skip any that don’t apply and think deeply about those that specifically resonate with you.Without further ado, let’s dive right in…Focusing on the UrgentIt's easy to jump from one urgent task to the next.But when you focus on the short-term urgent, you lose sight of the long-term important.Spend most of your time focused on long-term important tasks—the compounders.Delegate or delete the rest.Saying Yes to EverythingConfession: I've always had a tough time saying no. I'd take on too much and then grind my way through—or even worse, under-deliver vs. expectations.The ability to say no is a superpower of successful people. Be deliberate about what you spend your time on—and who you spend it with.My rule of thumb: You should spend your 20s saying yes and your 30s and beyond saying no. Your 20s are a time to say yes to almost everything. Saying yes puts you into new and uncomfortable situations that expand your luck surface area. Your 30s and beyond are a time to say no to almost everything. Saying no allows you to focus & build leverage.Glorifying the Wrong ThingsWhat I used to glorify:No sleep100-hour workweeksBusy schedulesFancy titles and credentialsWhat I now glorify:Sleeping 8 hoursRegular physical activityUnstructured schedulesWorking in short sprintsSpending time with family and friendsThe realization: Freedom and control over your time is the one true status symbol. Success and wealth is meaningless if it doesn’t provide that freedom and control.Comparison TrapsThroughout your life and career, it's tempting to compare yourself and your progress to those around you.It’s borderline impossible to avoid:This person made X dollars last yearThat person got Forbes 30 Under 30So and so raised $100m for their startupThey just got a vacation home and new carIt's natural, but dangerous—comparison is like gas on your “more” fire—it tears away the enjoyment of the present and tells you that it’s not enough.Learn to turn it off.Focus on what you can control. When you notice yourself falling into the trap, reset and focus on yourself.ProcrastinatingConfession: I spent most of my life as a chronic procrastinator.I also spent most of my life justifying that chronic procrastination—both internally and externally. I told myself it was "just how I worked”—that the pressure of an imminent deadline was what I needed to thrive.Procrastination holds you back from achieving at the level you are capable of.My framework for how to stop procrastinating:Awareness: Schedule a daily assessment of your day-to-day actions. Start by identifying the important long-term projects in your life. Then ask a few questions: Am I proud of the actions I am taking on these big projects? Am I doing what I should be doing? Create an awareness of your procrastination.Deconstruction: Large, long-term projects look like a big, black box. Our imaginations tend to fill that box with endless complexity and unknown horrors. It's critical to deconstruct the big and scary project into small and individually-manageable tasks.Plan Creation: Develop a plan of attack to check off the deconstructed task list. The plan for each micro task should be specific and time bound. Create a project document to track the plan and tasks.Stake Creation: Create stakes that turn big projects into a “game” for yourself. These mental games can be very effective!Action: A body in motion tends to stay in motion. Create systems that spark initial movement. Engineer small wins (they become big wins over time).You can find my full piece on how to stop procrastinating here.Complaining IncessantlyComplaining never got anyone anywhere worth going.The world is effectively split across complainers and doers—the former will always talk while the latter will always act.Complainers are on the sidelines. They sling ro...

