LessWrong (Curated & Popular)

LessWrong (Curated & Popular) “Many prediction markets would be better off as batched auctions” by William Howard

Aug 4, 2025

Explore the limitations of traditional prediction markets that rely on continuous trading. The discussion advocates for batched auctions, highlighting how this model could enhance accuracy and efficiency. Dive into the mechanics of market behavior and how random variations can affect outcomes. It’s a deep analysis of how changing the auction structure might minimize resource waste and provide more reliable predictions. A fresh look at optimizing how we forecast the future!

AI Snips

Chapters

Transcript

Episode notes

Current Continuous Trading Mechanism

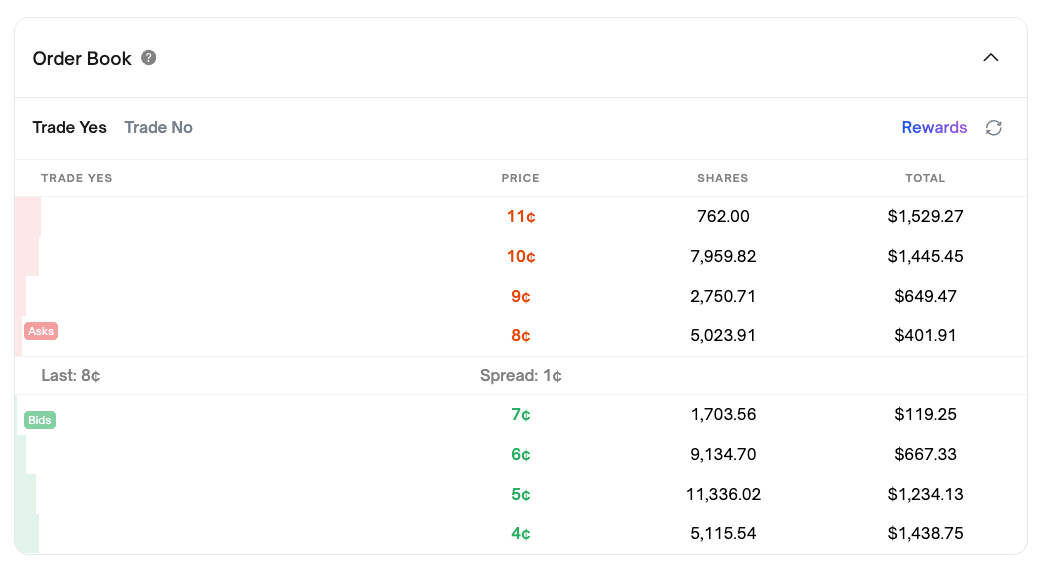

- Prediction markets currently use continuous trading with a Central Limit Order Book (CLOB) similar to stock markets.

- This system rewards fast reaction times but is not the only possible or necessary mechanism.

Call Auctions in Stock Markets

- Stock markets like NYSE use call auctions before open and close to set a single starting and ending price.

- This method removes the premium on reaction times during these windows and ensures orderly pricing.

