Intentional Growth

Intentional Growth Successful Exits Require Planning

John Brown, owner of Business Enterprise Institute (BEI), fell into the world of exit planning before there was even a term for the process. As an estate attorney in the 80’s, John was approached by clients wanting to exit their business without a clue how to do it. BEI was born from John’s realization of this unmet need in the marketplace. Now BEI educates, certifies and provides tools to Exit Planning Advisors who help owners create exit plans.

If you listen, you will learn:

- The three universal goals every owner needs to answer before exiting their business

- Goal vs reality in exit planning

- Importance of a written exit plan well before you want to exit your company

- Realizations owners have about their business in the exit process

- Definition and significance of transferable value

- The role a capable management team will play when planning for an exit

You Can’t Exit on Friday

Back when John was an attorney in the 80’s he had one of his clients call him up because they wanted to exit their company. He said “that’s great when are you thinking” and they responded, “Friday.”

At that time, John didn’t quite know what “exit planning” totally entailed. However, coming from the estate planning world, he knew in order to truly maximize the hard work of building a business, longer term planning was a necessity.

After some research John realized there were a lot of owners who thought they could just “make the decision” to sell and it would be so. John states in his book, Exit Planning: The Definitive Guide, that “as a consequence of poor or no preparation, owners cannot leave when they want, with the money they need, and/or to the person they choose.” Now after decades in the business, it is clear to John that to exit in one week (or even one year) is impossible if the owners wants a truly successful exit.

What Constitutes a Successful Exit?

“It’s All About the Owner’s Goals”

Every owner has a different view of what their life should be like after they sell their company. Certain parts of the process may be more important to one owner versus another.

John and BEI’s mission is to educate advisors so they can simply “help owners benefit from their lives’ work.” Exit Planning Advisors need to ask a lot of questions of the owner and understand their individual goals but also have a clear picture of where they stand on the three universal goals.

The 3 Universal Goals [questions you need to answer]:

- When do I want to leave the business and what does that mean?

- How much income do I want for the rest of my (and my spouse’s) life for as long as we live?

- Who do I want to transfer the business to?

See how we at Solidity incorporate the 7 Steps and 3 Universal Goals in our Value Advantage™ program HERE

John dives deeper into these universal goals in the podcast interview and how they drive the exit planning process.

The Bottom Line

A written exit plan will give you the roadmap to the rest of the life of your business. Starting with the end in mind is key to any project, goal or strategy. If you know where you’re going and what is important to you, then you can put all the advice and obstacles you come across into the context of your grander plan. Without a bigger vision you can be lead astray and find there are unintended consequences to decisions you made in a vacuum.

The goal is to build a business and legacy that gives you freedom and options.

“If you know what you want and know what your business is worth, you can find your GAP @BEIexitplanning @ryantansom” quote=”“If you know what you want and know what your business is worth, you can find your GAP .”