May 25, 2022 • 10min

The Beauty of Enough

Welcome to the 1,719 new members of the curiosity tribe who have joined us since Friday. Join the 94,548 others who are receiving high-signal, curiosity-inducing content every single week.Today’s newsletter is brought to you by Morning Brew!There's a reason why over 4 million people read Morning Brew—the free daily email that covers the latest from Wall Street to Silicon Valley. Unlike traditional news, Morning Brew will keep you informed AND entertained.Morning Brew is one of my consistent daily reads. I know you’ll love it as much as I do!The Beauty of Enough“There are decades where nothing happens, and there are weeks where decades happen.”My son was born one week ago—it feels like one of those fabled weeks where decades happen.I spent the first three decades of my life trying to find the meaning and purpose of all of this—then one week, it all came into view.On Monday morning, I was with him in bed and had this profound sensation: For the first time in my life, I have enough.I’ve always been extremely driven—I’ve always been in this constant cycle of wanting more.But I feel…different.Really, what more could I want?This profound feeling prompted today’s piece—on our perpetual desire for more, and more importantly, on the beauty of enough.My hope is for you to come away from it feeling empowered to think clearly and deeply about finding your “enough” amidst the constant search for more.The Fisherman & The BankerThere’s a beautiful parable that I think about quite often…A wealthy investment banker goes on vacation to a tropical fishing village. As he walks along the docks one afternoon, he comes upon a small, run-down fishing boat with several large fish on its deck."How long did it take you to catch those fish?" he asks.The fisherman looks up from his work and smiles at his new visitor."Only a little while."The investment banker is caught off guard by this response. He likes the fisherman and wants to help."Why don't you fish for longer so you can catch more fish?"The fisherman shrugs and explains to his new friend that he has all he needs."Each day, I sleep late, fish a little, and spend time with my children and beautiful wife. In the evening, I go into town, drink wine, play the guitar, and sing and laugh with my friends."The investment banker is puzzled. He wants to help his new friend, who he recognizes is clearly confused. The investment banker has helped many businesses and has an MBA and other fancy credentials to his name. So he lays out a plan for the fisherman..."First, you spend more time fishing, so you can catch and sell more fish. You use the proceeds to buy a bigger boat, which allows you to catch and sell even more fish. Then you buy a fleet of boats. You hire a team. Vertically integrate! As CEO of a large, growing enterprise, you could move to the big city. You would take your company public and make millions!"The fisherman looks confused, but smiles."And then what?" he asks.The investment banker laughs at the silly question."Well, then you could retire to a quiet town! You could sleep late, fish a little, and spend time with your children and beautiful wife. In the evening, you could go into town, drink wine, play the guitar, and sing and laugh with your friends."The fisherman smiles broadly, thanks his new friend for the advice, and wanders off slowly into the warm afternoon sun.More vs. EnoughThis parable illustrates the importance of perspective.The story isn’t about the fisherman or the banker being “right”—it’s about personally identifying what success and purpose looks like to you, and then