Investopoly

Investopoly If you invest in the wrong assets, you'll pay twice as much tax

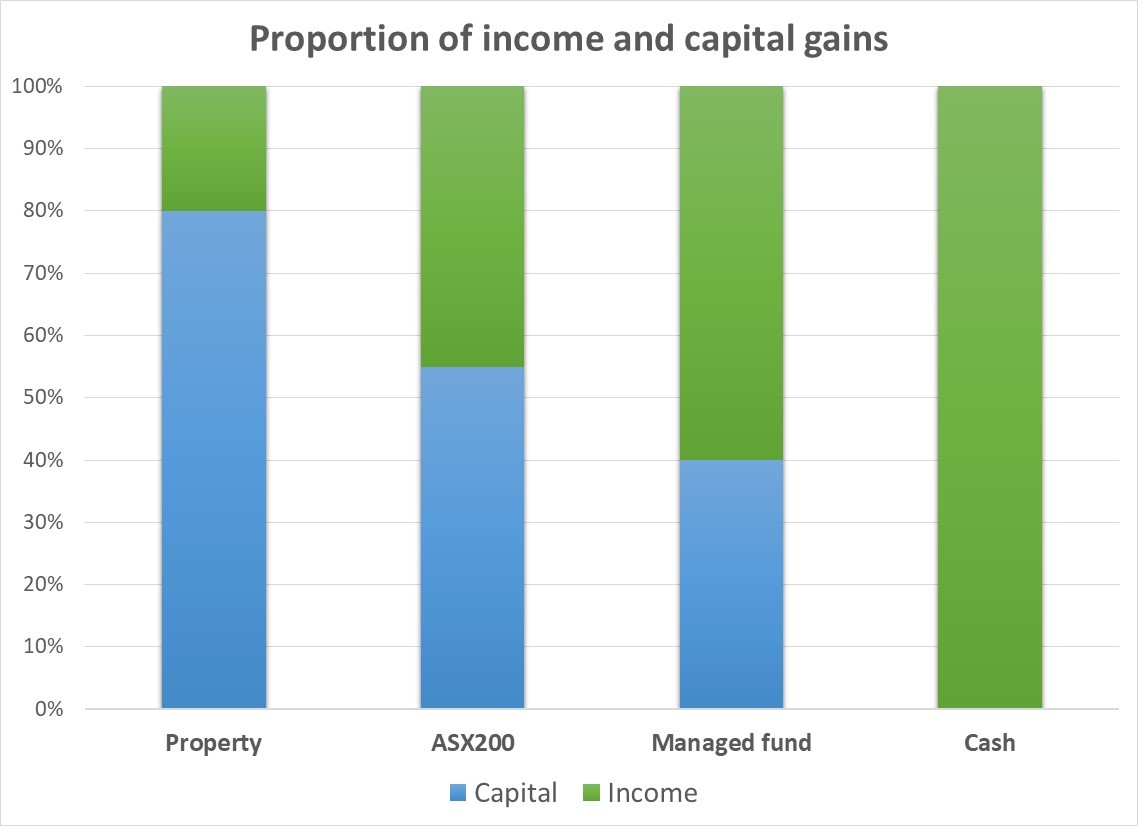

- You only pay capital gains tax when you sell the asset. However, income is taxed in the financial year it is received. This means that you get to reinvest the gross capital gain each year and avoid paying any tax until you sell it.

- This chart below demonstrates that you will enjoy more than four times more growth (in dollar terms) in the fifth 5-year period ($1.1m) comparted to the first 5-year period ($237k). This illustrates the power of compounding capital growth. Quality assets require time and patience. Its that sim

Subscribe via www.investopoly.com.au/email

Do you have a question? Email: questions@investopoly.com.au or for a faster response, post a comment on the episode's video over on YouTube: https://www.youtube.com/@investopolypodcast/podcasts

If you're interested in working with my team and me, discover how we can work together here: https://prosolution.com.au/prospective-client/

If this episode resonated with you, please leave a rating on your favourite podcast platform.

Subscribe to my weekly blog: https://www.prosolution.com.au/stay-connected/

Buy a one of Stuart's books for ONLY $20 including delivery. Use the discount code blog: https://prosolution.com.au/books/

DOWNLOAD our 97-point financial health checklist here: https://prosolution.com.au/download-checklist/

IMPORTANT: This podcast provides general information about finance, taxes, and credit. This means that the content does not consider your specific objectives, financial situation, or needs. It is crucial for you to assess whether the information is suitable for your circumstances before taking any actions based on it. If you find yourself uncertain about the relevance or your specific needs, it is advisable to seek advice from a licensed and trustworthy professional.