Curiosity Chronicle

Curiosity Chronicle Diamonds Aren't Forever: The Story of De Beers

Feb 2, 2022

12:00

Welcome to the 1,151 new members of the curiosity tribe who have joined us since Friday. Join the 67,557 others who are receiving high-signal, curiosity-inducing content every single week.

Today’s newsletter is brought to you by Babbel!

One of my goals for 2022 is to learn a new language. Studies show that learning a language increases the volume and density of gray matter, the volume of white matter, and brain connectivity.

Babbel is the tool I’m using to achieve this goal—it’s one of the world’s top language learning platforms and prepares you for situations you’ll actually encounter in real life. I’ve been blown away by the experience thus far—lessons are just 10 minutes and you can start having basic conversations in the new language in just 3 weeks. Plus, you get access to podcasts, games, videos and more. It’s a great household activity to enjoy with your partner and your kids!

For a limited time, you can join me on this journey and get up to 60% off your subscription by using the link below. Take advantage of this amazing offer and get your language learning on today!

Today at a Glance:

De Beers created the modern diamond industry through the use of market manipulation, psychological hacks, and clever marketing.

At its height, De Beers had direct or indirect control of the majority of the global diamond supply chain, allowing it to wield its influence to manage prices.

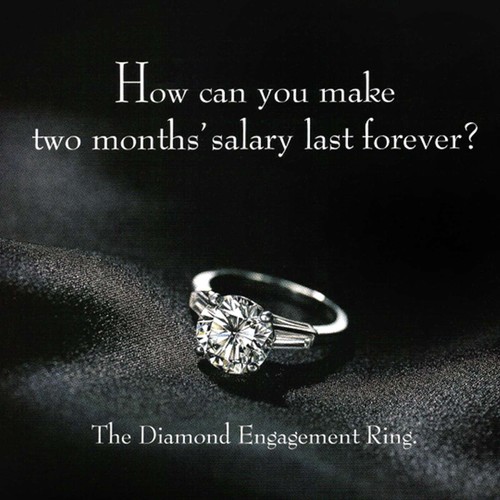

“A Diamond is Forever” was the genius marketing campaign that created the diamond industry as we know it—convincing generations of men and women (1) that diamonds are a show of love—and that the size and quality of the diamond is proportional to the size and quality of the love and (2) that courtship and engagement involve a diamond.

Broad-based pushback against the industry and its roots has led to the rise of alternatives—like lab-grown diamonds—but diamonds remain the standard show of love in most Western cultures.

Diamonds Aren’t Forever

The mandate of this newsletter is simple: I explore my curiosity and share what I learn along the way. To be clear, this is an intentionally-broad mandate—I don’t believe that curiosity follows any fixed lesson plan.

The topics I will continue to cover include:

Growth and decision-making

Startups, investing, business, and finance

Writing and storytelling

Marketing

Life

The one constant across all of this: I can guarantee you will learn something new and interesting from each and every piece I share. One new idea or insight that will make you smarter or spark your curiosity to go deeper.

This is a learning-rich journey and I am fortunate to have almost 70,000 of you along for the ride. We’re just getting started.

This felt like a fitting preface to today’s piece. Why? Well, every now and then, a story comes along that grabs my attention and simply won’t let go until I write about it.

The story of De Beers and the making of the modern diamond industry is one of those stories. It stands out because it’s not a clear fit for any one of those buckets above—rather, it’s a fit for all of them!

So sit back, grab a coffee (or whiskey), and let’s go down this rabbit hole together…

The Beginnings

The story of De Beers starts well before the international giant existed.

It may be difficult to believe in the current context, but for most of history, diamonds were not a particularly important gem. Largely found in parts of India and Brazil, they were considered rare and beautiful, but had little intrinsic value due to their lack of industrial or monetary use cases. Diamonds were a vanity item of the ultra-ultra-rich—a very niche market.

But in 1870, everything began to change.

Massive diamond stores were discovered in South Africa near the Orange River, setting off the first diamond rush. South Africa was officially a British colony at the time, which meant that British investors immediately flocked to the region and commissioned labor—both forced and paid—to begin building the diamond mines.

It quickly became clear that the new South African mines would be producing never-before-seen quantities of diamonds.

The British investors grew worried. In a free market, the glut of supply—and associated dent in the perception of scarcity—would send the price of diamonds into free fall. Given diamonds did not have any major industrial use cases to buoy demand, the perception of scarcity was critical to their price and desirability.

So in 1888, one British financier and mining operator proposed a plan…

The Making of De Beers

Cecil Rhodes was born in England in 1853, but after a sickly adolescence marked by severe asthma, his father sent him to South Africa, a climate he believed would be better for his health.

Rhodes entered the diamond industry at age 18 in 1871 and began to systematically acquire and consolidate mining operations in South Africa. By 1888, he had built one of the most powerful mining operations in the region.

But the diamond industry was in turmoil, with wild price fluctuations and uneven demand. Sensing an opportunity, Cecil Rhodes and his business partners led a push to merge and consolidate the various South African mining companies.

His pitch: continued competition meant death; consolidation meant survival.

The new company—or cartel, as it were—was named De Beers Consolidated Mines, Ltd. Its explicit goal: to manage diamond production and continue to perpetuate the perception of scarcity and desirability that was so important to the price of the stones.

De Beers was officially born.

“A Diamond is Forever”

Econ 101 Lesson of the Day: There are two sides to every market—supply and demand. The story of De Beers is unique in its practical application of the manipulation of both…

Supply-Side Manipulation

In the 20th century, De Beers methodically expanded its influence over the entire diamond supply chain.