building a life that meets that definition.Fundamentally, it’s about a dichotomy that rules our lives: More vs. Enough.The Hedonic TreadmillHedonic adaptation is the tendency of humans to revert to a happiness baseline shortly after new positive or negative events.It (probably) developed as a survival mechanism of sorts—in the wild, you needed to stay on an even keel in order to survive to reproductive age. After a big hunt and kill, the thrill of the victory had to wear off quickly so that you didn’t let your guard down and get eaten by a lion. That seems…good.But in the modern age, hedonic adaptation has a darker side.It becomes a treadmill—the Hedonic Treadmill—a perpetual motion machine that keeps us running in search of the next thing.We create this magical universe in our minds where that one next thing will be exactly what makes us permanently, sustainably happier.The harsh reality? We get to that next thing, appreciate it for a moment, and then turn our gaze to the next, next thing, with no marked improvement in our happiness.You’ve undoubtedly seen this general dynamic play out:We can finally buy the second home in Florida we’ve always dreamed of. Two weeks later, we’re complaining about maintaining it and thinking that a third home in Sedona sounds nice.We buy that fancy car—we ride around smiling broadly with the music blasting, and then see someone in the newer model and start thinking about the next one.We are like the modern equivalent of Sisyphus—a figure from Greek mythology who is sentenced by Zeus to an eternity of futile struggle. Sisyphus must roll a massive boulder up a steep hill, but as soon as he nears the top, the boulder rolls back down to the bottom, forcing him to start anew.We all strive for growth, but our outsized focus on progress can result in an inability to feel gratitude for the present.Finding Your “Enough”So how do we step off the treadmill?To me, this is about finding your version of “enough”—about balancing your natural desire for more with a deep appreciation for the beauty of the present.A few strategies that have worked for me:Develop a Gratitude Practice: Make it a daily practice to write down your gratitude. Either right when you wake up or right before bed, write down three things you are grateful for. They can be big (a healthy family) or small (a good meal in front of your favorite TV show)—the only thing that matters is that you make note of them. The practice forces gratitude for the present into the front of our minds and works wonders for your daily contentment and happiness.Identify Your Happiness Triggers: Using your gratitude lists, identify what makes you happy. Not what you think makes you happy or what society says should make you happy—but what truly makes YOU happy. Maybe it’s as simple as a cold beer at the end of a hard day of work or listening to smooth jazz by yourself when everyone has gone to sleep. Whatever it is, find those triggers and prioritize them in your life.End the Comparisons: We all have a horrible tendency to compare ourselves to others. Comparison is like gas on your “more” fire—it tears away the enjoyment of the present and tells you that it’s not enough. When you notice yourself falling into the comparison trap, reset and focus on yourself. “If we only wanted to be happy, it would be easy; but we want to be happier than other people, and that is almost always difficult, since we think them happier than they are.” - Montesquieu.Give these strategies a try. They will all bring the present into a clear, brilliant focus.ConclusionFor most of my life, I would have characterized myself as th...

