LessWrong (Curated & Popular)

LessWrong (Curated & Popular) “Where is the Capital? An Overview” by johnswentworth

Nov 17, 2025

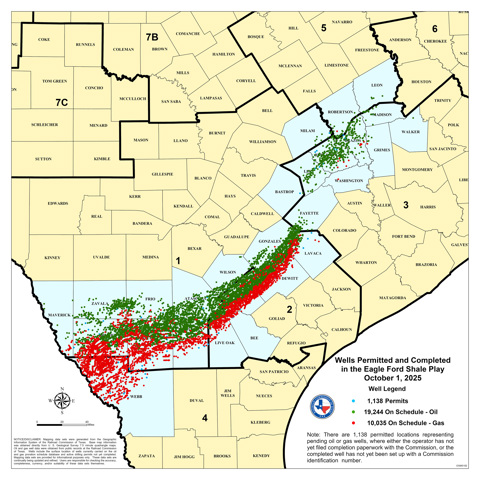

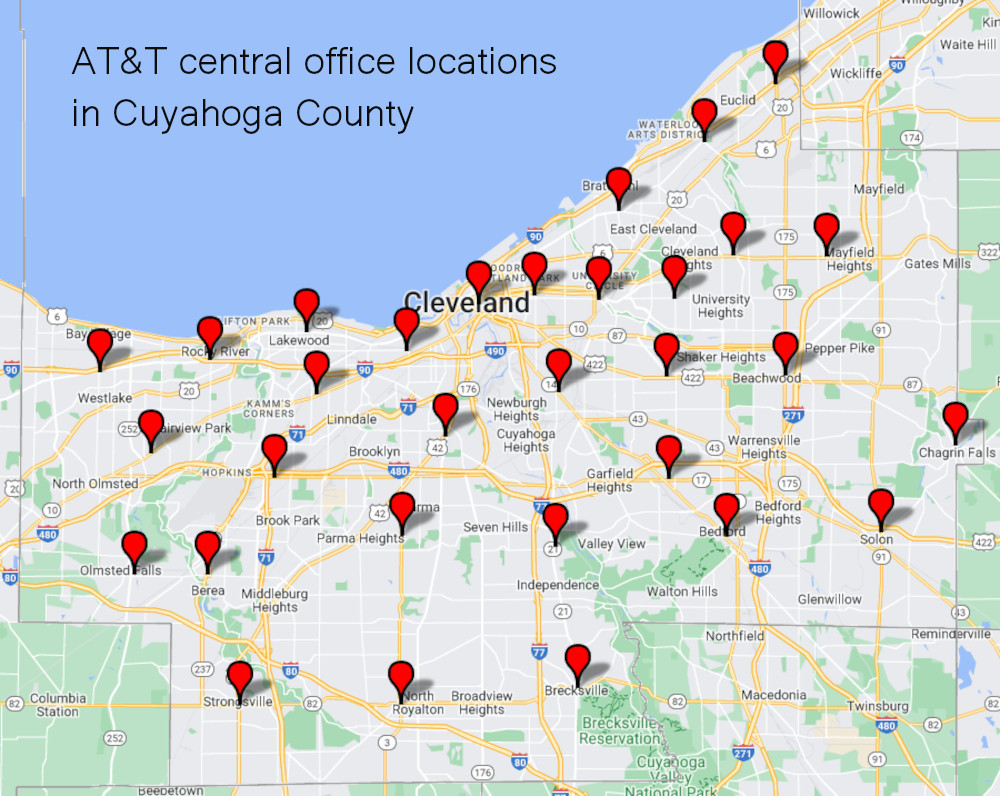

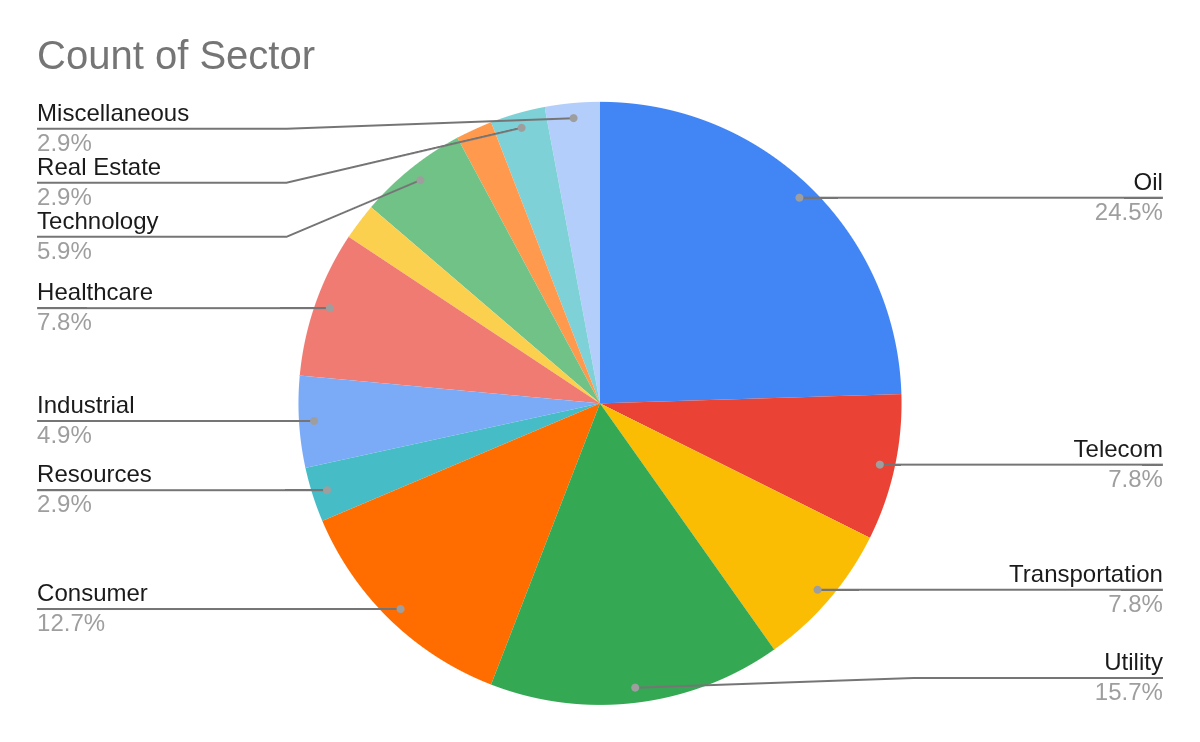

Where do new dollars in capital markets ultimately flow? The discussion explores the dominance of oil infrastructure, accounting for 25% of capital assets, alongside the power grid and consumer goods, each representing significant shares. Telecom and railroad investments are detailed, showcasing their vital roles in linking society. Healthcare and tech companies also reveal surprising asset compositions. Ultimately, the focus is on how infrastructure—the backbone of the economy—holds the majority of capital, driving societal progress and stability.

AI Snips

Chapters

Transcript

Episode notes

Net Savings End Up As Real Capital

- For every financial asset there is a matching liability, so net financial claims across the economy sum to zero.

- The real capital that grows with net savings is nonfinancial assets like roads, buildings, and machines.

Deep Dive Into 100+ Companies

- John S. Wentworth analyzed fundamentals from ~2,100 US public companies and focused on ~100 that held half of nonfinancial assets.

- He then read annual reports from 102 companies to catalog what those capital assets actually are.

Six Trillion Is A Rough Scale

- The sample's total nonfinancial capital summed to about $6 trillion, but this is accounting-sensitive and rough.

- Use the figure for scale intuition, not precise valuation.