In addition to having direct control over diamond mining and production, it began to accumulate direct or indirect control of the major diamond trading companies across England, Switzerland, Israel, Belgium, Holland, and Portugal.

It was widely known and understood that De Beers controlled the diamond industry. With control over production and distribution, De Beers was able to control the stock and flow of diamonds in the market, effectively creating direct control over prices. While other commodities saw wild price swings, diamonds exhibited no such volatility, creeping steadily upwards over time.

But many cartels throughout history have managed to manipulate supply—demand is much mo...

Today’s newsletter is brought to you by Babbel!

One of my goals for 2022 is to learn a new language. Studies show that learning a language increases the volume and density of gray matter, the volume of white matter, and brain connectivity.

Babbel is the tool I’m using to achieve this goal—it’s one of the world’s top language learning platforms and prepares you for situations you’ll actually encounter in real life. I’ve been blown away by the experience thus far—lessons are just 10 minutes and you can start having basic conversations in the new language in just 3 weeks. Plus, you get access to podcasts, games, videos and more. It’s a great household activity to enjoy with your partner and your kids!

For a limited time, you can join me on this journey and get up to 60% off your subscription by using the link below. Take advantage of this amazing offer and get your language learning on today!

Today at a Glance:

De Beers created the modern diamond industry through the use of market manipulation, psychological hacks, and clever marketing.

At its height, De Beers had direct or indirect control of the majority of the global diamond supply chain, allowing it to wield its influence to manage prices.

“A Diamond is Forever” was the genius marketing campaign that created the diamond industry as we know it—convincing generations of men and women (1) that diamonds are a show of love—and that the size and quality of the diamond is proportional to the size and quality of the love and (2) that courtship and engagement involve a diamond.

Broad-based pushback against the industry and its roots has led to the rise of alternatives—like lab-grown diamonds—but diamonds remain the standard show of love in most Western cultures.

Diamonds Aren’t Forever

The mandate of this newsletter is simple: I explore my curiosity and share what I learn along the way. To be clear, this is an intentionally-broad mandate—I don’t believe that curiosity follows any fixed lesson plan.

The topics I will continue to cover include:

Growth and decision-making

Startups, investing, business, and finance

Writing and storytelling

Marketing

Life

The one constant across all of this: I can guarantee you will learn something new and interesting from each and every piece I share. One new idea or insight that will make you smarter or spark your curiosity to go deeper.

This is a learning-rich journey and I am fortunate to have almost 70,000 of you along for the ride. We’re just getting started.

This felt like a fitting preface to today’s piece. Why? Well, every now and then, a story comes along that grabs my attention and simply won’t let go until I write about it.

The story of De Beers and the making of the modern diamond industry is one of those stories. It stands out because it’s not a clear fit for any one of those buckets above—rather, it’s a fit for all of them!

So sit back, grab a coffee (or whiskey), and let’s go down this rabbit hole together…

The Beginnings

The story of De Beers starts well before the international giant existed.

It may be difficult to believe in the current context, but for most of history, diamonds were not a particularly important gem. Largely found in parts of India and Brazil, they were considered rare and beautiful, but had little intrinsic value due to their lack of industrial or monetary use cases. Diamonds were a vanity item of the ultra-ultra-rich—a very niche market.

But in 1870, everything began to change.

Massive diamond stores were discovered in South Africa near the Orange River, setting off the first diamond rush. South Africa was officially a British colony at the time, which meant that British investors immediately flocked to the region and commissioned labor—both forced and paid—to begin building the diamond mines.

It quickly became clear that the new South African mines would be producing never-before-seen quantities of diamonds.

The British investors grew worried. In a free market, the glut of supply—and associated dent in the perception of scarcity—would send the price of diamonds into free fall. Given diamonds did not have any major industrial use cases to buoy demand, the perception of scarcity was critical to their price and desirability.

So in 1888, one British financier and mining operator proposed a plan…

The Making of De Beers

Cecil Rhodes was born in England in 1853, but after a sickly adolescence marked by severe asthma, his father sent him to South Africa, a climate he believed would be better for his health.

Rhodes entered the diamond industry at age 18 in 1871 and began to systematically acquire and consolidate mining operations in South Africa. By 1888, he had built one of the most powerful mining operations in the region.

But the diamond industry was in turmoil, with wild price fluctuations and uneven demand. Sensing an opportunity, Cecil Rhodes and his business partners led a push to merge and consolidate the various South African mining companies.

His pitch: continued competition meant death; consolidation meant survival.

The new company—or cartel, as it were—was named De Beers Consolidated Mines, Ltd. Its explicit goal: to manage diamond production and continue to perpetuate the perception of scarcity and desirability that was so important to the price of the stones.

De Beers was officially born.

“A Diamond is Forever”

Econ 101 Lesson of the Day: There are two sides to every market—supply and demand. The story of De Beers is unique in its practical application of the manipulation of both…

Supply-Side Manipulation

In the 20th century, De Beers methodically expanded its influence over the entire diamond supply chain.

In addition to having direct control over diamond mining and production, it began to accumulate direct or indirect control of the major diamond trading companies across England, Switzerland, Israel, Belgium, Holland, and Portugal.

It was widely known and understood that De Beers controlled the diamond industry. With control over production and distribution, De Beers was able to control the stock and flow of diamonds in the market, effectively creating direct control over prices. While other commodities saw wild price swings, diamonds exhibited no such volatility, creeping steadily upwards over time.

But many cartels throughout history have managed to manipulate supply—demand is much mo...