May 18, 2022 • 10min

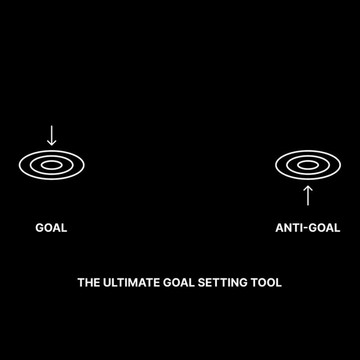

The Ultimate Goal Setting Tool

Welcome to the most important new member of the curiosity tribe who joined us since Friday—my son, Roman Reddy Bloom.I spent the first 30 years of my life trying to find the meaning and purpose of all of this. Then one day, it was staring right back at me. My new best friend.Today’s newsletter is brought to you by LEX!What they do: make it easy to invest in real estate!Pop quiz: What asset class has created more millionaires than any other? Answer: Real estate.LEX has a really cool angle for investing in real estate. LEX does an “IPO” for a building, so you can directly invest in marquee commercial real estate. You can build a portfolio of buildings you want to invest in. Each building has a ticker, just like stocks. As a shareholder, you can get paid dividends flowing from the rent paid by the tenants. You can also earn tax advantaged passive income and trade without lockups.Check out LEX’s live assets in New York City and upcoming IPO in Seattle.Sign up for free here and get a $50 bonus when you deposit at least $500.Today at a Glance:Anti-goals are the things we DON'T want to happen—either as final outcomes or along the way. Establishing them allows you to win the battle AND the war.If traditional goals are the rudders that set your direction, think of anti-goals as the map that tells you where the rapids are. Awareness keeps you on smooth waters.The generalized process involves four steps: (1) Choose Your Arena, (2) Establish Traditional Goals, (3) Invert the Problem, and (4) Establish Anti-Goals. Test it out by establishing anti-goals when planning for new projects, designing your life, or creating self-improvement plans.The Ultimate Goal Setting ToolI love writing this newsletter.There are plenty of reasons, but at the top of the list is the fact that I get to take you all on a journey with me. Not a physical journey—though it would be fun to do a Curiosity Chronicle retreat someday!—but a learning journey.I’m able to share new insights and perspectives in *real time*.This isn’t some academic newsletter where I lecture you on truths and personal wisdom—this is simply me sharing ideas, frameworks, and models that I am battle-testing on my own journey.I am not a teacher—I am a student, learning alongside all of you.In that vein, today’s piece will share a new learning: the power of Anti-Goals.An Introduction to Anti-GoalsAt the start of 2022, I shared a piece called The Goal Setting Guide—a breakdown of my framework for setting—and smashing—goals.Shortly after I shared the piece, however, I came across the intriguing concept of “anti-goals” from my friend Andrew Wilkinson. I began to wonder if my goal setting framework was in need of a refresh.I like to personally battle-test new concepts before I share them publicly, so I started establishing “Anti-Goals” for all new projects.Everything changed.It quickly became a staple for:Planning for new projectsDesigning my lifeCreating self-improvement plansSo with sufficient battle-testing behind me, I'd like to share how to leverage anti-goals to level up your goal setting process.The concept is grounded in inversion—a foundational mental model that says that complex