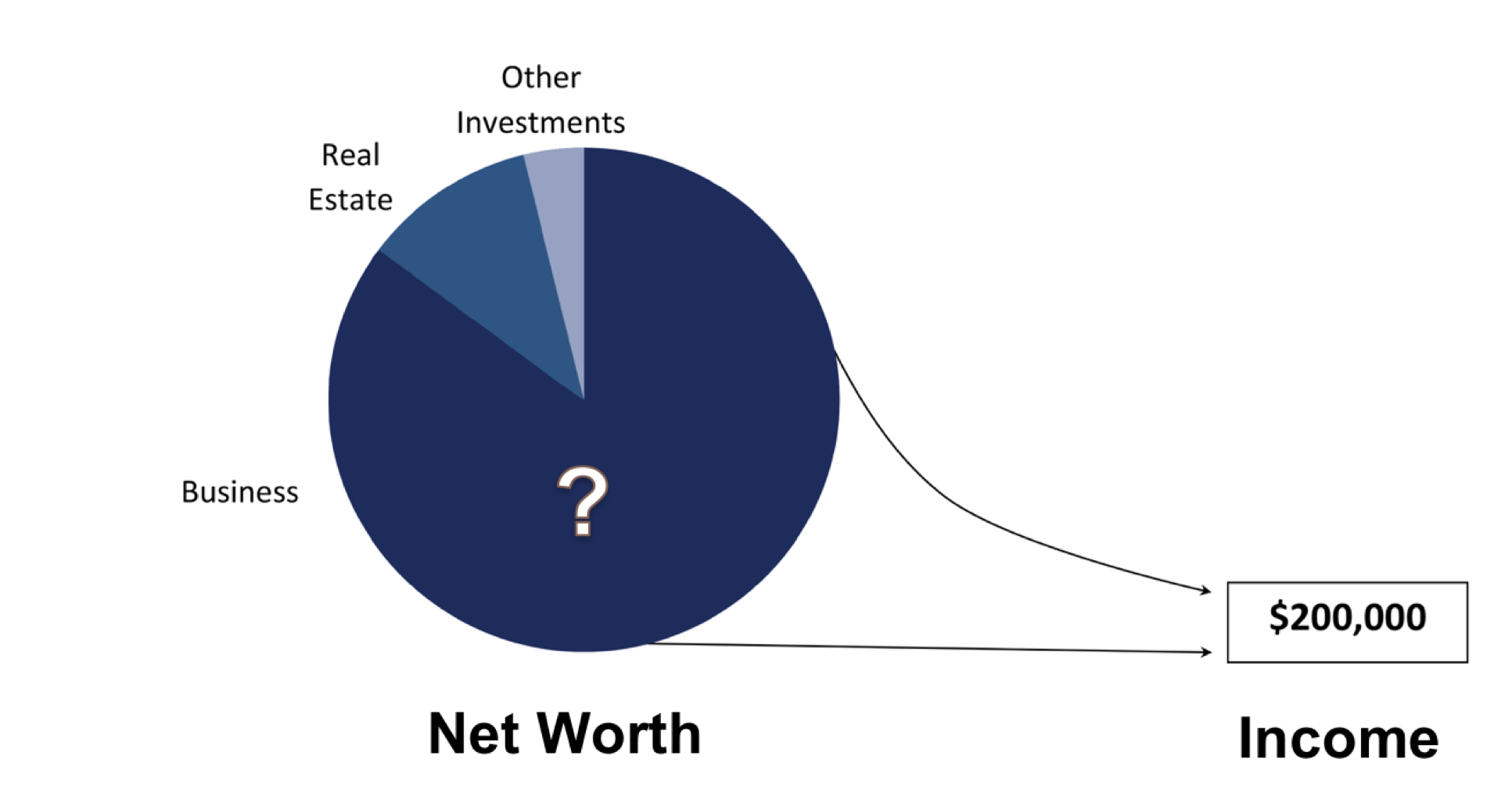

In order to find out how to continue your level of income and maintain your lifestyle [with or without the business] you need to know how much your biggest asset is worth! Many business owners (including us when before we sold) have a situation that looks way to familiar to this picture!

Build your financial score card:

- Run a normalized EBITDA, or at a minimum pre-tax earnings, for a benchmark going forward.

- Perform a business valuation [included in our free consultation call] using best in class valuation tools and technology.

- Analyze what your income needs are:

- salary + distributions + grossed up perks

- back into a liquid portfolio that you would need to maintain that lifestyle without the business

- Determine if there is a value GAP, or surplus, between what your business is worth and what it would take to maintain your lifestyle.

- Begin making the plan to fill the gap OR what do to with the additional future added value and capital.

An exit plan is derived to fill this gap. It will determine everything you do (or don’t do) as the owner of the company from that point on – how much to invest in people, how much to spend, and how much growth is needed to hit your goals.

John urges owners to take the next step…