Frequent Batch Auctions Explained

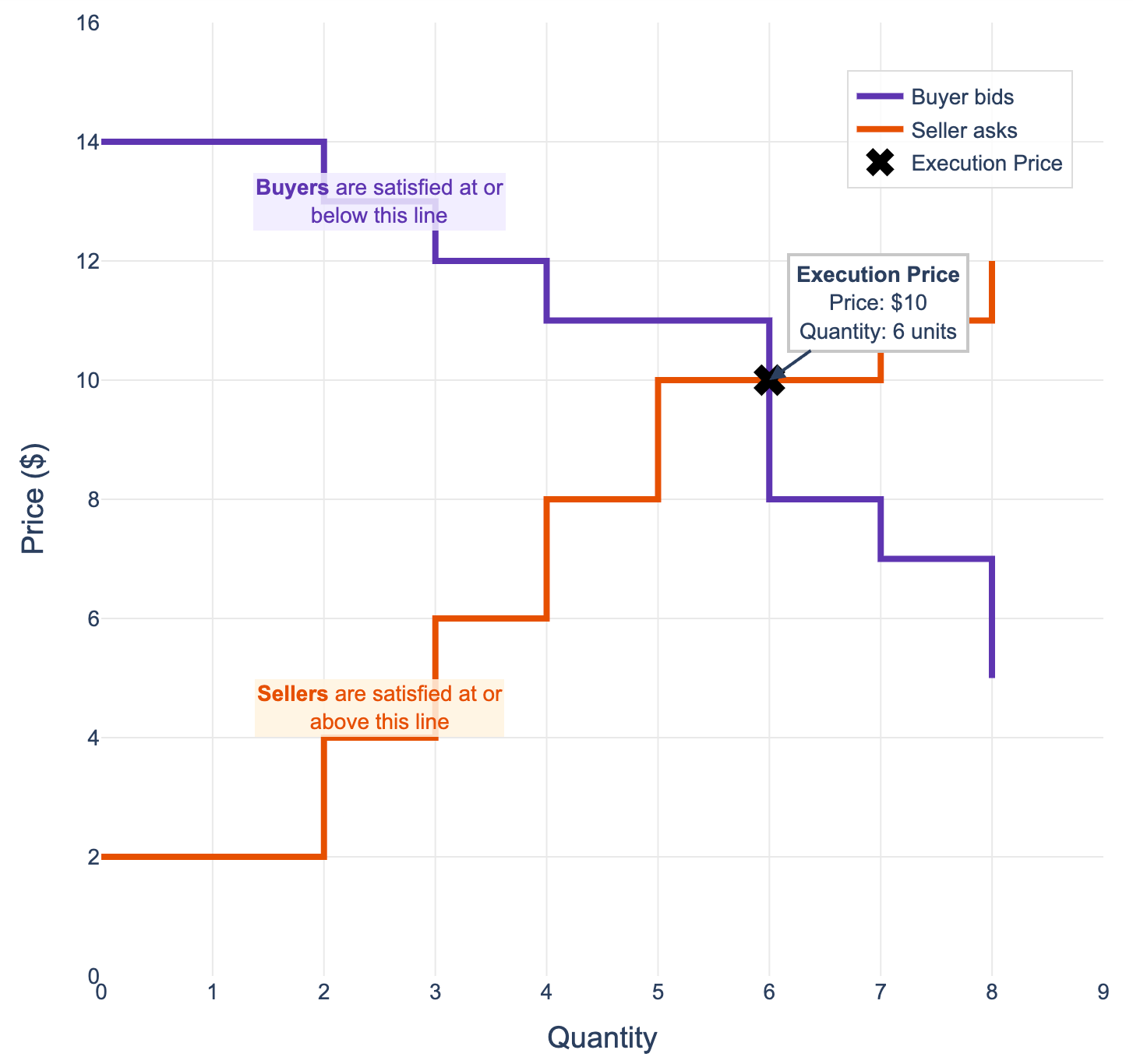

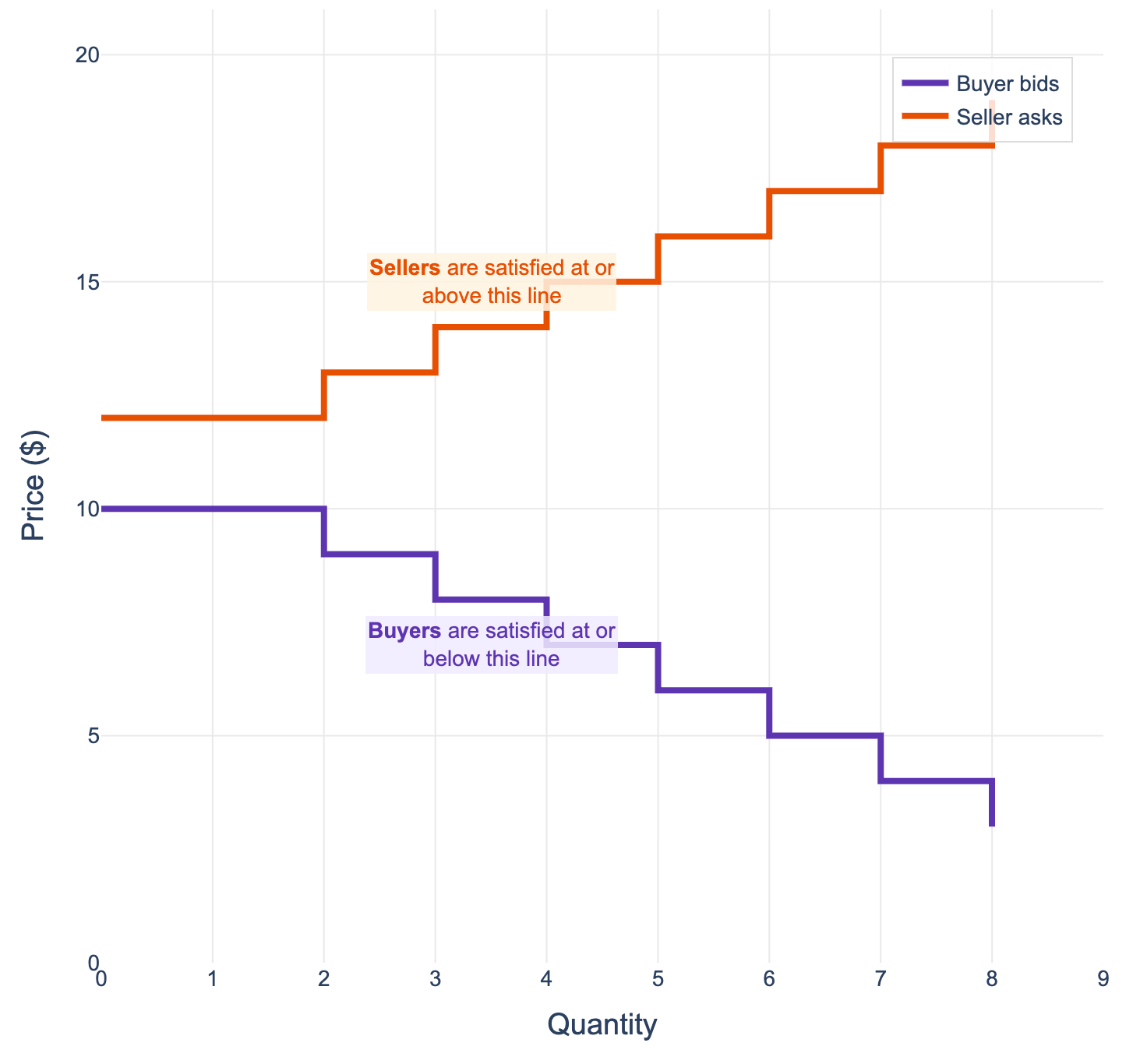

- Design of markets could use frequent batch auctions instead of continuous trading to reduce reaction time advantage.

- Frequent batch auctions execute trades in discrete intervals maximizing matched volume at a single price.