problems are often easier solved backwards vs. forwards.Inversion was made famous by one quote from Charlie Munger:All I want to know is where I’m going to die, so I’ll never go there.With traditional goals, we envision the optimal outcome. We then build systems that will—hopefully—lead to that outcome.This is important and necessary—but it’s incomplete. Anti-goals leverage inversion to complete the picture.Anti-goals are the things we DON'T want to happen—either as final outcomes or along the way.I think of anti-goals as being about avoiding the Pyrrhic victory—a term coined after King Pyrrhus of Epirus, who suffered devastating losses while defeating the Roman army in battle in 279 B.C.E.The term is now commonly used to refer to a victory that takes such a terrible toll on the victor that it might has well have been a defeat.My friend Shaan Puri, another proponent of anti-goals, elaborates:What if your dream was to be a musician. And guess what - you did it! But while you’re touring the world, you gain weight, get addicted to drugs, your marriage is in shambles, and your kids don’t recognize you....you won the battle but lost the war.Anti-goals allow you to win the battle AND the war!The Anti-Goal FrameworkOk, so how do you leverage anti-goals in your goal setting process?The generalized version involves four steps:Choose Your ArenaEstablish Traditional GoalsInvert the ProblemEstablish Anti-GoalsLet’s walk through each step:Choose Your ArenaThe arena is the "project" you’re going to be working on.A few broad categories to consider:PersonalWorkHealthYour arena should be a specific project under a larger category. It’s the place where you’re looking for achievement, progress, or growth.Establish Traditional GoalsThese are your standard goals—the desired outcomes from the chosen arena. This should be easy, as it’s familiar.A few examples of traditional goals:Run a 6-min mileBuild a 100,000 sub newsletterPromotion to VPCreate a top-25 podcastClear, big picture traditional goals are important.Note: As I covered in my Goal Setting Guide, it’s often helpful to have short, medium, and long-term traditional goals. Experiment with what works best for you.Invert the ProblemTo invert, ask and answer a few questions.In the pursuit of these traditional goals:What is the worst possible outcome?What systems would lead to that?What daily actions would I regret?In short, ask yourself what you would view as winning the battle but losing the war.Establish Anti-GoalsNow work backwards to establish your anti-goals—the outcomes you DON’T want.James Clear refers to traditional goals as rudders. Expanding on this analogy, if traditional goals are the rudders that set your direction, think of anti-goals as the map that tells you where the rapids are.A thoughtful, clear map keeps you on smooth waters.An Illustrative ExampleIt can be a bit confusing in the abstract, so let’s look at a recent example from my own life…Choose Your Arena: Physical FitnessEstablish Traditional Goals:Run a 6-minute mileUnder 8% bodyfatDeadlift 500 poundsPerhaps a bit too ambitious at age 31, but it feels doable if I’m dedicated (and if I get any sleep post baby arrival)!Invert the Problem:What does the worst possible outcome look like? Letting it con...

May 11, 2022 • 12min

The Power Speaking Guide

Welcome to the 1,044 new members of the curiosity tribe who have joined us since Friday. Join the 91,634 others who are receiving high-signal, curiosity-inducing content every single week.SPECIAL ANNOUNCEMENT: Hyper startup accelerator is open for applications!If you're thinking about joining an accelerator or raising capital for your startup, Hyper is a new accelerator backed by the biggest venture capital firms in tech.A few reasons I’m a huge fan:More competitive terms than competitors ($300k for 5%).Hyper is the sister company of Product Hunt—companies get unique access to Product Hunt, the team, and launch support.World-class advisors including Sequoia’s Alfred Lin, Ryan Hoover, Deena Shakir, Disney’s Jeffrey Katzenberg, and a lot more.Small batches make for a far more personalized experience.Efficient 4 week long program.Participants get time with me on how to scale your storytelling!This is an amazing opportunity for startups all around the world. Apply for the program here.Today’s newsletter is brought to you by Air!If you’re still using Google Drive and Dropbox to store your files, you’re going to want to listen up. While those tools are fine for people who just need to store everything, they fall terribly flat when it comes to creative collaboration and scalability on images and videos.Walk with me…let’s talk about Air. Air has built a solution—a platform that allows marketers and creatives to collaborate seamlessly across the entire content library of a business. All the work happens directly in the visual asset. The end result? Businesses can 10x the power of their content to become storytelling machines.Air is the “holy s*** why didn’t this already exist?!” solution for marketing and creative collaboration. My startup portfolio loves it and you will too. Get a demo today and level up your content.Today at a Glance:Public speaking is scary. So scary that a number of surveys and studies have found that people rank public speaking ahead of death on a list of their greatest fears.It’s also one of the most critical skill sets for your career and life. Confident, powerful public speaking—whether informal or formal—will accelerate your personal and professional life.Strategies for more confident public speaking: avoid memorization, study the best, strike a power pose, practice relentlessly, find the anxiety killers, play the lava game, slow down to 0.75x, engage the audience, implement a storytelling structure, move with purpose, never self-sabotage, and cut the fear.The Power Speaking Guide"There are two types of speakers: those that are nervous and those that are liars." — Mark TwainOk, so public speaking is scary.How scary?Well, a number of surveys and studies have found that people rank public speaking ahead of death on a list of their greatest fears…THAT scary.Unfortunately, public speaking is also one of the most critical skill sets for your career and life. Confident, powerful public speaking—whether informal or formal—will accelerate your personal and professional endeavors. It sits in the all-important top-right quadrant of the Scary vs. Beneficial 2x2 grid.So we can’t just hide from it. We need a set of strategies to increase our confidence and level up our speaking game.In today’s piece, I’ll propose 12 such strategies. Some of the strategies will appear non-obvious or even counter-intuitive—but trust me, they work.Without further ado, let’s dive in…Avoid MemorizationWhen we’re nervous for a speech, toast, presentation, or talk, our bias is to memorize the content word-for-word.We memorize in a valiant effort to avoid screwing up.Ironically, memorization often has the opposite effect.Imagine you are driving to a friend’s new house. You look up the directions before leaving—they seem simple enough, so you just memorize them. On the way, there’s a bit or roadwork that forces you to make a slight detour. Suddenly, you’re completely lost. You memorized the directions from A to B, but the slight twist has taken you off course and you have no clue how to get back on track. You only memorized the directions for one specific scenario (going directly from point A to point B), but the situation became more dynamic.For most people, the same general principle applies to public speaking.When you memorize material, one tiny slip-up can throw you off. You only know the material in one fixed direction, so you're unable to adapt. All it takes is a glitch in the slides, an off-track question from the audience, or a slight stumble in your opener and all of your preparation is out the window.Furthermore, rote memorization can make you appear distant to the audience.Instead of memorizing:Focus on a few key moments. Perfect the opening line, transitions, and closing. When you nail these, you create momentum—with the audience and yourself. It instills a confidence you can build on. Manufacture these small "wins" that compound.Create “lego blocks” that you can piece together. Hone small chunks of stories and ideas that you can naturally weave together depending on the situation. You’ll be able to pick and choose from your toolkit and be more dynamic in the moment.Study the BestWe live in an amazing era—we literally have the best speaking coaches in the world at our fingertips.Identify 3-5 speakers you admire. They can be politicians, business leaders, comedians, motivational coaches, whatever.Go on YouTube and find videos of each one delivering a speech.Slow down the playback speed—a great recommendation from my friend Ankur Warikoo—and take notes.Study the following:Structure: How are they structuring their talk?Cadence: What is the pacing of their words? When are they pausing and when are they accelerating?Tone: When are they raising their voice? When are they lowering it?Movement and Gestures: Note their movement on the stage (if any). How are they gesturing?Audience Engagement: How are they engaging with the audience?By analyzing the best, we naturally move to embody the traits we've identified.Strike a Power PoseA "power pose" is a stance that embodies a feeling of power—standing tall, arms spread and raised.The original discussion around the power pose entered the mainstream when social psychologist Amy Cuddy delivered a now famous Ted Talk on the topic that has been viewed over 20 million times.Cuddy asserted that executing power poses can actually create feelings of confidence and power...

May 4, 2022 • 12min

Dangerous Mental Errors (You Don't Know You're Making)

Welcome to the 404 new members of the curiosity tribe who have joined us since Friday. Join the 89,181 others who are receiving high-signal, curiosity-inducing content every single week.Today’s newsletter is brought to you by LEX!What they do: make it easy to invest in real estatePop quiz…What asset class has created more millionaires than any other? Answer: Real estate.Today’s sponsor, LEX, has a really cool angle for investing in real estate. LEX does an “IPO” for a building, so you can directly invest in marquee commercial real estate. You can build a portfolio of buildings you want to invest in. Each building has a ticker, just like stocks. As a shareholder, you can get paid dividends flowing from the rent paid by the tenants. You can also earn tax advantaged passive income and trade without lockups.Check out LEX’s live assets in New York City and upcoming IPO in Seattle.Sign up for free here and get a $50 bonus when you deposit at least $500.Today at a Glance:Cognitive biases and logical fallacies are systematic errors in thinking and reasoning that negatively impact decision-making quality, logic, and outcomes.Combatting them relies first and foremost on establishing a level of awareness—both academically and practically.Part I of this series covered Fundamental Attribution Error, Naïve Realism, the Curse of Knowledge, Availability Bias, and Survivorship Bias.Today’s Part II covers Loss Aversion, the Spotlight Effect, Heaven’s Reward Fallacy, Confirmation Bias, and Baader-Meinhof Phenomenon.Dangerous Mental ErrorsA few weeks ago, I shared Part I of a multi-part series on cognitive biases and logical fallacies.In the opening to the piece, I commented on the fascinating dichotomy of our species:We possess the capacity to accomplish some complex feat of technology and engineering, and subsequently fall victim to the most obviously flawed base logic. For a hyper-intelligent species, our thinking and decision-making patterns can be pretty fractured.To be sure, many of these fractures were—for much of human history—features, not bugs. It’s logical to surmise that they were hardwired into our DNA because they made it incrementally more likely that we would survive to reproductive age.But the facts on the ground have changed—we live in a Digital Age—and our thinking and reasoning pathways have not had enough time to “catch up” to those new realities.So, we have to force it—we have to fight back and regain control over the quality of our decision-making and logic.In today’s Part II of the multi-part series, I’ll cover five common cognitive biases and logical fallacies that negatively impact decision-making quality, logic, and outcomes. To really bring it to life, for each one, I’ll provide a definition, example, and perspectives on how to fight back.Without further ado, let’s dive in…Loss AversionDefinitionThe pain of losing something is more powerful than the pleasure of winning it.Loss aversion was first identified by famed behavioral scientists Amos Tversky and Daniel Kahneman, who found that humans had a tendency to prefer avoiding losses over acquiring equivalent gains.Accordingly, people were typically willing to take actions to avoid losses that they wouldn’t have taken to seek gains. Economists had previously assumed humans were rational actors—that $100 in losses would drive the same amount of pain as $100 in gains would create pleasure. Wrong. Humans are enigmatic creatures!ExampleInvestors—professional and amateur alike—provide some of the most clear, trackable examples of loss aversion. The pain and fear of realizing a loss often leads investors to hold onto losing positions much longer than they should.The media contributes to this bias—dunking on investors who cut ties with losing positions rather than celebrating the fact that they may have exhibited clear, rational thinking.How to Fight BackAvoid emotional connection to your possessions—whether they are investments, material items, or money. Attempt to distance your emotions from the decision-making process where possible.Ask questions:Am I being objective and rational in this decision?Am I too connected emotionally to make a rational decision?If you are too connected to a given decision, you may need to outsource it to an objective third-party.The Spotlight EffectDefinitionHumans significantly overestimate the degree to which other people are noticing or observing our appearance or actions.It causes a lot of social anxiety—it keeps people from being themselves due to an irrational fear of judgement.We incorrectly assume that others are thinking about us. The reality: Everyone is just thinking about themselves.ExampleImagine you go to a dinner party. You’re nervous about the party, because you know there will be a lot of smart attendees and you won’t know anyone there.During the cocktail hour, you’re in a small group discussion and say something incorrect about the current state of domestic economic affairs. Your error is pointed out politely and the conversation moves on in a different direction.The conversation has moved on—but you haven’t. Your brain is swirling around the moment where your error was pointed out.Your internal dialogue turns negative: “Everyone thinks I’m an idiot. They’re all staring at me. I wish I could leave.”For the rest of the event, you feel self-conscious and distant, worried about making another mistake.How to Fight BackIt sounds morbid, but constantly remind yourself that no one *really* cares about you. No one is obsessing over your hits and misses as much as you are. Full stop.Life is scary and complex—everyone is just trying to make their own way through it.It's liberating to realize that most people don't really think about you…Heaven’s Reward FallacyDefinitionHumans tend to have an expectation that they will be be justly rewarded and praised for all of their hard work and sacrifice.The reality is that a lot of our efforts go unnoticed, particularly early in our careers. Much of the work is thankless.This is a dangerous error because the constant expectation of external affirmation simply breeds resentment when it doesn’t come.ExampleEarly in your career—or really at any point in your career—you often have to sacrifice greatly for the benefit of the team or organization.The expectation that these actions will have an equal and opposite reaction—in the form of promotions, compensation, or praise—is unfortunately misguided.It leads to disappointment and resentment and is an underlying cause of a lot of employee churn and retention issues.How to Fight BackThere are two sides to this:As an individual, detach inputs from outputs. Design your own rewards for your hard work and sacrifice. Give yourself a...

Apr 27, 2022 • 10min

Intellectual Sparring Partners

Welcome to the 1,146 new members of the curiosity tribe who have joined us since Friday. Join the 88,500 others who are receiving high-signal, curiosity-inducing content every single week.Quick Announcement: Audience Building Course is back May 3-6!It's a live cohort-based course designed to help you build a high-leverage audience. Results from prior cohorts were awesome—hundreds of thousands of new followers and subscribers and countless new monetization opportunities created.Only 25 spots remaining—you can grab your seat here.Today’s newsletter is brought to you by LMNT!LMNT is my healthy alternative to sugary sports drinks.I work out a lot and pay close attention to what I put in my body (other than the occasional whiskey). That means that I reject all the standard sports drinks and their sugar-filled formulas.LMNT is a tasty solution—an electrolyte drink mix with everything you need and nothing you don't. That means a science-backed electrolyte ratio with no sugar, no coloring, no artificial ingredients, or any other junk.Get your free LMNT Sample pack below (you only cover the cost of shipping). You’re going to love it.Today at a Glance:An intellectual sparring partner is a friend, colleague, or acquaintance whose combination of background, competency, and personality makes them well-suited to strengthen the quality of your reasoning and decision-making via active, grounded discussion and debate.To identify one, look for a combination of a different background from your own, clarity and depth of thinking, and a kind but direct personality.Establish structure with regular “sparring sessions”—1 hour on a fixed weekly or monthly cadence, with clear topics and desired outcomes to guide the discussion.Intellectual Sparring PartnersOver the weekend, I posted a thread on Twitter on the topic of ideas I can’t stop thinking about.It was intentionally broad—a running list of some of the most interesting concepts, frameworks, paradoxes, and mental models that have been percolating in my mind over the last several months.If you’ve been following along for a while, by now you’ve realized that my posts are rarely intended to give you “the answer”—they’re intended to make you think. I want to give you the tools, but leave it up to you to create your own maps of how to use them.If I can spark new curiosity about a topic—and that curiosity leads to active thinking, learning, discussion, and personal or professional growth—I’ve done my job.One idea from the list—Intellectual Sparring Partners—seemed to spark a lot of interest, discussion, and follow-up questions.Interestingly, when my friend Alex Lieberman asked me which of the ideas on the list has had the biggest impact on my life to date, intellectual sparring partners was my answer.Why?Well, one intellectual sparring partner—and one “sparring session”—completely changed my life.So in today’s piece, I’d like to shine a spotlight on this idea:What is an Intellectual Sparring Partner?The sparring session that changed my life.How can you find one?The makeup of a great “sparring session”.With that context in mind, let’s dive right in…IntroductionI’ve been fortunate to meet and interact with many top performers in my life.One common trait I’ve observed: they all legitimately enjoy being wrong. They embrace new information that forces them to change their viewpoints—their open mindsets allow them to accumulate and compound knowledge at an accelerated rate.This innate desire to be wrong—to get closer to the truth—leads them to seek out people who are willing and able to push their thinking in new directions and to greater depths.These people are their intellectual sparring partners…Let’s check Sahil’s Dictionary for a definition:Intellectual Sparring Partner (Noun): A friend, colleague, or acquaintance whose combination of background, competency, and personality makes them well-suited to strengthen the quality of your reasoning and decision-making via active, grounded discussion and debate.Put simply, an intellectual sparring partner is a person who is willing and able to question, critique, and pressure test your thinking.Friends come easy—intellectual sparring partners are harder to find, but are incredibly important and valuable.A Personal StoryTo bring this concept to life, I’ll share a quick personal story…In early 2021, I was completely lost. From the outside looking in, everything was fine—I had built a large following on Twitter, I had a good job, etc. But on the inside, I felt like I was wandering around with a blindfold on.I had decided to leave my stable job in private equity—and the wonderful group of colleagues that came with it—to pursue something new, but had run into a series of rejections along the way.In May 2021, at my point of peak uncertainty, I sat down for a meal with Shaan Puri, the host of the My First Million podcast and one of my go-to intellectual sparring partners.The conversation went something like this:Shaan: So, tell me how you’re thinking about the next move?Sahil: Well, at this point, I’m basically thinking there’s a clear Path A and a not so clear Path B. Path A is to join another big investment fund, but one that’s doing early stage investing—the stuff I like thinking about. Path B is less clear, but it’s probably doubling down on all of my personal business, really trying to build that, and probably investing on my own.Shaan: Ok…so it sounds like you’re choosing between something that sounds really standard (join a fund) and something that sounds really fun and energizing (personal stuff).Sahil: Well, damn…when you put it that way…you’re right.In a very quick back and forth, Shaan had completely reframed the decision in my mind in a way that I never would have been able to on my own.My own biases and baggage—mainly the deep, misguided desire to have an important sounding title or impressive firm name on my resume—were clouding my ability to make a clear, thoughtful decision about what would be the most enjoyable, energy-creating, and profitable path.His pushback and reframe was critical. From that day forward, I went all in on Path B. Fast forward 12 months and I couldn’t be happier that I did.Score one for having an intellectual sparring partner…How to Identify OneLet’s shift to the tactical: how can you identify your intellectual sparring partner?First off, it’s important to note that there is no such thing as a one-size-fits-all intellectual sparring partner. The person that works for me might not work for you, and vice versa.Here are a few of the traits to consider in identifying yours:Background: Different from your own across a number of vectors. A fundamentally different “map of reality” is ideal.Competency: Exhibited clarity and depth of th...